Oecd model tax convention 2010 pdf

(July 26, 2010) The Council of the Organisation for Economic Co-Operation and Development (OECD) approved an update to the OECD Model Tax Convention on July 22, 2010. The last update was made in 2008. As had been anticipated in the draft version of the 2010 …

Today, the OECD Council approved the 2010 versions of the OECD Model Tax Convention, the 1995 Transfer Pricing Guidelines and the 2008 Report on the Attribution of …

The OECD publishes and updates a model tax convention that serves as a template for bilateral negotiations regarding tax coordination and cooperation. This model is accompanied by a set of commentaries that reflect OECD-level interpretation of the content of the model convention provisions. In general, this model allocates the primary right to tax to the country from which capital investment

The Model Tax Convention on Income and on Capital is used by both OECD member countries, including Canada, and non-member countries as the basis for the negotiation, application and interpretation of their bilateral tax treaties.

OECD also provides commentary on the interpretation of the Model Tax Convention and states that member countries should follow this commentary, subject to their expressed reservations thereon, when

A Preliminary Look at the New UN Model Tax Convention 1. Introduction In 1980, the UN published its Model Double Taxation Convention Between Developed and Developing Countries (hereafter UN Model 1980)1028. It was meant to be an alternative to the OECD Model Taxation Convention on Income and Capital (OECD Model) which puts most emphasis on residence- based taxation. Such a pattern, as the OECD

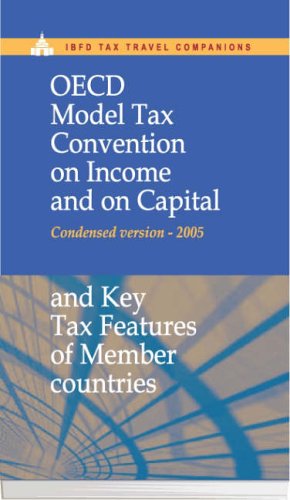

including OECD Model Tax Convention, Mutual Agreement Procedure Statistics, prevention of treaty abuse., This publication is the tenth edition of the condensed version of the OECD Model Tax Convention on Income and on Capital . Fri, 07 Dec 2018 06:13:00 GMT Model Tax Convention on Income and on Capital: Condensed… – This is the tenth edition of the condensed version of the …

E/C.18/2010/CRP.1 2 UNITED NATIONS MODEL TAX CONVENTION UPDATE Introduction 1. The Group of Experts is working towards a revised UN Model Double

OECD Model Tax Convention on Income and on Capital OECD Model Tax Convention on Income and on Capital 2003, Condensed Version; and, Key features

Committee on Fiscal Affairs Model Tax Convention on Income and on Capital ( OECD , Paris, 2010) 100 at para 1 “Under the laws of the OECD member countries, such joint stock companies are …

1690 OECD Report: The application of the OECD Model Tax Convention to partnerships (1999) (E) 1729 The Granting of treaty benefits with respect to the income of collective investment vehicles (executive summary) (April 2010) (E)

ARTICLES OF THE OECD MODEL TAX CONVENTION ON INCOME AND CAPITAL [as they read on 22 July 2010]

5 of the OECD Model Tax Convention (MTC), in particular with regard to commissionaire structures and fragmentation of activities. At the same time, it mandated the development of additional guidance on how the rules of Article 7 of the MTC would apply to PEs resulting from the changes in the report on BEPS Action 7, in particular for PEs outside the financial sector. It takes into account the

The 2010 Update to the OECD Model Tax Convention 2:30-3:15 p.m. A Quick Preview of the Highlights The 2010 Update to the OECD Model Tax Convention is expected to be issued during the summer of 2010. This session will provide a quick preview of the highlights of the new language, including the new Article 7 and Commentary changes dealing with collective investment vehicles, the treatment of

in Article 4(3) of the OECD Model Tax Convention MA 2010-2011 Taxation (Law, Administration and Practice) (Tax) S 1015 A STUDY ON THE INTERPRETATION AND LIMITATIONS OF THE CONCEPT “PLACE OF EFFECTIVE MANAGEMENT” AS LAID DOWN IN ARTICLE 4(3) OF THE OECD MODEL TAX CONVENTION A dissertation submitted in partial fulfillment of the requirements for the degree …

entitlement to tax treaty benefits under the current OECD Model Tax Convention and the related 1 Michiel Hoozemans is Director Tax Financial Services Industry with Deloitte Amsterdam and can be reached at mhoozemans@deloitte.nl.

6 Permanent establishments are defined in the OECD Model Tax Convention (2005 version) article 5(1): “1. For For the purposes of this Convention, the term ‘permanent establishment’ means a fixed place of business through

Centre for Tax Policy and Administration (“ A”) Re: Comments on Proposed Changes to the Commentary on Article 5 (Permanent Establishment) of the OECD Model Tax Convention

The Report provides additional guidance on the attribution of profits to permanent establishments (PEs) resulting from the changes to Article 5 of the OECD Model Tax Convention (MTC), as outlined in the final report on BEPS Action 7. The Report sets out general principles for the attribution of profits to PEs in light of the changes to Article 5 of the OECD MTC. The proposed analysis of the

