How to file tds return online in pdf

Generate the TDS return that can be filed at the TIN-FC or online uploaded to the ITD website. Acknowledgment Enter the acknowledgment (PRN and receipt) received after filing the returns.

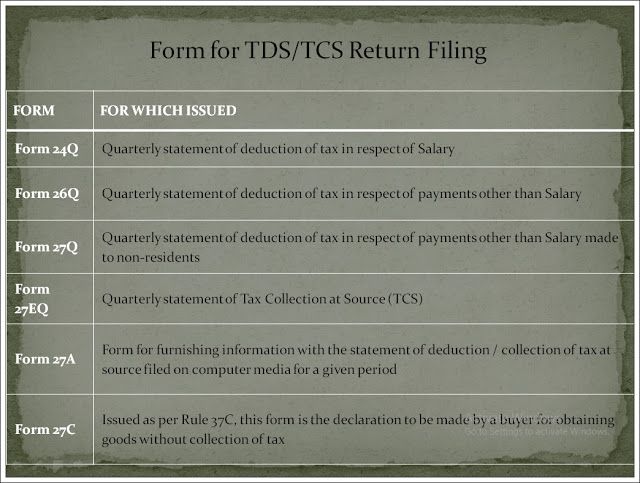

TDS Return is required to be filed by the assessee who has deducted the TDS. TDS Returns are required to be filed after specified intervals and details to be furnished in these returns include fields like TAN No., TDS Payment, amount deducted, type of payment, PAN No. etc.

In this article, we will discuss about What is eTDS return, how to file TDS Return, Where to file it, How to prepare it, software and documents. If you have any query related to TDS return, ask in the comment form given below. We will try to solve your query as soon as possible. We have covered all amendment by finance act 2018, so you can say that the below article will be applicable for A.Y

File correct and complete return within stipulated time frame, given the fact that the TDS credit will be available to the counter party taxpayer (supplier) upon filing of TDS return in Form GSTR-7 by the Deductor (i.e., person liable to deduct TDS); and

Note: The trial version of TDSMAN entitles you to complete one TDS returns & one correction statement for any quarter within FY: 17-18 or FY: 18-19 (except Q4).

TDS Return Form Online. A TDS return is a statement submitted to the income tax department on the quarterly basis. This formality requires filling up a TDS return form.

Deductors/collectors are required to prepare e-TDS/TCS statements as per these file formats using, NSDL e-Gov. Return Preparation Utility or in-house software or any other third party software and submit the same to any of the TIN-FCs established by NSDL e-Gov.

Return Record Register (filed / Not filed) and E-mail facility to customers for filing pending returns. Online services for TDS and Employee Download Form 16/16A/27D through online e-KYC, no need to remember CIN, PAN, Passwords and enter the KYC details every time.

A Step by step guide to filing your Income Tax returns online – SMITHA HARI can include it now while filing the returns). If you have fixed deposits, TDS is levied by bank @ 10%. Based on your tax slab, you may need to pay the additional tax, including penalties as applicable. What is the process involved in filing returns online? You must file your returns on the Income Tax department’s

The fastest and easiest way to open your TDS file is to double-click it. This allows the intelligence of Windows to decide the correct software application to open your TDS file.

TDS is one way of collecting the taxes by the department, And if you want to register your TDS return filing on time in India then Comply partner is an organization that provides the services of TDS return …

(File TDS return online at legalraasta. If a deductor fails to submit return in given time then he pays a fine of Rs. 300/- per day during which the failure continues will be levied till the default continues, not exceeding the TDS amount.

Electronic filing, or e-filing of returns, as it is also called, is basically the submission of an individual’s income tax returns online. The filing of returns can be done in two ways – one is the conventional offline route which requires you to visit the office of the Income Tax Department and doing it manually, and the other is to file the returns on the internet. E-filing has been

Based on this, deductee can file TDS Return and claim back the tax deducted on his income. The Central Board of Direct Taxes (CBDT) is responsible for handling the management of the TDS. The Central Board of Direct Taxes (CBDT) is responsible for handling the management of the TDS.

It is mandatory to file TDS Return within time as given below; otherwise they are liable to pay penalty for non-submitting of e-TDS Return. The following persons are required to file TDS return quarterly, if they have deducted any TDS regarding any payment.

File income tax return online in India 09891200793 by July 31, no plan to extend the deadline -The last date for file income tax return online in india for the financial year 2017-18 will not be extended beyond the july 31 deadline.the department has

TDS Return All You need to Know about TDS Return [A.Y

https://youtube.com/watch?v=v7qhzn05LGk

File TDS Return Online in India TDS Filing LegalRaasta

Online uploading of TDS returns with DSC Track request- Any request placed through TRACES/software can be tracked from software. Download TDS certificates- Facility to download TDS certificates like Form 16/16A/27D directly from TRACES.

usual manual for changed procedure for filing of e-tds quarterly statement w.e.f. 01 may 2016. with effect from 01 may 2016 etds quarterly statement / returns shall be uploaded at traces tdscpc website and not on tin nsdl website.

