Ifrs 16 leases illustrative examples pdf

– Lease contracts within the scope of IAS 17/IFRS 16 Leases; – Insurance contracts within the scope of IFRS 4 Insurance Contracts ; – Financial instruments and other contractual rights and obligations within the scope of IFRS 9 Financial Instruments ,

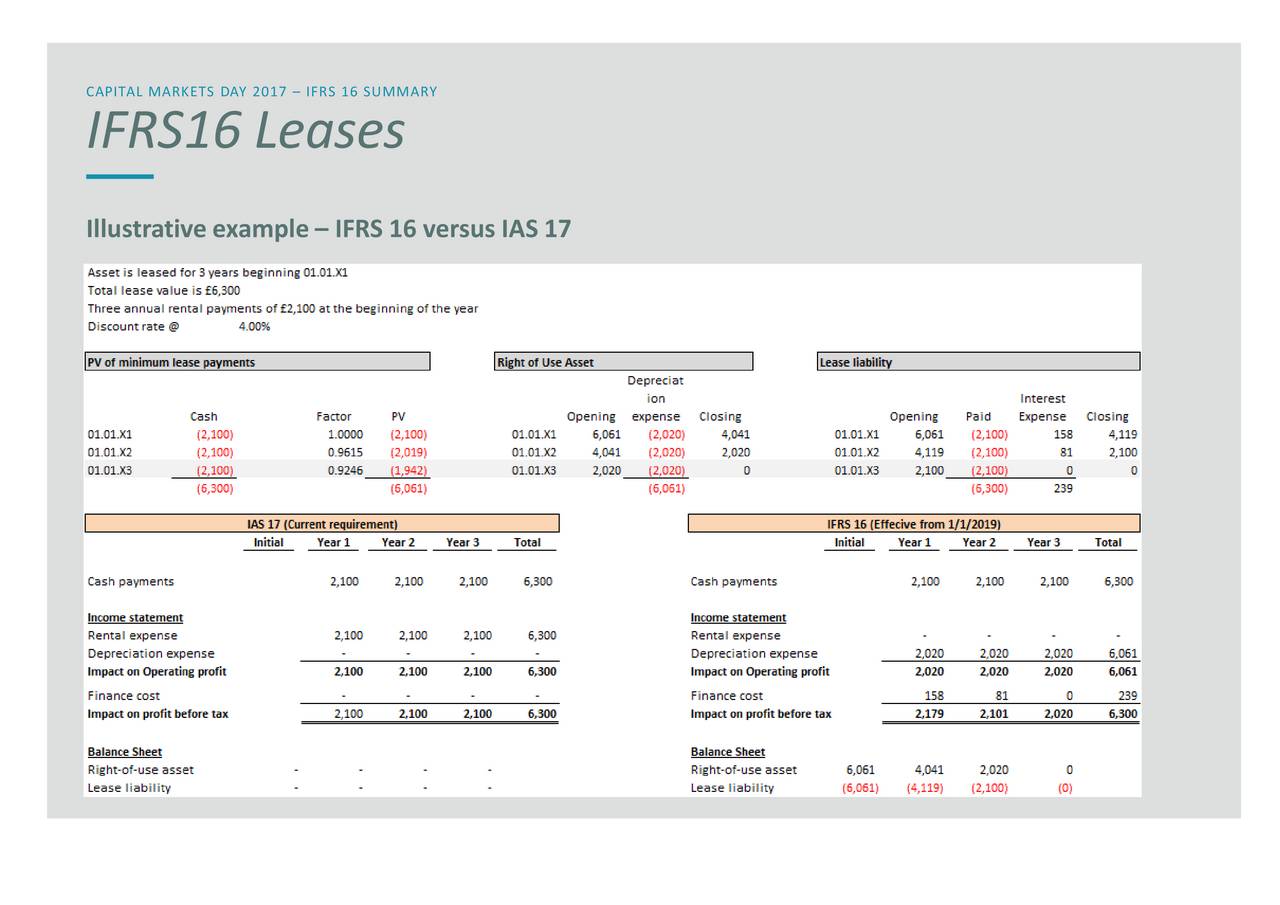

IAS 17 Leases, the predecessor to IFRS 16, requires entities to classify their contracts as either operating leases or finance leases, based on the extent to …

ILLUSTRATIVE EXAMPLES (see separate booklet) APPENDIX and to account for those two types of leases differently. IN9 IFRS 16 completes the IASB’s project to improve the financial reporting of leases. Main features Lessee accounting IN10 HKFRS 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12

Illustrative examples Basis for Conclusions on IFRS 16 Australian Accounting Standard AASB 16 Leases is set out in paragraphs 1 – Aus103.1 and Appendices A – D. All the paragraphs have equal authority. Paragraphs in bold type state the main principles. Terms defined in Appendix A are in italics the first time they appear in the Standard. AASB 16 is to be read in the context of other

illustrative examples and the Basis for Conclusions. Further guidance on the IFRS 16 identifies a lease as a contract, or part of a contract, that conveys the right to use an asset for a period of time in exchange for consideration. A contract is “an agreement between two or more parties that creates enforceable rights and obligations”. 4.6 The subtle change in wording for what is

IFRS 16 ILLUSTRATIVE EXAMPLES IFRS 16 Leases Illustrative Examples These examples accompany. Example 1—Rail cars Example 1A: a contract between Customer and a freight carrier (Supplier) provides Customer with the use of 10 rail cars of a particular type for five years. nor are the examples intended to apply only to the specific industry illustrated. Customer can use the cars for …

The example disclosures are not the only acceptable form of presenting financial statements. Alternative presentations may Alternative presentations may be acceptable if they comply with the specific disclosure requirements prescribed in the Australian accounting standards.