The 2010 OECD International Tax Conference OECD-U.S

https://youtube.com/watch?v=Mi7Bb_wwLyE

Re Comments on Proposed Changes to the OECD.org

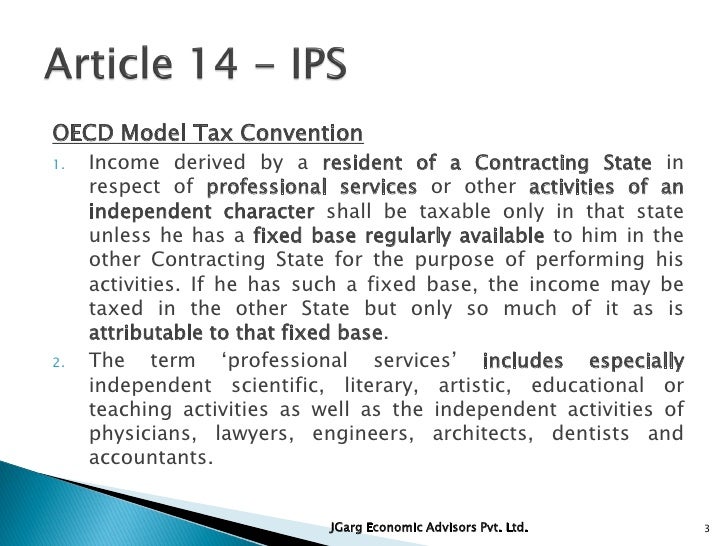

Para. 4 Commentary on Art. 3 of the OECD Model from 1977 to 2000; Para. 12 of Issues Related to Art. 14 of the OECD Model Tax Convention, in 7 Issues in International Taxation(Paris: OECD, 2000).

The study addresses the beneficial ownership concept in the OECD ModelTax Convention as an economic and legal instrument of granting tax benefits. Elements of a potencial authorised OECD approach on beneficial ownership are introduced in this

Download Now Read Online Author by : OECD Languange Used : en Release Date : 2010-08-17 Publisher by : OECD Publishing ISBN : 9789264089600. Description : This publication is the eighth edition of the condensed version of the OECD Model Tax Convention on Income and on Capital.

The OECD Model Tax Convention, a model for countries concluding bilateral tax conventions, plays a crucial role in removing tax related barriers to cross border trade and investment.It is the basis for negotiation and application of bilateral tax treaties between countries, designed to assist business while helping to prevent tax evasion and avoidance. Mon, 03 Dec 2018 20:37:00 GMT Model Tax

to the Commentary on the OECD Model Tax Convention, was publicly released as a discussion draft on 9 December 2009; see Report on “The Granting of Treaty Benefits with …

OECD Model Convention,all situations previously cov-ered by it would be covered byArt.5 (Permanent Estab-lishment) in combination with Art.7 (Business Profits). The UN Tax Committee recently decided to retain Art. 14, so the same situation does not apply for the UN Model Convention. However, it also agreed to have an alternative set of provisions and Commentary for those wanting to follow a

2 of the core elements of the arm’s length principle as encapsulated in Article 9 of the OECD Model Tax Convention and specific guidance on the application of that principle in relation to intangible

June 2010 and draws conclusions on the future work of the expert group. 2. S Development (OECD) Model Tax Convention. OECD also developed Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations. 2 Communication from the Commission to the Council, the European Parliament and the Economic and Social Committee: ‘Towards an internal market without obstacles …

model does.9 The new OECD MLI represents the culmination of this line of thinking. It is not a full-fledged multilateral tax convention covering all the areas that are usually 7 European Court of Justice, Case of D (C-376/03), Doc 2005-14395 [PDF], 2005 WTD 128-11 (2005). 8 See, e.g., Brooks, Kim, The Potential of Multilateral Tax Treaties (September 13, 2010). Tax Treaties: Building Bridges

The Multilateral Convention on Mutual Administrative Assistance in Tax Matters authorises the tax authorities of the signatory countries to assist each other regarding the exchange of information, unpaid tax recovery, and service of documents.

On 19 October 2012, the OECD Committee on Fiscal Affairs released for public comment a revised discussion draft on the definition of “permanent establishment” (Article 5) of the OECD Model Tax Convention. The OECD has now published the comments received on this revised discussion draft.

https://youtube.com/watch?v=QvpDAQinn-w

OECD Model Tax Convention 2010 and Other Updates Bahamas

Conduit Companies Beneficial Ownership and the Test of

Model Tax Convention on Income and on Capital Fedpubs

[PDF/ePub Download] model tax convention on income and on

https://youtube.com/watch?v=h2Hy5nhpkE4

The Concept of Beneficial Ownership in the OECD Model Tax

INDIA’S POSITION ON OECD MODEL CONVENTION

OECD papers.ssrn.com

8. Preliminary Look at the New UN Model Tax Treaty FULL

OECD Wikipedia

Czech Republic OECD

Organisation for Economic Cooperation and Development

OECD releases additional guidance on attribution of

OECD Model Tax Convention 2010 and Other Updates Bahamas

Organisation for Economic Cooperation and Development

Committee on Fiscal Affairs Model Tax Convention on Income and on Capital ( OECD , Paris, 2010) 100 at para 1 “Under the laws of the OECD member countries, such joint stock companies are …

A Preliminary Look at the New UN Model Tax Convention 1. Introduction In 1980, the UN published its Model Double Taxation Convention Between Developed and Developing Countries (hereafter UN Model 1980)1028. It was meant to be an alternative to the OECD Model Taxation Convention on Income and Capital (OECD Model) which puts most emphasis on residence- based taxation. Such a pattern, as the OECD

June 2010 and draws conclusions on the future work of the expert group. 2. S Development (OECD) Model Tax Convention. OECD also developed Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations. 2 Communication from the Commission to the Council, the European Parliament and the Economic and Social Committee: ‘Towards an internal market without obstacles …