The online filing of TDS return has become simple & easy. You should not be an expert to file a TDS return. I have explained the process in simple and detailed manner to understand how to file TDS return.

We have earlier explained the procedure for filing TDS Return and for payment of TDS Online and in Form 27A will be created by FVU in PDF Format; Copy the .fvu file on a CD/ Pen Drive and submit the same to the TIN-FC along with requisite fees and print out of the statement statistics report and Form 27A. Software for filing Revised TDS Return. There are various softwares which can be used

6 Responses to “NIL RETURN FILING OF TDS THROUGH TRACES FOR FY- 2014-15” VISHAL JINDAL October 30th, 2015 . How to obtain receipt of non – filling tds return as status show of such return as Non-filled as notice are received from IT Dept.

Do you getting difficulty to filling income taxes online? Watch out our videos on to better understand to how to fill file and other Issues step by step.

All about procedure for filing quarterly tds returns online in India. Due Dates for Filing TDS Returns How to File TDS Returns Quarterly Charges of Filing.

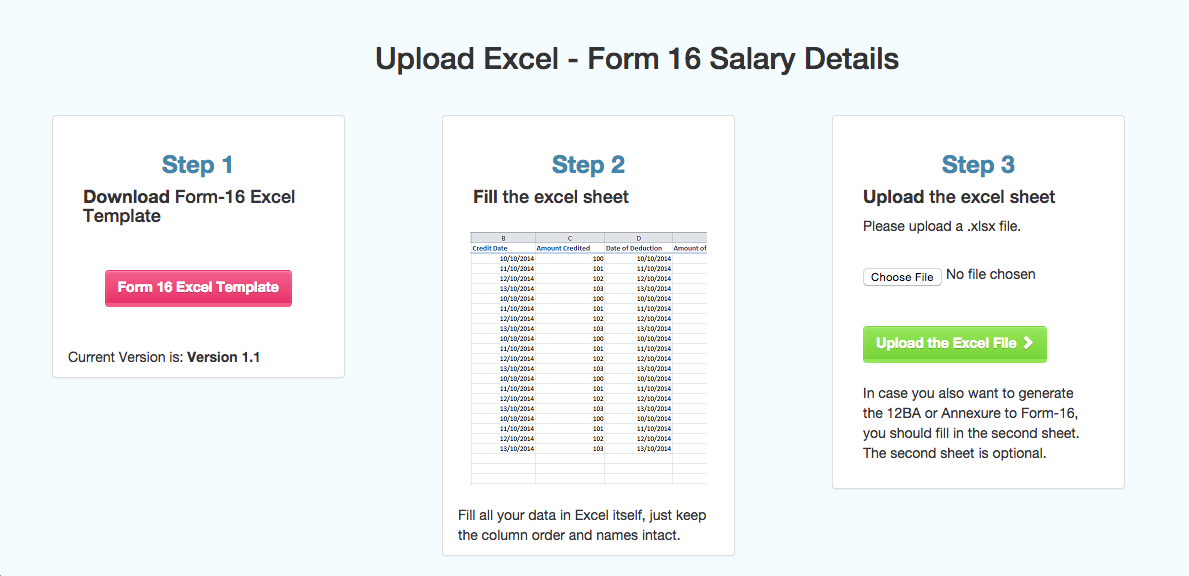

Filing TDS returns online and Validation of TDS returns file Step 1: Download the right forms from the TDS portal online. Step 2: Fill the file with respective details

What you need to convert a TDS file to a PDF file or how you can create a PDF version from your TDS file. Files of the type TDS or files with the file extension .tds can be easily converted to PDF with the help of a PDF printer.

Then install the Itr return form and fill the form and file the return through online (absolutely free of cost ) and before filling the tax return verify the income tax due through online cbdt calculator to double check it and also verify the traces to figure out the TDS and tcs, etc.

The Control totals of the amount paid and the TDS as per item no. 4 of Form No. 27A must tally with the corresponding totals in the e-TDS return in Form No. 24/Form No. 26 /Form No.27, as the case may be.

19/07/2016 · Now you have not required to go NSDL agency for Filing Tds return with Pen drive data.You can upload Tds Return at your office,learn how to upload TDS Statement(.FVU FILE) online on e filing …

As we all know, TDS is being deducted to deposit a certain amount of your salary to the government in the form of tax. Apart from depositing tax, you are required to file a TDS Return as well.