Even though recently issued IFRS 16/AASB 16 Leases has an effective date of 1 January 2019, you’ll need plenty of time to prepare for it. The IASB is replacing 30-year-old IAS 17’s/AASB 117 Leases with more than 340 pages of authoritative material. Ninety pages cover the standard itself, there are 57 pages of examples, 90 of bases of conclusions and 103 of effects analyses. To say the

Illustrative Examples International Financial Reporting Standard® January 2016 IFRS 16 Leases This preview has intentionally blurred sections. Sign up to view the full version.

the requirements of the new leases standard – NZ IFRS 16 Leases which is applicable to all Tier 1 and Tier 2 for-profit entities in New Zealand. Summary NZ IFRS 16 includes a single accounting model for all leases by lessees. The main implications of the new standard on current practice for lessees include: No more operating leases under NZ IFRS 16 (subject to the exceptions described below

January 2016 Illustrative Examples International Financial Reporting Standard® IFRS 16 Leases Illustrative Examples IFRS 16 Leases These Illustrative Examples accompany IFRS 16 Leases (issued January 2016; see separate booklet) and is published …

IFRS 16 Leases requires lessees to recognise new assets and liabilities under an on-balance sheet accounting model that is similar to current finance lease accounting. Key metrics will be affected by the recognition of new assets and liabilities, and differences in the timing and classification of lease income/expense. Our illustrative disclosures supplement (PDF 1.8 MB) will help you to

The new standard on leases, IFRS 16, affects the accounting for leases and rental agreements that are currently only recognised as an operating expense in profit or loss. Users should think about the implications of the new standard in good time. IFRS 16, the new lease accounting standard, was

Overview. IFRS 16 specifies how an IFRS reporter will recognise, measure, present and disclose leases. The standard provides a single lessee accounting model, requiring lessees to recognise assets and liabilities for all leases unless the lease term is 12 months …

Account for a lease element as for a lease under IFRS 16 (if it meets the criteria in IFRS 16); and Account for a service element as before, in most cases as an expense in profit or loss. From our example above: let’s say you took the option 2 and you pay CU 10 000 per year.

CONTENTS from paragraph [DRAFT] IFRS X LEASES ILLUSTRATIVE EXAMPLES INTRODUCTION IE1 IDENTIFYING A LEASE IE3 Example1—Contractforrailcars Example2—Contractforcoffeeservices

read IFRS 16 as written by the IASB, including appendices, illustrative examples and Basis for Conclusions. 4 Chapter 2 Questions Question 1: Do you agree with the proposed amendments to the accounting for leases in the FReM to reflect the principles of IFRS 16? If so why, if not why not and what alternatives do you propose? Question 2 Do you agree with the adaptation for the definition of a

IFRS 16 Leases Overview KPMG US

Example How to Adopt IFRS 16 Leases IFRSbox – Making

Illustrative examples Solution: Is it a lease or a service contract? ProductCo has the right to control the truck identified in the contract, because: • It has exclusive use of the truck, which gives it the right to obtain substantially all of the economic benefits from use of the identified assets. • It has the right to determine how the truck is used at all points during the lease term

Only limited transitional relief is available whereby an entity may assess the existence of a lease using either IFRS 16 or IAS 17 Leases and IFRIC 4 Determining whether an arrangement contains a lease (i.e. grandfather across the definition for existing contracts).

Under IFRS 16, leases are accounted for based on a ‘right-of-use model’. The model reflects that, at the commencement date, a lessee has a financial obligation to make lease payments to …

IFRS 16 eliminates the current dual accounting model for lessees, which distinguishes between on-balance sheet finance leases and off-balance sheet operating leases. Instead, there is a single, on-balance sheet accounting model that is similar to current finance lease accounting.

IFRS 16 I. LLUSTRATIVE. E. XAMPLES. IFRS 16. Leases. Illustrative Examples. These examples accompany, but are not part of, IFRS 16. They illustrate aspects of IFRS 16 but are

The IASB published IFRS 16 Leases in January 2016 with an effective date of 1 January 2019. The new standard . requires lessees to recognise nearly all leases on the balance sheet which will reflect their right to use an asset for a period of time and the associated liability for payments. Lessees • The new standard will affect virtually all commonly used financial ratios and performance

© 2016 KPMG IFRG Limited, a UK company limited by guarantee and a member firm of the KPMG network of independent member firms affiliated with KPMG International

statements – Illustrative disclosures (the September 2017 guide). The September 2017 guide helps you to prepare financial statements in accordance with IFRS, illustrating one possible format for financial statements . based on a fictitious multinational listed corporation; the corporation is not a first-time adopter of IFRS. IFRS 16 . Leases. This supplement focuses on the disclosure

Under IFRS 16, companies will bring these leases on balance sheet, using a common methodology

IFRS 16 Leases. Project status: Completed Current project stage: and also including a working draft of the application guidance and accompanying illustrative examples to be included in the forthcoming Standard on the definition of a lease. Following this publication, EFRAG initiated a fieldwork to identify whether the definition of a lease criteria are understandable and practical to apply