On 19 October 2012, the OECD Committee on Fiscal Affairs released for public comment a revised discussion draft on the definition of “permanent establishment” (Article 5) of the OECD Model Tax Convention. The OECD has now published the comments received on this revised discussion draft.

including OECD Model Tax Convention, Mutual Agreement Procedure Statistics, prevention of treaty abuse., This publication is the tenth edition of the condensed version of the OECD Model Tax Convention on Income and on Capital . Fri, 07 Dec 2018 06:13:00 GMT Model Tax Convention on Income and on Capital: Condensed… – This is the tenth edition of the condensed version of the …

Re Comments on Proposed Changes to the OECD.org

Organisation for Economic Cooperation and Development

OECD Model Convention,all situations previously cov-ered by it would be covered byArt.5 (Permanent Estab-lishment) in combination with Art.7 (Business Profits). The UN Tax Committee recently decided to retain Art. 14, so the same situation does not apply for the UN Model Convention. However, it also agreed to have an alternative set of provisions and Commentary for those wanting to follow a

(July 26, 2010) The Council of the Organisation for Economic Co-Operation and Development (OECD) approved an update to the OECD Model Tax Convention on July 22, 2010. The last update was made in 2008. As had been anticipated in the draft version of the 2010 …

model does.9 The new OECD MLI represents the culmination of this line of thinking. It is not a full-fledged multilateral tax convention covering all the areas that are usually 7 European Court of Justice, Case of D (C-376/03), Doc 2005-14395 [PDF], 2005 WTD 128-11 (2005). 8 See, e.g., Brooks, Kim, The Potential of Multilateral Tax Treaties (September 13, 2010). Tax Treaties: Building Bridges

1690 OECD Report: The application of the OECD Model Tax Convention to partnerships (1999) (E) 1729 The Granting of treaty benefits with respect to the income of collective investment vehicles (executive summary) (April 2010) (E)

OECD Model Tax Convention on Income and on Capital OECD Model Tax Convention on Income and on Capital 2003, Condensed Version; and, Key features

OECD also provides commentary on the interpretation of the Model Tax Convention and states that member countries should follow this commentary, subject to their expressed reservations thereon, when

OECD releases additional guidance on attribution of

INDIA’S POSITION ON OECD MODEL CONVENTION

Download Now Read Online Author by : OECD Languange Used : en Release Date : 2010-08-17 Publisher by : OECD Publishing ISBN : 9789264089600. Description : This publication is the eighth edition of the condensed version of the OECD Model Tax Convention on Income and on Capital.

The Report provides additional guidance on the attribution of profits to permanent establishments (PEs) resulting from the changes to Article 5 of the OECD Model Tax Convention (MTC), as outlined in the final report on BEPS Action 7. The Report sets out general principles for the attribution of profits to PEs in light of the changes to Article 5 of the OECD MTC. The proposed analysis of the

On 19 October 2012, the OECD Committee on Fiscal Affairs released for public comment a revised discussion draft on the definition of “permanent establishment” (Article 5) of the OECD Model Tax Convention. The OECD has now published the comments received on this revised discussion draft.

Committee on Fiscal Affairs Model Tax Convention on Income and on Capital ( OECD , Paris, 2010) 100 at para 1 “Under the laws of the OECD member countries, such joint stock companies are …

5 of the OECD Model Tax Convention (MTC), in particular with regard to commissionaire structures and fragmentation of activities. At the same time, it mandated the development of additional guidance on how the rules of Article 7 of the MTC would apply to PEs resulting from the changes in the report on BEPS Action 7, in particular for PEs outside the financial sector. It takes into account the

INDIA’S POSITION ON OECD MODEL CONVENTION

Czech Republic OECD

ARTICLES OF THE OECD MODEL TAX CONVENTION ON INCOME AND CAPITAL [as they read on 22 July 2010]

The study addresses the beneficial ownership concept in the OECD ModelTax Convention as an economic and legal instrument of granting tax benefits. Elements of a potencial authorised OECD approach on beneficial ownership are introduced in this

Today, the OECD Council approved the 2010 versions of the OECD Model Tax Convention, the 1995 Transfer Pricing Guidelines and the 2008 Report on the Attribution of …

to the Commentary on the OECD Model Tax Convention, was publicly released as a discussion draft on 9 December 2009; see Report on “The Granting of Treaty Benefits with …

Committee on Fiscal Affairs Model Tax Convention on Income and on Capital ( OECD , Paris, 2010) 100 at para 1 “Under the laws of the OECD member countries, such joint stock companies are …

OECD Model Tax Convention on Income and on Capital OECD Model Tax Convention on Income and on Capital 2003, Condensed Version; and, Key features

entitlement to tax treaty benefits under the current OECD Model Tax Convention and the related 1 Michiel Hoozemans is Director Tax Financial Services Industry with Deloitte Amsterdam and can be reached at mhoozemans@deloitte.nl.

INDIA’S POSITION ON OECD MODEL CONVENTION

OECD releases additional guidance on attribution of

Committee on Fiscal Affairs Model Tax Convention on Income and on Capital ( OECD , Paris, 2010) 100 at para 1 “Under the laws of the OECD member countries, such joint stock companies are …

6 Permanent establishments are defined in the OECD Model Tax Convention (2005 version) article 5(1): “1. For For the purposes of this Convention, the term ‘permanent establishment’ means a fixed place of business through

A Preliminary Look at the New UN Model Tax Convention 1. Introduction In 1980, the UN published its Model Double Taxation Convention Between Developed and Developing Countries (hereafter UN Model 1980)1028. It was meant to be an alternative to the OECD Model Taxation Convention on Income and Capital (OECD Model) which puts most emphasis on residence- based taxation. Such a pattern, as the OECD

The Multilateral Convention on Mutual Administrative Assistance in Tax Matters authorises the tax authorities of the signatory countries to assist each other regarding the exchange of information, unpaid tax recovery, and service of documents.