26/11/2018 · In this Article: Obtaining TAN Registration Computing TDS on Salary Filing TDS Returns Community Q&A 17 References. The Central Government …

Pass the ZIP file through the utility to convert it into individual PDF files for each PAN User can opt to digitally sign the Form 16 As during conversion Deductor can also opt to manually sign the PDF files …

TDS Return state the TDS subtracted & paid to government throughout the Quarter to which it relates. Pre-Requisites for Uploading TDS Statement To transfer TDS, the user ought to hold valid TAN and will be registered in e-Filing.

Nil Return Filing of TDS Relyonsoft

TDSCPC website has started a new facility to update declaration for Non filing of TDS statement for deductor. Deductors can update status of TDS/TCS statement to non-filing online after login at TDSCPC website.The benefit of this facility is that you need not file NIL tds/tcs return for a particular quarter/period.Just update your status to non

Also, you have an option of using the software available at NSDL website known as Return Prepare Utility (e-TDS RPU Light) for filing the return online. It is important to ensure that the online TDS file formats come with ‘txt’ as the filename extension.

Rectification of Errors: Consolidated TDS/TCS File Available to registered TANs at TDSCPC. Mandatory from financial year 2007-08 to prepare correction return

Due Dates for E-Filing of TDS/TCS Return AY 2017-18 (FY 2016-17) In this article we will share Due Date for Filing TDS Return, Issuance of Form 16 and TDS Payment.

File TDS Return online in Delhi, Gurgaon, Noida & other cities in India at best prices. TDS Filing is your online CA / agent to Register TDS Return. TDS Filing is your online CA / agent to Register TDS Return.

So basically writing this was necessary because i got some mails where people had asked me to whether they can file their TDS returns i.e. what they prepare using TDS RPU (return preparer utility) or any other software they use for preparing TDS returns ONLINE.

Online TDS Return Software TDSMAN Online FAQ

TDS Return Form: So as to file TDS, you have the option of going in for an e-TDS these days. Yes, the wave of digitalization has not spared the Income Tax Department, making it more convenient than ever for the filers to rush through the procedure.

e-TDS/e-TCS return in accordance with the file formats is to be prepared in clean text ASCII format with ‘txt’ as filename extension. e-TDS/e-TCS return can be prepared using in-house software, any other third party software or the NSDL e-TDS Return Preparation Utility.

So to make it easy, here is the step by step process for online filing TDS return making use of the utility present on NSDL: Step 1: Registration on Traces and E-filing is the first step. Firstly, on traces, register your TAN number.

Online Tax Accounting System PREPARATION & FILING OF TDS RETURN : 1. e-TDS/TCS statement must be prepared in clean text ASCII Format with “txt” as filename extension. 2. NSDL has prepared an e-TDS Return Preparation Utility (NSDL quarterly e-TDS RPU) for preparation of quarterly e-TDS statements and an e-TCS Return Preparation Utility (NSDL quarterly e-TCS RPU) for …

TDSMAN Online is cloud-based TDS software or you can say an Online TDS Return preparation software as per the system specified by TIN-NSDL in line with the requirements of the Income Tax Department, Government of India.

TDSMAN User Manual Page 4 1 Preface TDSMAN is a state-of-the-art software solution, enabling the companies / deductors to keep in pace with the ever changing TDS filing …

Priya July 26, 2014 at 12:36 pm. Hi. Can you tell me if I can apply for my tds return with only my form 26AS? I have lost the TDS statements that I received from the company I used to work for.

e-TDS/TCS Return tin-nsdl.com

How should I file TDS/TAN quarterly returns? Quora

It is the duty of the person who is making payment to someone for specified goods or services to deduct TDS and file TDS return. The specified payment includes salary, interest, commission, brokerage, professional fees, royalty, contract payments, etc.

Filing of TDS Return The deductors should prepare their e-TDS return as per the above procedure, store the data on a CD ROM, Pen Drive enclose the Form 27A in paper format and submit these at any of the front offices of NSDL (TIN-FC center) Charges of e-TDS Return R.J. Soni & Associates Chartered Accountants No. of Dedutee Amount Upto 100 39.50 100-1000 200.00 More than 1000 650.00. …

How to Upload TDS Return on www.incometaxindiaefiling.gov.in After Successful Validation of TDS Return, click on Efile FVU file on ITD website button . In next screen click on Efile button In next screen select authorized person name digital signature and click on select signature button . Enter PIN and Press OK button Press OK Button to Login to ITD Website . Enter Capta Code in ITD Site

TDS software Gen e-TDS software which give you the facility for generate TDS returns. These are some basic features regarding software working. You can generate all types of TDS forms through software. You can import data from Fvu. File or excel file. Do Tds regarding online process through software. You can also upload e-returns directly. Some other options like bulk SMS ,billing, backup

Instruction For Tds Return File Software The data structure (file format) in which the e-TDS / e-TCS return is to be File Format for Form 24Q correction (1st,2nd & 3rd quarters) Version 5.3 · File Format.