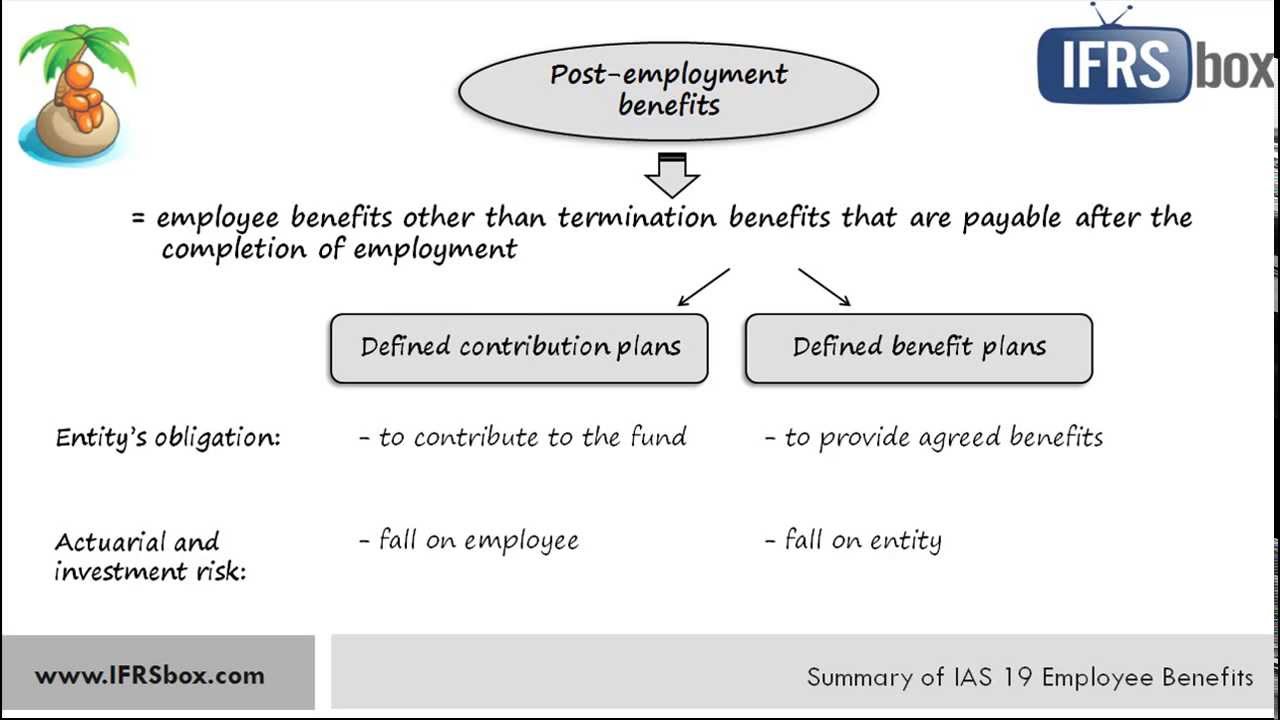

IAS 17 Leases 1 Overview IAS 17 sets out the required accounting treatments and disclosures for finance and operating leases by both lessors and lessees, except where IAS 40 is applied to investment property held by a lessee. Definitions A finance lease – a lease that transfers substantially all the risks and reward of ownership. An operating lease – any lease that is not a finance lease

The essence of IFRS 16 (replacing the IAS 17 standard, which has been valid for the past 30 years) is a requirement to disclose operating lease liability on the balance sheet, together with Right-of-use asset.

IFRS 16, ‘Leases’ In relation to the impact of IFRSs 9, 15 and 16 which are not yet effective, entities should refer to the latest illustrative disclosure in PwC’s VALUE IFRS Plc Illustrative IFRS consolidated financial statements December 2017. It should be emphasised that regulators expect disclosure of entity-specific quantitative and qualitative information as to the impact of applying

IFRS 16 ILLUSTRATIVE EXAMPLES IFRS 16 Leases Illustrative Examples These examples accompany.. Customer can use the cars for another purpose (for example. If a particular car needs to be serviced or repaired. There are 10 identified cars. The contract specifies the rail cars. Supplier can choose to use any one of a number of engines to fulfil each of Customer’s requests. Although some …

and illustrative examples. The Board will analyse submissions received and other information gathered to decide whether further guidance is needed. Hypothesis Lessees exclude all variable lease payments when calculating the lease liability. Testing and analysis IFRS 16 identifies three types of variable lease payments: The leases lab 4 IFRS/HKFRS News August 2017 Variable lease payments

IFRS 16 Leases prescribes a single lessee accounting model that requires the recognition of asset and corresponding liability for all leases with terms over 12 months unless the …

book containing the requirements and the illustrative examples in Finnish. IASB julkaisi uuden IFRS 16 Leases -standardin tammikuussa 2016. Standardi tulee voimaan 1.1.2019 ja korvaa IAS 17 -standardin.

In my last article I tried to outline the strategy and your choices when implementing the new lease standard IFRS 16 Leases. I am grateful for many responses and comments I got from you.

Illustrative Examples Exposure Draft ED/2013/6 ey.com

• IFRS 16 applies a control model to the identification of leases, distinguishing between leases and service contracts on the basis of whether there is an identified asset controlled by the customer.

issued IFRS 16 Leases in January 2016 which will be effective from January 2019. IFRS 16 introduces major changes in lessee accounting while lessor accounting remains largely unchanged. In the current leases standard IAS 17, lessees account for leases according to the terms of the lease contracts as either operating leases or finance leases. In IFRS 16, lessees are generally not allowed to use

IFRS 16 requires that the ‘right of use asset’ and the lease liability should initially be measured at the present value of the minimum lease payments. The discount rate used to determine present value should be the rate of interest implicit in the lease.

The International Accounting Standards Board (IASB) has published a new standard, IFRS 16 ‘Leases’. The new standard brings most leases on-balance sheet for lessees under a single model, eliminating the distinction between operating and finance leases.

IAS 17 [ILLUSTRATIVE EXAMPLES ON LEASES] Illustrative Example from IFRS 16 – Leases Example—Measurement by a lessee and accounting for a change in the lease term Part 1—Initial measurement of the right-of-use asset and the lease liability Lessee enters into a 10-year lease of a floor of a building, with an option to extend for five years.

Hkfrs 16 leases hkicpa standard setting department staff summary (may 2016) introduction 1. hkfrs 16 is the equivalent of ifrs 16 leases issued by the…

This guide (PDF 2.8 MB) is based on a fictitious multinational insurer that is not a first-time adopter of IFRS. It illustrates example disclosures for an annual period beginning on 1 January 2021, when IFRS 17 Insurance Contracts and IFRS 9 Financial Instruments are applied for the first time.

Major reforms to global lease accounting IFRS News Special Edition February 2016 on Lease Accounting The IASB has published IFRS 16 ‘Leases’ completing its long-running project on lease accounting. This special edition of IFRS News explains the key features of the new Standard and provides practical insights into its application and impact. Major reforms to global lease accounting

IFRS 16 Leases_Illustrative Examples January 2016

IFRS 16 – Leases Illustrative Examples. Rechercher : Articles récents (pas de titre) EFRAG requests comments on its Preliminary Consultation Document regarding the endorsement of IFRS 16 Leases; Lessor accounting – how the new lease and revenue standards interact

IFRS 16 includes new guidance and illustrative examples on assessing whether a contract contains a lease, a service or both. The new guidance focuses on the principle of

IFRS 16 provides two options for transitioning existing operating leases into the model required: Full retrospective application as if IFRS 16 always applied; or Partial retrospective application as at the date of initial application (start of financial year when IFRS 16 is first adopted).

CONTENTS from paragraph [DRAFT] IFRS X LEASES ILLUSTRATIVE EXAMPLES INTRODUCTION IE1 IDENTIFYING A LEASE IE3 Example 1—Contract for rail cars Example …

Guide to annual financial statements IFRS and IFRS 16 . Leases. As a consequence, significant focus is expected on the pre‑transition disclosures about the possible impact of new standards that are required under the existing requirements of IAS 8 . Accounting Policies, Changes in Accounting Estimates and Errors. Regulators have communicated their expectation that, as the implementation

8 ifrs in practice – ifrs 16 leases Short-term Leases Short-term leases are defined as ‘leases that, at the commencement date, have a lease term of 12 months or less.

ifrs in practice fi ifrs 16 leases 9 Example 1 – Low Value Lease Assessment Entity A is a large, multi-national technology company with approximately CU 10 billion in its annual operating budget.