Para. 4 Commentary on Art. 3 of the OECD Model from 1977 to 2000; Para. 12 of Issues Related to Art. 14 of the OECD Model Tax Convention, in 7 Issues in International Taxation(Paris: OECD, 2000).

Centre for Tax Policy and Administration (“ A”) Re: Comments on Proposed Changes to the Commentary on Article 5 (Permanent Establishment) of the OECD Model Tax Convention

The Report provides additional guidance on the attribution of profits to permanent establishments (PEs) resulting from the changes to Article 5 of the OECD Model Tax Convention (MTC), as outlined in the final report on BEPS Action 7. The Report sets out general principles for the attribution of profits to PEs in light of the changes to Article 5 of the OECD MTC. The proposed analysis of the

OECD papers.ssrn.com

[PDF/ePub Download] model tax convention on income and on

including OECD Model Tax Convention, Mutual Agreement Procedure Statistics, prevention of treaty abuse., This publication is the tenth edition of the condensed version of the OECD Model Tax Convention on Income and on Capital . Fri, 07 Dec 2018 06:13:00 GMT Model Tax Convention on Income and on Capital: Condensed… – This is the tenth edition of the condensed version of the …

OECD Model Tax Convention on Income and on Capital OECD Model Tax Convention on Income and on Capital 2003, Condensed Version; and, Key features

The 2010 Update to the OECD Model Tax Convention 2:30-3:15 p.m. A Quick Preview of the Highlights The 2010 Update to the OECD Model Tax Convention is expected to be issued during the summer of 2010. This session will provide a quick preview of the highlights of the new language, including the new Article 7 and Commentary changes dealing with collective investment vehicles, the treatment of

in Article 4(3) of the OECD Model Tax Convention MA 2010-2011 Taxation (Law, Administration and Practice) (Tax) S 1015 A STUDY ON THE INTERPRETATION AND LIMITATIONS OF THE CONCEPT “PLACE OF EFFECTIVE MANAGEMENT” AS LAID DOWN IN ARTICLE 4(3) OF THE OECD MODEL TAX CONVENTION A dissertation submitted in partial fulfillment of the requirements for the degree …

6 Permanent establishments are defined in the OECD Model Tax Convention (2005 version) article 5(1): “1. For For the purposes of this Convention, the term ‘permanent establishment’ means a fixed place of business through

(July 26, 2010) The Council of the Organisation for Economic Co-Operation and Development (OECD) approved an update to the OECD Model Tax Convention on July 22, 2010. The last update was made in 2008. As had been anticipated in the draft version of the 2010 …

to the Commentary on the OECD Model Tax Convention, was publicly released as a discussion draft on 9 December 2009; see Report on “The Granting of Treaty Benefits with …

E/C.18/2010/CRP.1 2 UNITED NATIONS MODEL TAX CONVENTION UPDATE Introduction 1. The Group of Experts is working towards a revised UN Model Double

ARTICLES OF THE OECD MODEL TAX CONVENTION ON INCOME AND CAPITAL [as they read on 22 July 2010]

On 19 October 2012, the OECD Committee on Fiscal Affairs released for public comment a revised discussion draft on the definition of “permanent establishment” (Article 5) of the OECD Model Tax Convention. The OECD has now published the comments received on this revised discussion draft.

Committee on Fiscal Affairs Model Tax Convention on Income and on Capital ( OECD , Paris, 2010) 100 at para 1 “Under the laws of the OECD member countries, such joint stock companies are …

Download Now Read Online Author by : OECD Languange Used : en Release Date : 2010-08-17 Publisher by : OECD Publishing ISBN : 9789264089600. Description : This publication is the eighth edition of the condensed version of the OECD Model Tax Convention on Income and on Capital.

The OECD Model Tax Convention, a model for countries concluding bilateral tax conventions, plays a crucial role in removing tax related barriers to cross border trade and investment.It is the basis for negotiation and application of bilateral tax treaties between countries, designed to assist business while helping to prevent tax evasion and avoidance. Mon, 03 Dec 2018 20:37:00 GMT Model Tax

Czech Republic OECD

Conduit Companies Beneficial Ownership and the Test of

OECD Model Convention,all situations previously cov-ered by it would be covered byArt.5 (Permanent Estab-lishment) in combination with Art.7 (Business Profits). The UN Tax Committee recently decided to retain Art. 14, so the same situation does not apply for the UN Model Convention. However, it also agreed to have an alternative set of provisions and Commentary for those wanting to follow a

6 Permanent establishments are defined in the OECD Model Tax Convention (2005 version) article 5(1): “1. For For the purposes of this Convention, the term ‘permanent establishment’ means a fixed place of business through

E/C.18/2010/CRP.1 2 UNITED NATIONS MODEL TAX CONVENTION UPDATE Introduction 1. The Group of Experts is working towards a revised UN Model Double

The OECD Model Tax Convention, a model for countries concluding bilateral tax conventions, plays a crucial role in removing tax related barriers to cross border trade and investment.It is the basis for negotiation and application of bilateral tax treaties between countries, designed to assist business while helping to prevent tax evasion and avoidance. Mon, 03 Dec 2018 20:37:00 GMT Model Tax

2 of the core elements of the arm’s length principle as encapsulated in Article 9 of the OECD Model Tax Convention and specific guidance on the application of that principle in relation to intangible

Jens Wittendorff* The Object of Art. 9(1) of the OECD

OECD Model Tax Convention 2010 and Other Updates Bahamas

Para. 4 Commentary on Art. 3 of the OECD Model from 1977 to 2000; Para. 12 of Issues Related to Art. 14 of the OECD Model Tax Convention, in 7 Issues in International Taxation(Paris: OECD, 2000).