Income Tax Return Filing TDS Software Taxmann’s One

TDS Return filing in India Steps to file TDS return

TDS Return Form Brief about Form Number and Particulars

How to Videos for Filling TDS Return Online For Free SureTDS

Know Online TDS Return Filing Process tin-nsdl.com

HOW TO FILE TDS RETURN ONLINE? Rajput Jain & Associates

HOW TO FILE TDS RETURN Archives StudyCafe

How to Open TDS Files File Extension TDS

File TDS Return Online in India TDS Filing LegalRaasta

What is the process of filing E-TDS Return? LegalRaasta

TDS is one way of collecting the taxes by the department, And if you want to register your TDS return filing on time in India then Comply partner is an organization that provides the services of TDS return …

e-TDS/e-TCS return in accordance with the file formats is to be prepared in clean text ASCII format with ‘txt’ as filename extension. e-TDS/e-TCS return can be prepared using in-house software, any other third party software or the NSDL e-TDS Return Preparation Utility.

TDS Return Form: So as to file TDS, you have the option of going in for an e-TDS these days. Yes, the wave of digitalization has not spared the Income Tax Department, making it more convenient than ever for the filers to rush through the procedure.

So basically writing this was necessary because i got some mails where people had asked me to whether they can file their TDS returns i.e. what they prepare using TDS RPU (return preparer utility) or any other software they use for preparing TDS returns ONLINE.

In this article, we will discuss about What is eTDS return, how to file TDS Return, Where to file it, How to prepare it, software and documents. If you have any query related to TDS return, ask in the comment form given below. We will try to solve your query as soon as possible. We have covered all amendment by finance act 2018, so you can say that the below article will be applicable for A.Y

The online filing of TDS return has become simple & easy. You should not be an expert to file a TDS return. I have explained the process in simple and detailed manner to understand how to file TDS return.

Do you getting difficulty to filling income taxes online? Watch out our videos on to better understand to how to fill file and other Issues step by step.

TDSMAN User Manual Page 4 1 Preface TDSMAN is a state-of-the-art software solution, enabling the companies / deductors to keep in pace with the ever changing TDS filing …

File TDS Return online in Delhi, Gurgaon, Noida & other cities in India at best prices. TDS Filing is your online CA / agent to Register TDS Return. TDS Filing is your online CA / agent to Register TDS Return.

19/07/2016 · Now you have not required to go NSDL agency for Filing Tds return with Pen drive data.You can upload Tds Return at your office,learn how to upload TDS Statement(.FVU FILE) online on e filing …

usual manual for changed procedure for filing of e-tds quarterly statement w.e.f. 01 may 2016. with effect from 01 may 2016 etds quarterly statement / returns shall be uploaded at traces tdscpc website and not on tin nsdl website.

TDS Return All You need to Know about TDS Return [A.Y

How to Videos for Filling TDS Return Online For Free SureTDS

TDS Return Form: So as to file TDS, you have the option of going in for an e-TDS these days. Yes, the wave of digitalization has not spared the Income Tax Department, making it more convenient than ever for the filers to rush through the procedure.

Also, you have an option of using the software available at NSDL website known as Return Prepare Utility (e-TDS RPU Light) for filing the return online. It is important to ensure that the online TDS file formats come with ‘txt’ as the filename extension.

Generate the TDS return that can be filed at the TIN-FC or online uploaded to the ITD website. Acknowledgment Enter the acknowledgment (PRN and receipt) received after filing the returns.

19/07/2016 · Now you have not required to go NSDL agency for Filing Tds return with Pen drive data.You can upload Tds Return at your office,learn how to upload TDS Statement(.FVU FILE) online on e filing …

Online Tax Accounting System PREPARATION & FILING OF TDS RETURN : 1. e-TDS/TCS statement must be prepared in clean text ASCII Format with “txt” as filename extension. 2. NSDL has prepared an e-TDS Return Preparation Utility (NSDL quarterly e-TDS RPU) for preparation of quarterly e-TDS statements and an e-TCS Return Preparation Utility (NSDL quarterly e-TCS RPU) for …

Rectification of Errors: Consolidated TDS/TCS File Available to registered TANs at TDSCPC. Mandatory from financial year 2007-08 to prepare correction return