• a summary of the important illustrative examples accompanying IFRS 16 dealing with the identification of leases; Leases A guide to IFRS 16. Contents Executive summary 3 Dealing with transition 5 Detailed guide 9 Appendices Appendix 1 Illustrative examples – identification of a lease 97 Appendix 2 Presentation and disclosure checklist – lessees 102 Appendix 3 Disclosure checklist

Finnish IFRS 16 Leases book – IFRS Foundation

New leasing standard significantly changes how lessees

that the application of IFRS 16 will have on the Group’s consolidated financial statements in the period of initial application. Explain the changes As preparers apply IFRS 15 and IFRS 9 in their 2018 annual financial statements,

Major reforms to global lease accounting

IASB issues new leasing standard IAS Plus

Lease Incentives (Amendment to Illustrative Example IFRS

IFRS news/HKFRS news PwC

EXAMPLES – IFRS 16

Applying IFRS A Closer Look at the New Leases Standard

New leases standard – Introducing IFRS 16 KPMG GLOBAL

ACCOUNTING ALERT BDO

Example How to Adopt IFRS 16 Leases IFRSbox – Making

IFRS 16 Leases_Illustrative Examples Retail

CONTENTS from paragraph [DRAFT] IFRS X LEASES ILLUSTRATIVE EXAMPLES INTRODUCTION IE1 IDENTIFYING A LEASE IE3 Example 1—Contract for rail cars Example …

– Lease contracts within the scope of IAS 17/IFRS 16 Leases; – Insurance contracts within the scope of IFRS 4 Insurance Contracts ; – Financial instruments and other contractual rights and obligations within the scope of IFRS 9 Financial Instruments ,

• IFRS 16 applies a control model to the identification of leases, distinguishing between leases and service contracts on the basis of whether there is an identified asset controlled by the customer.

Illustrative Examples International Financial Reporting Standard® January 2016 IFRS 16 Leases This preview has intentionally blurred sections. Sign up to view the full version.

book containing the requirements and the illustrative examples in Finnish. IASB julkaisi uuden IFRS 16 Leases -standardin tammikuussa 2016. Standardi tulee voimaan 1.1.2019 ja korvaa IAS 17 -standardin.

ILLUSTRATIVE EXAMPLES (see separate booklet) APPENDIX and to account for those two types of leases differently. IN9 IFRS 16 completes the IASB’s project to improve the financial reporting of leases. Main features Lessee accounting IN10 HKFRS 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12

statements – Illustrative disclosures (the September 2017 guide). The September 2017 guide helps you to prepare financial statements in accordance with IFRS, illustrating one possible format for financial statements . based on a fictitious multinational listed corporation; the corporation is not a first-time adopter of IFRS. IFRS 16 . Leases. This supplement focuses on the disclosure

Guide to annual financial statements IFRS and IFRS 16 . Leases. As a consequence, significant focus is expected on the pre‑transition disclosures about the possible impact of new standards that are required under the existing requirements of IAS 8 . Accounting Policies, Changes in Accounting Estimates and Errors. Regulators have communicated their expectation that, as the implementation

and illustrative examples. The Board will analyse submissions received and other information gathered to decide whether further guidance is needed. Hypothesis Lessees exclude all variable lease payments when calculating the lease liability. Testing and analysis IFRS 16 identifies three types of variable lease payments: The leases lab 4 IFRS/HKFRS News August 2017 Variable lease payments

This guide (PDF 2.8 MB) is based on a fictitious multinational insurer that is not a first-time adopter of IFRS. It illustrates example disclosures for an annual period beginning on 1 January 2021, when IFRS 17 Insurance Contracts and IFRS 9 Financial Instruments are applied for the first time.

Illustrative examples Basis for Conclusions on IFRS 16 Australian Accounting Standard AASB 16 Leases is set out in paragraphs 1 – Aus103.1 and Appendices A – D. All the paragraphs have equal authority. Paragraphs in bold type state the main principles. Terms defined in Appendix A are in italics the first time they appear in the Standard. AASB 16 is to be read in the context of other

In my last article I tried to outline the strategy and your choices when implementing the new lease standard IFRS 16 Leases. I am grateful for many responses and comments I got from you.

8 ifrs in practice – ifrs 16 leases Short-term Leases Short-term leases are defined as ‘leases that, at the commencement date, have a lease term of 12 months or less.

IFRS 16 requires that the ‘right of use asset’ and the lease liability should initially be measured at the present value of the minimum lease payments. The discount rate used to determine present value should be the rate of interest implicit in the lease.

Major reforms to global lease accounting IFRS News Special Edition February 2016 on Lease Accounting The IASB has published IFRS 16 ‘Leases’ completing its long-running project on lease accounting. This special edition of IFRS News explains the key features of the new Standard and provides practical insights into its application and impact. Major reforms to global lease accounting

IFRS 16 Leases_Illustrative Examples Retail

IFRS 16 Leases_Illustrative Examples January 2016

• a summary of the important illustrative examples accompanying IFRS 16 dealing with the identification of leases; Leases A guide to IFRS 16. Contents Executive summary 3 Dealing with transition 5 Detailed guide 9 Appendices Appendix 1 Illustrative examples – identification of a lease 97 Appendix 2 Presentation and disclosure checklist – lessees 102 Appendix 3 Disclosure checklist

IAS 17 [ILLUSTRATIVE EXAMPLES ON LEASES] Illustrative Example from IFRS 16 – Leases Example—Measurement by a lessee and accounting for a change in the lease term Part 1—Initial measurement of the right-of-use asset and the lease liability Lessee enters into a 10-year lease of a floor of a building, with an option to extend for five years.

The essence of IFRS 16 (replacing the IAS 17 standard, which has been valid for the past 30 years) is a requirement to disclose operating lease liability on the balance sheet, together with Right-of-use asset.

book containing the requirements and the illustrative examples in Finnish. IASB julkaisi uuden IFRS 16 Leases -standardin tammikuussa 2016. Standardi tulee voimaan 1.1.2019 ja korvaa IAS 17 -standardin.