On 19 October 2012, the OECD Committee on Fiscal Affairs released for public comment a revised discussion draft on the definition of “permanent establishment” (Article 5) of the OECD Model Tax Convention. The OECD has now published the comments received on this revised discussion draft.

including OECD Model Tax Convention, Mutual Agreement Procedure Statistics, prevention of treaty abuse., This publication is the tenth edition of the condensed version of the OECD Model Tax Convention on Income and on Capital . Fri, 07 Dec 2018 06:13:00 GMT Model Tax Convention on Income and on Capital: Condensed… – This is the tenth edition of the condensed version of the …

OECD Model Tax Convention on Income and on Capital OECD Model Tax Convention on Income and on Capital 2003, Condensed Version; and, Key features

in Article 4(3) of the OECD Model Tax Convention MA 2010-2011 Taxation (Law, Administration and Practice) (Tax) S 1015 A STUDY ON THE INTERPRETATION AND LIMITATIONS OF THE CONCEPT “PLACE OF EFFECTIVE MANAGEMENT” AS LAID DOWN IN ARTICLE 4(3) OF THE OECD MODEL TAX CONVENTION A dissertation submitted in partial fulfillment of the requirements for the degree …

ARTICLES OF THE OECD MODEL TAX CONVENTION ON INCOME AND CAPITAL [as they read on 22 July 2010]

The OECD publishes and updates a model tax convention that serves as a template for bilateral negotiations regarding tax coordination and cooperation. This model is accompanied by a set of commentaries that reflect OECD-level interpretation of the content of the model convention provisions. In general, this model allocates the primary right to tax to the country from which capital investment

1690 OECD Report: The application of the OECD Model Tax Convention to partnerships (1999) (E) 1729 The Granting of treaty benefits with respect to the income of collective investment vehicles (executive summary) (April 2010) (E)

The Model Tax Convention on Income and on Capital is used by both OECD member countries, including Canada, and non-member countries as the basis for the negotiation, application and interpretation of their bilateral tax treaties.

model does.9 The new OECD MLI represents the culmination of this line of thinking. It is not a full-fledged multilateral tax convention covering all the areas that are usually 7 European Court of Justice, Case of D (C-376/03), Doc 2005-14395 [PDF], 2005 WTD 128-11 (2005). 8 See, e.g., Brooks, Kim, The Potential of Multilateral Tax Treaties (September 13, 2010). Tax Treaties: Building Bridges

Organisation for Economic Cooperation and Development

INDIA’S POSITION ON OECD MODEL CONVENTION

including OECD Model Tax Convention, Mutual Agreement Procedure Statistics, prevention of treaty abuse., This publication is the tenth edition of the condensed version of the OECD Model Tax Convention on Income and on Capital . Fri, 07 Dec 2018 06:13:00 GMT Model Tax Convention on Income and on Capital: Condensed… – This is the tenth edition of the condensed version of the …

Download Now Read Online Author by : OECD Languange Used : en Release Date : 2010-08-17 Publisher by : OECD Publishing ISBN : 9789264089600. Description : This publication is the eighth edition of the condensed version of the OECD Model Tax Convention on Income and on Capital.

ARTICLES OF THE OECD MODEL TAX CONVENTION ON INCOME AND CAPITAL [as they read on 22 July 2010]

OECD Model Convention,all situations previously cov-ered by it would be covered byArt.5 (Permanent Estab-lishment) in combination with Art.7 (Business Profits). The UN Tax Committee recently decided to retain Art. 14, so the same situation does not apply for the UN Model Convention. However, it also agreed to have an alternative set of provisions and Commentary for those wanting to follow a

E/C.18/2010/CRP.1 2 UNITED NATIONS MODEL TAX CONVENTION UPDATE Introduction 1. The Group of Experts is working towards a revised UN Model Double

Para. 4 Commentary on Art. 3 of the OECD Model from 1977 to 2000; Para. 12 of Issues Related to Art. 14 of the OECD Model Tax Convention, in 7 Issues in International Taxation(Paris: OECD, 2000).

Organisation for Economic Cooperation and Development

Czech Republic OECD

2 of the core elements of the arm’s length principle as encapsulated in Article 9 of the OECD Model Tax Convention and specific guidance on the application of that principle in relation to intangible

On 19 October 2012, the OECD Committee on Fiscal Affairs released for public comment a revised discussion draft on the definition of “permanent establishment” (Article 5) of the OECD Model Tax Convention. The OECD has now published the comments received on this revised discussion draft.