In this article, we will discuss about What is eTDS return, how to file TDS Return, Where to file it, How to prepare it, software and documents. If you have any query related to TDS return, ask in the comment form given below. We will try to solve your query as soon as possible. We have covered all amendment by finance act 2018, so you can say that the below article will be applicable for A.Y

How to File TDS Return Online investsaver.com

After Successful Validation of TDS Return click on Efile

File correct and complete return within stipulated time frame, given the fact that the TDS credit will be available to the counter party taxpayer (supplier) upon filing of TDS return in Form GSTR-7 by the Deductor (i.e., person liable to deduct TDS); and

Pass the ZIP file through the utility to convert it into individual PDF files for each PAN User can opt to digitally sign the Form 16 As during conversion Deductor can also opt to manually sign the PDF files …

Online uploading of TDS returns with DSC Track request- Any request placed through TRACES/software can be tracked from software. Download TDS certificates- Facility to download TDS certificates like Form 16/16A/27D directly from TRACES.

In this article, we will discuss about What is eTDS return, how to file TDS Return, Where to file it, How to prepare it, software and documents. If you have any query related to TDS return, ask in the comment form given below. We will try to solve your query as soon as possible. We have covered all amendment by finance act 2018, so you can say that the below article will be applicable for A.Y

Note: The trial version of TDSMAN entitles you to complete one TDS returns & one correction statement for any quarter within FY: 17-18 or FY: 18-19 (except Q4).

usual manual for changed procedure for filing of e-tds quarterly statement w.e.f. 01 may 2016. with effect from 01 may 2016 etds quarterly statement / returns shall be uploaded at traces tdscpc website and not on tin nsdl website.

TDS Return Form Brief about Form Number and Particulars

TDS Returns Eligibility Filing Process Due Dates

File correct and complete return within stipulated time frame, given the fact that the TDS credit will be available to the counter party taxpayer (supplier) upon filing of TDS return in Form GSTR-7 by the Deductor (i.e., person liable to deduct TDS); and

We have earlier explained the procedure for filing TDS Return and for payment of TDS Online and in Form 27A will be created by FVU in PDF Format; Copy the .fvu file on a CD/ Pen Drive and submit the same to the TIN-FC along with requisite fees and print out of the statement statistics report and Form 27A. Software for filing Revised TDS Return. There are various softwares which can be used

The Control totals of the amount paid and the TDS as per item no. 4 of Form No. 27A must tally with the corresponding totals in the e-TDS return in Form No. 24/Form No. 26 /Form No.27, as the case may be.

It is the duty of the person who is making payment to someone for specified goods or services to deduct TDS and file TDS return. The specified payment includes salary, interest, commission, brokerage, professional fees, royalty, contract payments, etc.

File TDS Return online in Delhi, Gurgaon, Noida & other cities in India at best prices. TDS Filing is your online CA / agent to Register TDS Return. TDS Filing is your online CA / agent to Register TDS Return.

TDS Return Form: So as to file TDS, you have the option of going in for an e-TDS these days. Yes, the wave of digitalization has not spared the Income Tax Department, making it more convenient than ever for the filers to rush through the procedure.

Generate the TDS return that can be filed at the TIN-FC or online uploaded to the ITD website. Acknowledgment Enter the acknowledgment (PRN and receipt) received after filing the returns.

Online Tax Accounting System PREPARATION & FILING OF TDS RETURN : 1. e-TDS/TCS statement must be prepared in clean text ASCII Format with “txt” as filename extension. 2. NSDL has prepared an e-TDS Return Preparation Utility (NSDL quarterly e-TDS RPU) for preparation of quarterly e-TDS statements and an e-TCS Return Preparation Utility (NSDL quarterly e-TCS RPU) for …

Gen TDS Help SAG Infotech

Step by Step Process To File TDS Return Online By Utility

Due Dates for E-Filing of TDS/TCS Return AY 2017-18 (FY 2016-17) In this article we will share Due Date for Filing TDS Return, Issuance of Form 16 and TDS Payment.

Online Tax Accounting System PREPARATION & FILING OF TDS RETURN : 1. e-TDS/TCS statement must be prepared in clean text ASCII Format with “txt” as filename extension. 2. NSDL has prepared an e-TDS Return Preparation Utility (NSDL quarterly e-TDS RPU) for preparation of quarterly e-TDS statements and an e-TCS Return Preparation Utility (NSDL quarterly e-TCS RPU) for …

File TDS Return online in Delhi, Gurgaon, Noida & other cities in India at best prices. TDS Filing is your online CA / agent to Register TDS Return. TDS Filing is your online CA / agent to Register TDS Return.