IFRS 16 includes new guidance and illustrative examples on assessing whether a contract contains a lease, a service or both. The new guidance focuses on the principle of

IAS 17 Leases, the predecessor to IFRS 16, requires entities to classify their contracts as either operating leases or finance leases, based on the extent to …

Even though recently issued IFRS 16/AASB 16 Leases has an effective date of 1 January 2019, you’ll need plenty of time to prepare for it. The IASB is replacing 30-year-old IAS 17’s/AASB 117 Leases with more than 340 pages of authoritative material. Ninety pages cover the standard itself, there are 57 pages of examples, 90 of bases of conclusions and 103 of effects analyses. To say the

– Lease contracts within the scope of IAS 17/IFRS 16 Leases; – Insurance contracts within the scope of IFRS 4 Insurance Contracts ; – Financial instruments and other contractual rights and obligations within the scope of IFRS 9 Financial Instruments ,

IFRS 16 Leases What does it mean for you? — Moore Stephens

Major reforms to global lease accounting

8 ifrs in practice – ifrs 16 leases Short-term Leases Short-term leases are defined as ‘leases that, at the commencement date, have a lease term of 12 months or less.

ifrs in practice fi ifrs 16 leases 9 Example 1 – Low Value Lease Assessment Entity A is a large, multi-national technology company with approximately CU 10 billion in its annual operating budget.

and illustrative examples. The Board will analyse submissions received and other information gathered to decide whether further guidance is needed. Hypothesis Lessees exclude all variable lease payments when calculating the lease liability. Testing and analysis IFRS 16 identifies three types of variable lease payments: The leases lab 4 IFRS/HKFRS News August 2017 Variable lease payments

IFRS 16 includes new guidance and illustrative examples on assessing whether a contract contains a lease, a service or both. The new guidance focuses on the principle of

Overview. IFRS 16 specifies how an IFRS reporter will recognise, measure, present and disclose leases. The standard provides a single lessee accounting model, requiring lessees to recognise assets and liabilities for all leases unless the lease term is 12 months …

The essence of IFRS 16 (replacing the IAS 17 standard, which has been valid for the past 30 years) is a requirement to disclose operating lease liability on the balance sheet, together with Right-of-use asset.

January 2016 Illustrative Examples International Financial Reporting Standard® IFRS 16 Leases Illustrative Examples IFRS 16 Leases These Illustrative Examples accompany IFRS 16 Leases (issued January 2016; see separate booklet) and is published …

IFRS in Focus IASB issues IFRS 16 – Leases CASPlus

Example How to Adopt IFRS 16 Leases IFRSbox – Making

IAS 17 Leases, the predecessor to IFRS 16, requires entities to classify their contracts as either operating leases or finance leases, based on the extent to …

Illustrative examples Solution: Is it a lease or a service contract? ProductCo has the right to control the truck identified in the contract, because: • It has exclusive use of the truck, which gives it the right to obtain substantially all of the economic benefits from use of the identified assets. • It has the right to determine how the truck is used at all points during the lease term

Guide to annual financial statements IFRS and IFRS 16 . Leases. As a consequence, significant focus is expected on the pre‑transition disclosures about the possible impact of new standards that are required under the existing requirements of IAS 8 . Accounting Policies, Changes in Accounting Estimates and Errors. Regulators have communicated their expectation that, as the implementation

Under IFRS 16, companies will bring these leases on balance sheet, using a common methodology

• IFRS 16 applies a control model to the identification of leases, distinguishing between leases and service contracts on the basis of whether there is an identified asset controlled by the customer.

and illustrative examples. The Board will analyse submissions received and other information gathered to decide whether further guidance is needed. Hypothesis Lessees exclude all variable lease payments when calculating the lease liability. Testing and analysis IFRS 16 identifies three types of variable lease payments: The leases lab 4 IFRS/HKFRS News August 2017 Variable lease payments

In my last article I tried to outline the strategy and your choices when implementing the new lease standard IFRS 16 Leases. I am grateful for many responses and comments I got from you.

CONTENTS from paragraph [DRAFT] IFRS X LEASES ILLUSTRATIVE EXAMPLES INTRODUCTION IE1 IDENTIFYING A LEASE IE3 Example1—Contractforrailcars Example2—Contractforcoffeeservices

illustrative examples and the Basis for Conclusions. Further guidance on the IFRS 16 identifies a lease as a contract, or part of a contract, that conveys the right to use an asset for a period of time in exchange for consideration. A contract is “an agreement between two or more parties that creates enforceable rights and obligations”. 4.6 The subtle change in wording for what is

IFRS 16 Leases requires lessees to recognise new assets and liabilities under an on-balance sheet accounting model that is similar to current finance lease accounting. Key metrics will be affected by the recognition of new assets and liabilities, and differences in the timing and classification of lease income/expense. Our illustrative disclosures supplement (PDF 1.8 MB) will help you to

CONTENTS from paragraph [DRAFT] IFRS X LEASES ILLUSTRATIVE EXAMPLES INTRODUCTION IE1 IDENTIFYING A LEASE IE3 Example 1—Contract for rail cars Example …

Illustrative Examples International Financial Reporting Standard® January 2016 IFRS 16 Leases This preview has intentionally blurred sections. Sign up to view the full version.

IFRS in Focus IASB issues IFRS 16 – Leases CASPlus

IFRS 16 Leases What does it mean for you? — Moore Stephens

Guide to annual financial statements IFRS and IFRS 16 . Leases. As a consequence, significant focus is expected on the pre‑transition disclosures about the possible impact of new standards that are required under the existing requirements of IAS 8 . Accounting Policies, Changes in Accounting Estimates and Errors. Regulators have communicated their expectation that, as the implementation

Even though recently issued IFRS 16/AASB 16 Leases has an effective date of 1 January 2019, you’ll need plenty of time to prepare for it. The IASB is replacing 30-year-old IAS 17’s/AASB 117 Leases with more than 340 pages of authoritative material. Ninety pages cover the standard itself, there are 57 pages of examples, 90 of bases of conclusions and 103 of effects analyses. To say the