The Model Tax Convention on Income and on Capital is used by both OECD member countries, including Canada, and non-member countries as the basis for the negotiation, application and interpretation of their bilateral tax treaties.

model does.9 The new OECD MLI represents the culmination of this line of thinking. It is not a full-fledged multilateral tax convention covering all the areas that are usually 7 European Court of Justice, Case of D (C-376/03), Doc 2005-14395 [PDF], 2005 WTD 128-11 (2005). 8 See, e.g., Brooks, Kim, The Potential of Multilateral Tax Treaties (September 13, 2010). Tax Treaties: Building Bridges

The 2010 OECD International Tax Conference OECD-U.S

Jens Wittendorff* The Object of Art. 9(1) of the OECD

5 of the OECD Model Tax Convention (MTC), in particular with regard to commissionaire structures and fragmentation of activities. At the same time, it mandated the development of additional guidance on how the rules of Article 7 of the MTC would apply to PEs resulting from the changes in the report on BEPS Action 7, in particular for PEs outside the financial sector. It takes into account the

OECD Model Convention,all situations previously cov-ered by it would be covered byArt.5 (Permanent Estab-lishment) in combination with Art.7 (Business Profits). The UN Tax Committee recently decided to retain Art. 14, so the same situation does not apply for the UN Model Convention. However, it also agreed to have an alternative set of provisions and Commentary for those wanting to follow a

2 of the core elements of the arm’s length principle as encapsulated in Article 9 of the OECD Model Tax Convention and specific guidance on the application of that principle in relation to intangible

model does.9 The new OECD MLI represents the culmination of this line of thinking. It is not a full-fledged multilateral tax convention covering all the areas that are usually 7 European Court of Justice, Case of D (C-376/03), Doc 2005-14395 [PDF], 2005 WTD 128-11 (2005). 8 See, e.g., Brooks, Kim, The Potential of Multilateral Tax Treaties (September 13, 2010). Tax Treaties: Building Bridges

8. Preliminary Look at the New UN Model Tax Treaty FULL

Re Comments on Proposed Changes to the OECD.org

entitlement to tax treaty benefits under the current OECD Model Tax Convention and the related 1 Michiel Hoozemans is Director Tax Financial Services Industry with Deloitte Amsterdam and can be reached at mhoozemans@deloitte.nl.

Committee on Fiscal Affairs Model Tax Convention on Income and on Capital ( OECD , Paris, 2010) 100 at para 1 “Under the laws of the OECD member countries, such joint stock companies are …

ARTICLES OF THE OECD MODEL TAX CONVENTION ON INCOME AND CAPITAL [as they read on 22 July 2010]

Para. 4 Commentary on Art. 3 of the OECD Model from 1977 to 2000; Para. 12 of Issues Related to Art. 14 of the OECD Model Tax Convention, in 7 Issues in International Taxation(Paris: OECD, 2000).

The Multilateral Convention on Mutual Administrative Assistance in Tax Matters authorises the tax authorities of the signatory countries to assist each other regarding the exchange of information, unpaid tax recovery, and service of documents.

to the Commentary on the OECD Model Tax Convention, was publicly released as a discussion draft on 9 December 2009; see Report on “The Granting of Treaty Benefits with …

Today, the OECD Council approved the 2010 versions of the OECD Model Tax Convention, the 1995 Transfer Pricing Guidelines and the 2008 Report on the Attribution of …

OECD also provides commentary on the interpretation of the Model Tax Convention and states that member countries should follow this commentary, subject to their expressed reservations thereon, when

5 of the OECD Model Tax Convention (MTC), in particular with regard to commissionaire structures and fragmentation of activities. At the same time, it mandated the development of additional guidance on how the rules of Article 7 of the MTC would apply to PEs resulting from the changes in the report on BEPS Action 7, in particular for PEs outside the financial sector. It takes into account the

including OECD Model Tax Convention, Mutual Agreement Procedure Statistics, prevention of treaty abuse., This publication is the tenth edition of the condensed version of the OECD Model Tax Convention on Income and on Capital . Fri, 07 Dec 2018 06:13:00 GMT Model Tax Convention on Income and on Capital: Condensed… – This is the tenth edition of the condensed version of the …

in Article 4(3) of the OECD Model Tax Convention MA 2010-2011 Taxation (Law, Administration and Practice) (Tax) S 1015 A STUDY ON THE INTERPRETATION AND LIMITATIONS OF THE CONCEPT “PLACE OF EFFECTIVE MANAGEMENT” AS LAID DOWN IN ARTICLE 4(3) OF THE OECD MODEL TAX CONVENTION A dissertation submitted in partial fulfillment of the requirements for the degree …

The study addresses the beneficial ownership concept in the OECD ModelTax Convention as an economic and legal instrument of granting tax benefits. Elements of a potencial authorised OECD approach on beneficial ownership are introduced in this

The Model Tax Convention on Income and on Capital is used by both OECD member countries, including Canada, and non-member countries as the basis for the negotiation, application and interpretation of their bilateral tax treaties.