File correct and complete return within stipulated time frame, given the fact that the TDS credit will be available to the counter party taxpayer (supplier) upon filing of TDS return in Form GSTR-7 by the Deductor (i.e., person liable to deduct TDS); and

Electronic filing, or e-filing of returns, as it is also called, is basically the submission of an individual’s income tax returns online. The filing of returns can be done in two ways – one is the conventional offline route which requires you to visit the office of the Income Tax Department and doing it manually, and the other is to file the returns on the internet. E-filing has been

Deductors/collectors are required to prepare e-TDS/TCS statements as per these file formats using, NSDL e-Gov. Return Preparation Utility or in-house software or any other third party software and submit the same to any of the TIN-FCs established by NSDL e-Gov.

usual manual for changed procedure for filing of e-tds quarterly statement w.e.f. 01 may 2016. with effect from 01 may 2016 etds quarterly statement / returns shall be uploaded at traces tdscpc website and not on tin nsdl website.

(File TDS return online at legalraasta. If a deductor fails to submit return in given time then he pays a fine of Rs. 300/- per day during which the failure continues will be levied till the default continues, not exceeding the TDS amount.

Then install the Itr return form and fill the form and file the return through online (absolutely free of cost ) and before filling the tax return verify the income tax due through online cbdt calculator to double check it and also verify the traces to figure out the TDS and tcs, etc.

The fastest and easiest way to open your TDS file is to double-click it. This allows the intelligence of Windows to decide the correct software application to open your TDS file.

A Step by step guide to filing your Income Tax returns online – SMITHA HARI can include it now while filing the returns). If you have fixed deposits, TDS is levied by bank @ 10%. Based on your tax slab, you may need to pay the additional tax, including penalties as applicable. What is the process involved in filing returns online? You must file your returns on the Income Tax department’s

TDS is one way of collecting the taxes by the department, And if you want to register your TDS return filing on time in India then Comply partner is an organization that provides the services of TDS return …

In this article, we will discuss about What is eTDS return, how to file TDS Return, Where to file it, How to prepare it, software and documents. If you have any query related to TDS return, ask in the comment form given below. We will try to solve your query as soon as possible. We have covered all amendment by finance act 2018, so you can say that the below article will be applicable for A.Y

Priya July 26, 2014 at 12:36 pm. Hi. Can you tell me if I can apply for my tds return with only my form 26AS? I have lost the TDS statements that I received from the company I used to work for.

All about procedure for filing quarterly tds returns online in India. Due Dates for Filing TDS Returns How to File TDS Returns Quarterly Charges of Filing.

How to File Nil TDS return online on TDSCPC website

Income Tax Return Filing TDS Software Taxmann’s One

usual manual for changed procedure for filing of e-tds quarterly statement w.e.f. 01 may 2016. with effect from 01 may 2016 etds quarterly statement / returns shall be uploaded at traces tdscpc website and not on tin nsdl website.

So basically writing this was necessary because i got some mails where people had asked me to whether they can file their TDS returns i.e. what they prepare using TDS RPU (return preparer utility) or any other software they use for preparing TDS returns ONLINE.

Due Dates for E-Filing of TDS/TCS Return AY 2017-18 (FY 2016-17) In this article we will share Due Date for Filing TDS Return, Issuance of Form 16 and TDS Payment.

What you need to convert a TDS file to a PDF file or how you can create a PDF version from your TDS file. Files of the type TDS or files with the file extension .tds can be easily converted to PDF with the help of a PDF printer.

The fastest and easiest way to open your TDS file is to double-click it. This allows the intelligence of Windows to decide the correct software application to open your TDS file.

Instruction For Tds Return File Software The data structure (file format) in which the e-TDS / e-TCS return is to be File Format for Form 24Q correction (1st,2nd & 3rd quarters) Version 5.3 · File Format.

How to Upload TDS Return on www.incometaxindiaefiling.gov.in After Successful Validation of TDS Return, click on Efile FVU file on ITD website button . In next screen click on Efile button In next screen select authorized person name digital signature and click on select signature button . Enter PIN and Press OK button Press OK Button to Login to ITD Website . Enter Capta Code in ITD Site

Return Record Register (filed / Not filed) and E-mail facility to customers for filing pending returns. Online services for TDS and Employee Download Form 16/16A/27D through online e-KYC, no need to remember CIN, PAN, Passwords and enter the KYC details every time.

Online uploading of TDS returns with DSC Track request- Any request placed through TRACES/software can be tracked from software. Download TDS certificates- Facility to download TDS certificates like Form 16/16A/27D directly from TRACES.

Then install the Itr return form and fill the form and file the return through online (absolutely free of cost ) and before filling the tax return verify the income tax due through online cbdt calculator to double check it and also verify the traces to figure out the TDS and tcs, etc.