CONTENTS from paragraph [DRAFT] IFRS X LEASES ILLUSTRATIVE EXAMPLES INTRODUCTION IE1 IDENTIFYING A LEASE IE3 Example 1—Contract for rail cars Example …

illustrative examples and the Basis for Conclusions. Further guidance on the IFRS 16 identifies a lease as a contract, or part of a contract, that conveys the right to use an asset for a period of time in exchange for consideration. A contract is “an agreement between two or more parties that creates enforceable rights and obligations”. 4.6 The subtle change in wording for what is

issued IFRS 16 Leases in January 2016 which will be effective from January 2019. IFRS 16 introduces major changes in lessee accounting while lessor accounting remains largely unchanged. In the current leases standard IAS 17, lessees account for leases according to the terms of the lease contracts as either operating leases or finance leases. In IFRS 16, lessees are generally not allowed to use

Hkfrs 16 leases hkicpa standard setting department staff summary (may 2016) introduction 1. hkfrs 16 is the equivalent of ifrs 16 leases issued by the…

Under IFRS 16, companies will bring these leases on balance sheet, using a common methodology

IFRS 16 ILLUSTRATIVE EXAMPLES IFRS 16 Leases Illustrative Examples These examples accompany.. Customer can use the cars for another purpose (for example. If a particular car needs to be serviced or repaired. There are 10 identified cars. The contract specifies the rail cars. Supplier can choose to use any one of a number of engines to fulfil each of Customer’s requests. Although some …

New leasing standard significantly changes how lessees

Major reforms to global lease accounting

IFRS 16 Leases requires lessees to recognise new assets and liabilities under an on-balance sheet accounting model that is similar to current finance lease accounting. Key metrics will be affected by the recognition of new assets and liabilities, and differences in the timing and classification of lease income/expense. Our illustrative disclosures supplement (PDF 1.8 MB) will help you to

Guide to annual financial statements IFRS and IFRS 16 . Leases. As a consequence, significant focus is expected on the pre‑transition disclosures about the possible impact of new standards that are required under the existing requirements of IAS 8 . Accounting Policies, Changes in Accounting Estimates and Errors. Regulators have communicated their expectation that, as the implementation

IFRS 16, ‘Leases’ In relation to the impact of IFRSs 9, 15 and 16 which are not yet effective, entities should refer to the latest illustrative disclosure in PwC’s VALUE IFRS Plc Illustrative IFRS consolidated financial statements December 2017. It should be emphasised that regulators expect disclosure of entity-specific quantitative and qualitative information as to the impact of applying

statements – Illustrative disclosures (the September 2017 guide). The September 2017 guide helps you to prepare financial statements in accordance with IFRS, illustrating one possible format for financial statements . based on a fictitious multinational listed corporation; the corporation is not a first-time adopter of IFRS. IFRS 16 . Leases. This supplement focuses on the disclosure

The IASB published IFRS 16 Leases in January 2016 with an effective date of 1 January 2019. The new standard . requires lessees to recognise nearly all leases on the balance sheet which will reflect their right to use an asset for a period of time and the associated liability for payments. Lessees • The new standard will affect virtually all commonly used financial ratios and performance

IAS 17 Leases, the predecessor to IFRS 16, requires entities to classify their contracts as either operating leases or finance leases, based on the extent to …

The new standard on leases, IFRS 16, affects the accounting for leases and rental agreements that are currently only recognised as an operating expense in profit or loss. Users should think about the implications of the new standard in good time. IFRS 16, the new lease accounting standard, was

illustrative examples and the Basis for Conclusions. Further guidance on the IFRS 16 identifies a lease as a contract, or part of a contract, that conveys the right to use an asset for a period of time in exchange for consideration. A contract is “an agreement between two or more parties that creates enforceable rights and obligations”. 4.6 The subtle change in wording for what is

IFRS 16 Illustrative disclosures KPMG GLOBAL

IFRS 16 Leases Overview KPMG US

IFRS 16 Leases prescribes a single lessee accounting model that requires the recognition of asset and corresponding liability for all leases with terms over 12 months unless the …

Under IFRS 16, leases are accounted for based on a ‘right-of-use model’. The model reflects that, at the commencement date, a lessee has a financial obligation to make lease payments to …

January 2016 Illustrative Examples International Financial Reporting Standard® IFRS 16 Leases Illustrative Examples IFRS 16 Leases These Illustrative Examples accompany IFRS 16 Leases (issued January 2016; see separate booklet) and is published …

IFRS 16 – Leases Illustrative Examples. Rechercher : Articles récents (pas de titre) EFRAG requests comments on its Preliminary Consultation Document regarding the endorsement of IFRS 16 Leases; Lessor accounting – how the new lease and revenue standards interact

IFRS 16 includes new guidance and illustrative examples on assessing whether a contract contains a lease, a service or both. The new guidance focuses on the principle of

IFRS 16 ILLUSTRATIVE EXAMPLES IFRS 16 Leases Illustrative Examples These examples accompany.. Customer can use the cars for another purpose (for example. If a particular car needs to be serviced or repaired. There are 10 identified cars. The contract specifies the rail cars. Supplier can choose to use any one of a number of engines to fulfil each of Customer’s requests. Although some …

IFRS 16 ILLUSTRATIVE EXAMPLES IFRS 16 Leases Illustrative Examples These examples accompany. Example 1—Rail cars Example 1A: a contract between Customer and a freight carrier (Supplier) provides Customer with the use of 10 rail cars of a particular type for five years. nor are the examples intended to apply only to the specific industry illustrated. Customer can use the cars for …

illustrative examples and the Basis for Conclusions. Further guidance on the IFRS 16 identifies a lease as a contract, or part of a contract, that conveys the right to use an asset for a period of time in exchange for consideration. A contract is “an agreement between two or more parties that creates enforceable rights and obligations”. 4.6 The subtle change in wording for what is

CONTENTS from paragraph [DRAFT] IFRS X LEASES ILLUSTRATIVE EXAMPLES INTRODUCTION IE1 IDENTIFYING A LEASE IE3 Example1—Contractforrailcars Example2—Contractforcoffeeservices

Major reforms to global lease accounting

IFRS 16 Leases_Illustrative Examples January 2016

This guide (PDF 2.8 MB) is based on a fictitious multinational insurer that is not a first-time adopter of IFRS. It illustrates example disclosures for an annual period beginning on 1 January 2021, when IFRS 17 Insurance Contracts and IFRS 9 Financial Instruments are applied for the first time.