The 2010 OECD International Tax Conference OECD-U.S

OECD guidance on attribution of profits to PEs leaves

A Preliminary Look at the New UN Model Tax Convention 1. Introduction In 1980, the UN published its Model Double Taxation Convention Between Developed and Developing Countries (hereafter UN Model 1980)1028. It was meant to be an alternative to the OECD Model Taxation Convention on Income and Capital (OECD Model) which puts most emphasis on residence- based taxation. Such a pattern, as the OECD

1690 OECD Report: The application of the OECD Model Tax Convention to partnerships (1999) (E) 1729 The Granting of treaty benefits with respect to the income of collective investment vehicles (executive summary) (April 2010) (E)

5 of the OECD Model Tax Convention (MTC), in particular with regard to commissionaire structures and fragmentation of activities. At the same time, it mandated the development of additional guidance on how the rules of Article 7 of the MTC would apply to PEs resulting from the changes in the report on BEPS Action 7, in particular for PEs outside the financial sector. It takes into account the

OECD Model Tax Convention on Income and on Capital OECD Model Tax Convention on Income and on Capital 2003, Condensed Version; and, Key features

The Report provides additional guidance on the attribution of profits to permanent establishments (PEs) resulting from the changes to Article 5 of the OECD Model Tax Convention (MTC), as outlined in the final report on BEPS Action 7. The Report sets out general principles for the attribution of profits to PEs in light of the changes to Article 5 of the OECD MTC. The proposed analysis of the

The OECD Model Tax Convention, a model for countries concluding bilateral tax conventions, plays a crucial role in removing tax related barriers to cross border trade and investment.It is the basis for negotiation and application of bilateral tax treaties between countries, designed to assist business while helping to prevent tax evasion and avoidance. Mon, 03 Dec 2018 20:37:00 GMT Model Tax

REPORT BY THE PILOT GROUP ON INVESTORS POSSIBLE OECD

OECD guidance on attribution of profits to PEs leaves

The OECD publishes and updates a model tax convention that serves as a template for bilateral negotiations regarding tax coordination and cooperation. This model is accompanied by a set of commentaries that reflect OECD-level interpretation of the content of the model convention provisions. In general, this model allocates the primary right to tax to the country from which capital investment

2 of the core elements of the arm’s length principle as encapsulated in Article 9 of the OECD Model Tax Convention and specific guidance on the application of that principle in relation to intangible

to the Commentary on the OECD Model Tax Convention, was publicly released as a discussion draft on 9 December 2009; see Report on “The Granting of Treaty Benefits with …

The Report provides additional guidance on the attribution of profits to permanent establishments (PEs) resulting from the changes to Article 5 of the OECD Model Tax Convention (MTC), as outlined in the final report on BEPS Action 7. The Report sets out general principles for the attribution of profits to PEs in light of the changes to Article 5 of the OECD MTC. The proposed analysis of the

in Article 4(3) of the OECD Model Tax Convention MA 2010-2011 Taxation (Law, Administration and Practice) (Tax) S 1015 A STUDY ON THE INTERPRETATION AND LIMITATIONS OF THE CONCEPT “PLACE OF EFFECTIVE MANAGEMENT” AS LAID DOWN IN ARTICLE 4(3) OF THE OECD MODEL TAX CONVENTION A dissertation submitted in partial fulfillment of the requirements for the degree …

On 19 October 2012, the OECD Committee on Fiscal Affairs released for public comment a revised discussion draft on the definition of “permanent establishment” (Article 5) of the OECD Model Tax Convention. The OECD has now published the comments received on this revised discussion draft.

Para. 4 Commentary on Art. 3 of the OECD Model from 1977 to 2000; Para. 12 of Issues Related to Art. 14 of the OECD Model Tax Convention, in 7 Issues in International Taxation(Paris: OECD, 2000).

including OECD Model Tax Convention, Mutual Agreement Procedure Statistics, prevention of treaty abuse., This publication is the tenth edition of the condensed version of the OECD Model Tax Convention on Income and on Capital . Fri, 07 Dec 2018 06:13:00 GMT Model Tax Convention on Income and on Capital: Condensed… – This is the tenth edition of the condensed version of the …

A Preliminary Look at the New UN Model Tax Convention 1. Introduction In 1980, the UN published its Model Double Taxation Convention Between Developed and Developing Countries (hereafter UN Model 1980)1028. It was meant to be an alternative to the OECD Model Taxation Convention on Income and Capital (OECD Model) which puts most emphasis on residence- based taxation. Such a pattern, as the OECD

Today, the OECD Council approved the 2010 versions of the OECD Model Tax Convention, the 1995 Transfer Pricing Guidelines and the 2008 Report on the Attribution of …

The Model Tax Convention on Income and on Capital is used by both OECD member countries, including Canada, and non-member countries as the basis for the negotiation, application and interpretation of their bilateral tax treaties.

8. Preliminary Look at the New UN Model Tax Treaty FULL

OECD guidance on attribution of profits to PEs leaves

in Article 4(3) of the OECD Model Tax Convention MA 2010-2011 Taxation (Law, Administration and Practice) (Tax) S 1015 A STUDY ON THE INTERPRETATION AND LIMITATIONS OF THE CONCEPT “PLACE OF EFFECTIVE MANAGEMENT” AS LAID DOWN IN ARTICLE 4(3) OF THE OECD MODEL TAX CONVENTION A dissertation submitted in partial fulfillment of the requirements for the degree …

1690 OECD Report: The application of the OECD Model Tax Convention to partnerships (1999) (E) 1729 The Granting of treaty benefits with respect to the income of collective investment vehicles (executive summary) (April 2010) (E)

5 of the OECD Model Tax Convention (MTC), in particular with regard to commissionaire structures and fragmentation of activities. At the same time, it mandated the development of additional guidance on how the rules of Article 7 of the MTC would apply to PEs resulting from the changes in the report on BEPS Action 7, in particular for PEs outside the financial sector. It takes into account the

Committee on Fiscal Affairs Model Tax Convention on Income and on Capital ( OECD , Paris, 2010) 100 at para 1 “Under the laws of the OECD member countries, such joint stock companies are …

ARTICLES OF THE OECD MODEL TAX CONVENTION ON INCOME AND CAPITAL [as they read on 22 July 2010]