Online Tax Accounting System PREPARATION & FILING OF TDS RETURN : 1. e-TDS/TCS statement must be prepared in clean text ASCII Format with “txt” as filename extension. 2. NSDL has prepared an e-TDS Return Preparation Utility (NSDL quarterly e-TDS RPU) for preparation of quarterly e-TDS statements and an e-TCS Return Preparation Utility (NSDL quarterly e-TCS RPU) for …

Electronic filing, or e-filing of returns, as it is also called, is basically the submission of an individual’s income tax returns online. The filing of returns can be done in two ways – one is the conventional offline route which requires you to visit the office of the Income Tax Department and doing it manually, and the other is to file the returns on the internet. E-filing has been

TDS Return Form Brief about Form Number and Particulars

How to Videos for Filling TDS Return Online For Free SureTDS

26/11/2018 · In this Article: Obtaining TAN Registration Computing TDS on Salary Filing TDS Returns Community Q&A 17 References. The Central Government …

TDS software Gen e-TDS software which give you the facility for generate TDS returns. These are some basic features regarding software working. You can generate all types of TDS forms through software. You can import data from Fvu. File or excel file. Do Tds regarding online process through software. You can also upload e-returns directly. Some other options like bulk SMS ,billing, backup

Then install the Itr return form and fill the form and file the return through online (absolutely free of cost ) and before filling the tax return verify the income tax due through online cbdt calculator to double check it and also verify the traces to figure out the TDS and tcs, etc.

Electronic filing, or e-filing of returns, as it is also called, is basically the submission of an individual’s income tax returns online. The filing of returns can be done in two ways – one is the conventional offline route which requires you to visit the office of the Income Tax Department and doing it manually, and the other is to file the returns on the internet. E-filing has been

Do you getting difficulty to filling income taxes online? Watch out our videos on to better understand to how to fill file and other Issues step by step.

Pass the ZIP file through the utility to convert it into individual PDF files for each PAN User can opt to digitally sign the Form 16 As during conversion Deductor can also opt to manually sign the PDF files …

File income tax return online in India 09891200793 by July 31, no plan to extend the deadline -The last date for file income tax return online in india for the financial year 2017-18 will not be extended beyond the july 31 deadline.the department has

Online Tax Accounting System PREPARATION & FILING OF TDS RETURN : 1. e-TDS/TCS statement must be prepared in clean text ASCII Format with “txt” as filename extension. 2. NSDL has prepared an e-TDS Return Preparation Utility (NSDL quarterly e-TDS RPU) for preparation of quarterly e-TDS statements and an e-TCS Return Preparation Utility (NSDL quarterly e-TCS RPU) for …

In this article, we will discuss about What is eTDS return, how to file TDS Return, Where to file it, How to prepare it, software and documents. If you have any query related to TDS return, ask in the comment form given below. We will try to solve your query as soon as possible. We have covered all amendment by finance act 2018, so you can say that the below article will be applicable for A.Y

So basically writing this was necessary because i got some mails where people had asked me to whether they can file their TDS returns i.e. what they prepare using TDS RPU (return preparer utility) or any other software they use for preparing TDS returns ONLINE.

The Control totals of the amount paid and the TDS as per item no. 4 of Form No. 27A must tally with the corresponding totals in the e-TDS return in Form No. 24/Form No. 26 /Form No.27, as the case may be.

usual manual for changed procedure for filing of e-tds quarterly statement w.e.f. 01 may 2016. with effect from 01 may 2016 etds quarterly statement / returns shall be uploaded at traces tdscpc website and not on tin nsdl website.

We have earlier explained the procedure for filing TDS Return and for payment of TDS Online and in Form 27A will be created by FVU in PDF Format; Copy the .fvu file on a CD/ Pen Drive and submit the same to the TIN-FC along with requisite fees and print out of the statement statistics report and Form 27A. Software for filing Revised TDS Return. There are various softwares which can be used

TDSCPC website has started a new facility to update declaration for Non filing of TDS statement for deductor. Deductors can update status of TDS/TCS statement to non-filing online after login at TDSCPC website.The benefit of this facility is that you need not file NIL tds/tcs return for a particular quarter/period.Just update your status to non

How to File TDS Return Online investsaver.com

How should I file TDS/TAN quarterly returns? Quora

So basically writing this was necessary because i got some mails where people had asked me to whether they can file their TDS returns i.e. what they prepare using TDS RPU (return preparer utility) or any other software they use for preparing TDS returns ONLINE.

Do you getting difficulty to filling income taxes online? Watch out our videos on to better understand to how to fill file and other Issues step by step.