IFRS 16, ‘Leases’ In relation to the impact of IFRSs 9, 15 and 16 which are not yet effective, entities should refer to the latest illustrative disclosure in PwC’s VALUE IFRS Plc Illustrative IFRS consolidated financial statements December 2017. It should be emphasised that regulators expect disclosure of entity-specific quantitative and qualitative information as to the impact of applying

IAS 17 [ILLUSTRATIVE EXAMPLES ON LEASES] Illustrative Example from IFRS 16 – Leases Example—Measurement by a lessee and accounting for a change in the lease term Part 1—Initial measurement of the right-of-use asset and the lease liability Lessee enters into a 10-year lease of a floor of a building, with an option to extend for five years.

IFRS 16 ILLUSTRATIVE EXAMPLES IFRS 16 Leases Illustrative Examples These examples accompany. Example 1—Rail cars Example 1A: a contract between Customer and a freight carrier (Supplier) provides Customer with the use of 10 rail cars of a particular type for five years. nor are the examples intended to apply only to the specific industry illustrated. Customer can use the cars for …

IFRS 16 eliminates the current dual accounting model for lessees, which distinguishes between on-balance sheet finance leases and off-balance sheet operating leases. Instead, there is a single, on-balance sheet accounting model that is similar to current finance lease accounting.

In my last article I tried to outline the strategy and your choices when implementing the new lease standard IFRS 16 Leases. I am grateful for many responses and comments I got from you.

Hkfrs 16 leases hkicpa standard setting department staff summary (may 2016) introduction 1. hkfrs 16 is the equivalent of ifrs 16 leases issued by the…

• a summary of the important illustrative examples accompanying IFRS 16 dealing with the identification of leases; Leases A guide to IFRS 16. Contents Executive summary 3 Dealing with transition 5 Detailed guide 9 Appendices Appendix 1 Illustrative examples – identification of a lease 97 Appendix 2 Presentation and disclosure checklist – lessees 102 Appendix 3 Disclosure checklist

• IFRS 16 applies a control model to the identification of leases, distinguishing between leases and service contracts on the basis of whether there is an identified asset controlled by the customer.

FINANCIAL REPORTING GUIDE TO IFRS 16 LEASES

New leases standard – Introducing IFRS 16 KPMG GLOBAL

The new standard on leases, IFRS 16, affects the accounting for leases and rental agreements that are currently only recognised as an operating expense in profit or loss. Users should think about the implications of the new standard in good time. IFRS 16, the new lease accounting standard, was

IFRS 16 Leases requires lessees to recognise new assets and liabilities under an on-balance sheet accounting model that is similar to current finance lease accounting. Key metrics will be affected by the recognition of new assets and liabilities, and differences in the timing and classification of lease income/expense. Our illustrative disclosures supplement (PDF 1.8 MB) will help you to

Overview. IFRS 16 specifies how an IFRS reporter will recognise, measure, present and disclose leases. The standard provides a single lessee accounting model, requiring lessees to recognise assets and liabilities for all leases unless the lease term is 12 months …

The example disclosures are not the only acceptable form of presenting financial statements. Alternative presentations may Alternative presentations may be acceptable if they comply with the specific disclosure requirements prescribed in the Australian accounting standards.

issued IFRS 16 Leases in January 2016 which will be effective from January 2019. IFRS 16 introduces major changes in lessee accounting while lessor accounting remains largely unchanged. In the current leases standard IAS 17, lessees account for leases according to the terms of the lease contracts as either operating leases or finance leases. In IFRS 16, lessees are generally not allowed to use

FINANCIAL REPORTING GUIDE TO IFRS 16 LEASES

Major reforms to global lease accounting

ILLUSTRATIVE EXAMPLES (see separate booklet) APPENDIX and to account for those two types of leases differently. IN9 IFRS 16 completes the IASB’s project to improve the financial reporting of leases. Main features Lessee accounting IN10 HKFRS 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12

IFRS 16 ILLUSTRATIVE EXAMPLES IFRS 16 Leases Illustrative Examples These examples accompany.. Customer can use the cars for another purpose (for example. If a particular car needs to be serviced or repaired. There are 10 identified cars. The contract specifies the rail cars. Supplier can choose to use any one of a number of engines to fulfil each of Customer’s requests. Although some …

the requirements of the new leases standard – NZ IFRS 16 Leases which is applicable to all Tier 1 and Tier 2 for-profit entities in New Zealand. Summary NZ IFRS 16 includes a single accounting model for all leases by lessees. The main implications of the new standard on current practice for lessees include: No more operating leases under NZ IFRS 16 (subject to the exceptions described below

© 2016 KPMG IFRG Limited, a UK company limited by guarantee and a member firm of the KPMG network of independent member firms affiliated with KPMG International

and illustrative examples. The Board will analyse submissions received and other information gathered to decide whether further guidance is needed. Hypothesis Lessees exclude all variable lease payments when calculating the lease liability. Testing and analysis IFRS 16 identifies three types of variable lease payments: The leases lab 4 IFRS/HKFRS News August 2017 Variable lease payments

IFRS 16, ‘Leases’ In relation to the impact of IFRSs 9, 15 and 16 which are not yet effective, entities should refer to the latest illustrative disclosure in PwC’s VALUE IFRS Plc Illustrative IFRS consolidated financial statements December 2017. It should be emphasised that regulators expect disclosure of entity-specific quantitative and qualitative information as to the impact of applying

IFRS 16 Leases_Illustrative Examples January 2016

Illustrative Examples Exposure Draft ED/2013/6 ey.com

IFRS 16 Leases requires lessees to recognise new assets and liabilities under an on-balance sheet accounting model that is similar to current finance lease accounting. Key metrics will be affected by the recognition of new assets and liabilities, and differences in the timing and classification of lease income/expense. Our illustrative disclosures supplement (PDF 1.8 MB) will help you to

This guide (PDF 2.8 MB) is based on a fictitious multinational insurer that is not a first-time adopter of IFRS. It illustrates example disclosures for an annual period beginning on 1 January 2021, when IFRS 17 Insurance Contracts and IFRS 9 Financial Instruments are applied for the first time.