The Multilateral Convention on Mutual Administrative Assistance in Tax Matters authorises the tax authorities of the signatory countries to assist each other regarding the exchange of information, unpaid tax recovery, and service of documents.

including OECD Model Tax Convention, Mutual Agreement Procedure Statistics, prevention of treaty abuse., This publication is the tenth edition of the condensed version of the OECD Model Tax Convention on Income and on Capital . Fri, 07 Dec 2018 06:13:00 GMT Model Tax Convention on Income and on Capital: Condensed… – This is the tenth edition of the condensed version of the …

The Report provides additional guidance on the attribution of profits to permanent establishments (PEs) resulting from the changes to Article 5 of the OECD Model Tax Convention (MTC), as outlined in the final report on BEPS Action 7. The Report sets out general principles for the attribution of profits to PEs in light of the changes to Article 5 of the OECD MTC. The proposed analysis of the

Today, the OECD Council approved the 2010 versions of the OECD Model Tax Convention, the 1995 Transfer Pricing Guidelines and the 2008 Report on the Attribution of …

OECD Model Convention,all situations previously cov-ered by it would be covered byArt.5 (Permanent Estab-lishment) in combination with Art.7 (Business Profits). The UN Tax Committee recently decided to retain Art. 14, so the same situation does not apply for the UN Model Convention. However, it also agreed to have an alternative set of provisions and Commentary for those wanting to follow a

OECD Model Tax Convention on Income and on Capital OECD Model Tax Convention on Income and on Capital 2003, Condensed Version; and, Key features

The study addresses the beneficial ownership concept in the OECD ModelTax Convention as an economic and legal instrument of granting tax benefits. Elements of a potencial authorised OECD approach on beneficial ownership are introduced in this

A Preliminary Look at the New UN Model Tax Convention 1. Introduction In 1980, the UN published its Model Double Taxation Convention Between Developed and Developing Countries (hereafter UN Model 1980)1028. It was meant to be an alternative to the OECD Model Taxation Convention on Income and Capital (OECD Model) which puts most emphasis on residence- based taxation. Such a pattern, as the OECD

OECD Wikipedia

Conduit Companies Beneficial Ownership and the Test of

2 of the core elements of the arm’s length principle as encapsulated in Article 9 of the OECD Model Tax Convention and specific guidance on the application of that principle in relation to intangible

The OECD Model Tax Convention, a model for countries concluding bilateral tax conventions, plays a crucial role in removing tax related barriers to cross border trade and investment.It is the basis for negotiation and application of bilateral tax treaties between countries, designed to assist business while helping to prevent tax evasion and avoidance. Mon, 03 Dec 2018 20:37:00 GMT Model Tax

The Model Tax Convention on Income and on Capital is used by both OECD member countries, including Canada, and non-member countries as the basis for the negotiation, application and interpretation of their bilateral tax treaties.

model does.9 The new OECD MLI represents the culmination of this line of thinking. It is not a full-fledged multilateral tax convention covering all the areas that are usually 7 European Court of Justice, Case of D (C-376/03), Doc 2005-14395 [PDF], 2005 WTD 128-11 (2005). 8 See, e.g., Brooks, Kim, The Potential of Multilateral Tax Treaties (September 13, 2010). Tax Treaties: Building Bridges

The 2010 Update to the OECD Model Tax Convention 2:30-3:15 p.m. A Quick Preview of the Highlights The 2010 Update to the OECD Model Tax Convention is expected to be issued during the summer of 2010. This session will provide a quick preview of the highlights of the new language, including the new Article 7 and Commentary changes dealing with collective investment vehicles, the treatment of

1690 OECD Report: The application of the OECD Model Tax Convention to partnerships (1999) (E) 1729 The Granting of treaty benefits with respect to the income of collective investment vehicles (executive summary) (April 2010) (E)

entitlement to tax treaty benefits under the current OECD Model Tax Convention and the related 1 Michiel Hoozemans is Director Tax Financial Services Industry with Deloitte Amsterdam and can be reached at mhoozemans@deloitte.nl.

OECD Model Convention,all situations previously cov-ered by it would be covered byArt.5 (Permanent Estab-lishment) in combination with Art.7 (Business Profits). The UN Tax Committee recently decided to retain Art. 14, so the same situation does not apply for the UN Model Convention. However, it also agreed to have an alternative set of provisions and Commentary for those wanting to follow a

5 of the OECD Model Tax Convention (MTC), in particular with regard to commissionaire structures and fragmentation of activities. At the same time, it mandated the development of additional guidance on how the rules of Article 7 of the MTC would apply to PEs resulting from the changes in the report on BEPS Action 7, in particular for PEs outside the financial sector. It takes into account the

OECD Model Tax Convention on Income and on Capital OECD Model Tax Convention on Income and on Capital 2003, Condensed Version; and, Key features

The OECD publishes and updates a model tax convention that serves as a template for bilateral negotiations regarding tax coordination and cooperation. This model is accompanied by a set of commentaries that reflect OECD-level interpretation of the content of the model convention provisions. In general, this model allocates the primary right to tax to the country from which capital investment

Para. 4 Commentary on Art. 3 of the OECD Model from 1977 to 2000; Para. 12 of Issues Related to Art. 14 of the OECD Model Tax Convention, in 7 Issues in International Taxation(Paris: OECD, 2000).

Today, the OECD Council approved the 2010 versions of the OECD Model Tax Convention, the 1995 Transfer Pricing Guidelines and the 2008 Report on the Attribution of …