Instruction For Tds Return File Software The data structure (file format) in which the e-TDS / e-TCS return is to be File Format for Form 24Q correction (1st,2nd & 3rd quarters) Version 5.3 · File Format.

6 Responses to “NIL RETURN FILING OF TDS THROUGH TRACES FOR FY- 2014-15” VISHAL JINDAL October 30th, 2015 . How to obtain receipt of non – filling tds return as status show of such return as Non-filled as notice are received from IT Dept.

How to Open TDS Files File Extension TDS

File TDS Return Online in India LegalRaasta PowerPoint

Rectification of Errors: Consolidated TDS/TCS File Available to registered TANs at TDSCPC. Mandatory from financial year 2007-08 to prepare correction return

So basically writing this was necessary because i got some mails where people had asked me to whether they can file their TDS returns i.e. what they prepare using TDS RPU (return preparer utility) or any other software they use for preparing TDS returns ONLINE.

As we all know, TDS is being deducted to deposit a certain amount of your salary to the government in the form of tax. Apart from depositing tax, you are required to file a TDS Return as well.

Do you getting difficulty to filling income taxes online? Watch out our videos on to better understand to how to fill file and other Issues step by step.

usual manual for changed procedure for filing of e-tds quarterly statement w.e.f. 01 may 2016. with effect from 01 may 2016 etds quarterly statement / returns shall be uploaded at traces tdscpc website and not on tin nsdl website.

Nil Return Filing of TDS Relyonsoft

After Successful Validation of TDS Return click on Efile

So to make it easy, here is the step by step process for online filing TDS return making use of the utility present on NSDL: Step 1: Registration on Traces and E-filing is the first step. Firstly, on traces, register your TAN number.

Note: The trial version of TDSMAN entitles you to complete one TDS returns & one correction statement for any quarter within FY: 17-18 or FY: 18-19 (except Q4).

Also, you have an option of using the software available at NSDL website known as Return Prepare Utility (e-TDS RPU Light) for filing the return online. It is important to ensure that the online TDS file formats come with ‘txt’ as the filename extension.

Generate the TDS return that can be filed at the TIN-FC or online uploaded to the ITD website. Acknowledgment Enter the acknowledgment (PRN and receipt) received after filing the returns.

Online Tax Accounting System PREPARATION & FILING OF TDS RETURN : 1. e-TDS/TCS statement must be prepared in clean text ASCII Format with “txt” as filename extension. 2. NSDL has prepared an e-TDS Return Preparation Utility (NSDL quarterly e-TDS RPU) for preparation of quarterly e-TDS statements and an e-TCS Return Preparation Utility (NSDL quarterly e-TCS RPU) for …

We have earlier explained the procedure for filing TDS Return and for payment of TDS Online and in Form 27A will be created by FVU in PDF Format; Copy the .fvu file on a CD/ Pen Drive and submit the same to the TIN-FC along with requisite fees and print out of the statement statistics report and Form 27A. Software for filing Revised TDS Return. There are various softwares which can be used

File correct and complete return within stipulated time frame, given the fact that the TDS credit will be available to the counter party taxpayer (supplier) upon filing of TDS return in Form GSTR-7 by the Deductor (i.e., person liable to deduct TDS); and

TDS Return state the TDS subtracted & paid to government throughout the Quarter to which it relates. Pre-Requisites for Uploading TDS Statement To transfer TDS, the user ought to hold valid TAN and will be registered in e-Filing.

File income tax return online in India 09891200793 by July 31, no plan to extend the deadline -The last date for file income tax return online in india for the financial year 2017-18 will not be extended beyond the july 31 deadline.the department has

The online filing of TDS return has become simple & easy. You should not be an expert to file a TDS return. I have explained the process in simple and detailed manner to understand how to file TDS return.

TDSCPC website has started a new facility to update declaration for Non filing of TDS statement for deductor. Deductors can update status of TDS/TCS statement to non-filing online after login at TDSCPC website.The benefit of this facility is that you need not file NIL tds/tcs return for a particular quarter/period.Just update your status to non

(File TDS return online at legalraasta. If a deductor fails to submit return in given time then he pays a fine of Rs. 300/- per day during which the failure continues will be levied till the default continues, not exceeding the TDS amount.

Return Record Register (filed / Not filed) and E-mail facility to customers for filing pending returns. Online services for TDS and Employee Download Form 16/16A/27D through online e-KYC, no need to remember CIN, PAN, Passwords and enter the KYC details every time.

Electronic filing, or e-filing of returns, as it is also called, is basically the submission of an individual’s income tax returns online. The filing of returns can be done in two ways – one is the conventional offline route which requires you to visit the office of the Income Tax Department and doing it manually, and the other is to file the returns on the internet. E-filing has been