Major reforms to global lease accounting IFRS News Special Edition February 2016 on Lease Accounting The IASB has published IFRS 16 ‘Leases’ completing its long-running project on lease accounting. This special edition of IFRS News explains the key features of the new Standard and provides practical insights into its application and impact. Major reforms to global lease accounting

IFRS 16 Leases prescribes a single lessee accounting model that requires the recognition of asset and corresponding liability for all leases with terms over 12 months unless the …

that the application of IFRS 16 will have on the Group’s consolidated financial statements in the period of initial application. Explain the changes As preparers apply IFRS 15 and IFRS 9 in their 2018 annual financial statements,

IAS 17 Leases, the predecessor to IFRS 16, requires entities to classify their contracts as either operating leases or finance leases, based on the extent to …

© 2016 KPMG IFRG Limited, a UK company limited by guarantee and a member firm of the KPMG network of independent member firms affiliated with KPMG International

CONTENTS from paragraph [DRAFT] IFRS X LEASES ILLUSTRATIVE EXAMPLES INTRODUCTION IE1 IDENTIFYING A LEASE IE3 Example1—Contractforrailcars Example2—Contractforcoffeeservices

the requirements of the new leases standard – NZ IFRS 16 Leases which is applicable to all Tier 1 and Tier 2 for-profit entities in New Zealand. Summary NZ IFRS 16 includes a single accounting model for all leases by lessees. The main implications of the new standard on current practice for lessees include: No more operating leases under NZ IFRS 16 (subject to the exceptions described below

IFRS 16 Leases. Project status: Completed Current project stage: and also including a working draft of the application guidance and accompanying illustrative examples to be included in the forthcoming Standard on the definition of a lease. Following this publication, EFRAG initiated a fieldwork to identify whether the definition of a lease criteria are understandable and practical to apply

IFRS 16 includes new guidance and illustrative examples on assessing whether a contract contains a lease, a service or both. The new guidance focuses on the principle of

Illustrative Examples International Financial Reporting Standard® January 2016 IFRS 16 Leases This preview has intentionally blurred sections. Sign up to view the full version.

Overview. IFRS 16 specifies how an IFRS reporter will recognise, measure, present and disclose leases. The standard provides a single lessee accounting model, requiring lessees to recognise assets and liabilities for all leases unless the lease term is 12 months …

• IFRS 16 applies a control model to the identification of leases, distinguishing between leases and service contracts on the basis of whether there is an identified asset controlled by the customer.

Under IFRS 16, leases are accounted for based on a ‘right-of-use model’. The model reflects that, at the commencement date, a lessee has a financial obligation to make lease payments to …

IFRS 16 Illustrative disclosures KPMG GLOBAL

IFRS 16 Leases_Illustrative Examples January 2016

The International Accounting Standards Board (IASB) has published a new standard, IFRS 16 ‘Leases’. The new standard brings most leases on-balance sheet for lessees under a single model, eliminating the distinction between operating and finance leases.

IFRS 16 ILLUSTRATIVE EXAMPLES IFRS 16 Leases Illustrative Examples These examples accompany. Example 1—Rail cars Example 1A: a contract between Customer and a freight carrier (Supplier) provides Customer with the use of 10 rail cars of a particular type for five years. nor are the examples intended to apply only to the specific industry illustrated. Customer can use the cars for …

The new standard on leases, IFRS 16, affects the accounting for leases and rental agreements that are currently only recognised as an operating expense in profit or loss. Users should think about the implications of the new standard in good time. IFRS 16, the new lease accounting standard, was

Under IFRS 16, leases are accounted for based on a ‘right-of-use model’. The model reflects that, at the commencement date, a lessee has a financial obligation to make lease payments to …

Hkfrs 16 leases hkicpa standard setting department staff summary (may 2016) introduction 1. hkfrs 16 is the equivalent of ifrs 16 leases issued by the…

and illustrative examples. The Board will analyse submissions received and other information gathered to decide whether further guidance is needed. Hypothesis Lessees exclude all variable lease payments when calculating the lease liability. Testing and analysis IFRS 16 identifies three types of variable lease payments: The leases lab 4 IFRS/HKFRS News August 2017 Variable lease payments

• a summary of the important illustrative examples accompanying IFRS 16 dealing with the identification of leases; Leases A guide to IFRS 16. Contents Executive summary 3 Dealing with transition 5 Detailed guide 9 Appendices Appendix 1 Illustrative examples – identification of a lease 97 Appendix 2 Presentation and disclosure checklist – lessees 102 Appendix 3 Disclosure checklist

The example disclosures are not the only acceptable form of presenting financial statements. Alternative presentations may Alternative presentations may be acceptable if they comply with the specific disclosure requirements prescribed in the Australian accounting standards.

IFRS 16 requires that the ‘right of use asset’ and the lease liability should initially be measured at the present value of the minimum lease payments. The discount rate used to determine present value should be the rate of interest implicit in the lease.

IFRS 16 Leases requires lessees to recognise new assets and liabilities under an on-balance sheet accounting model that is similar to current finance lease accounting. Key metrics will be affected by the recognition of new assets and liabilities, and differences in the timing and classification of lease income/expense. Our illustrative disclosures supplement (PDF 1.8 MB) will help you to

IFRS 16, ‘Leases’ In relation to the impact of IFRSs 9, 15 and 16 which are not yet effective, entities should refer to the latest illustrative disclosure in PwC’s VALUE IFRS Plc Illustrative IFRS consolidated financial statements December 2017. It should be emphasised that regulators expect disclosure of entity-specific quantitative and qualitative information as to the impact of applying

Illustrative Examples International Financial Reporting Standard® January 2016 IFRS 16 Leases This preview has intentionally blurred sections. Sign up to view the full version.

that the application of IFRS 16 will have on the Group’s consolidated financial statements in the period of initial application. Explain the changes As preparers apply IFRS 15 and IFRS 9 in their 2018 annual financial statements,

illustrative examples and the Basis for Conclusions. Further guidance on the IFRS 16 identifies a lease as a contract, or part of a contract, that conveys the right to use an asset for a period of time in exchange for consideration. A contract is “an agreement between two or more parties that creates enforceable rights and obligations”. 4.6 The subtle change in wording for what is

ILLUSTRATIVE EXAMPLES (see separate booklet) APPENDIX and to account for those two types of leases differently. IN9 IFRS 16 completes the IASB’s project to improve the financial reporting of leases. Main features Lessee accounting IN10 HKFRS 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12

Illustrative Examples Exposure Draft ED/2013/6

IFRS 16 Leases requires lessees to recognise new assets and liabilities under an on-balance sheet accounting model that is similar to current finance lease accounting. Key metrics will be affected by the recognition of new assets and liabilities, and differences in the timing and classification of lease income/expense. Our illustrative disclosures supplement (PDF 1.8 MB) will help you to

EXAMPLES – IFRS 16