Quantity theory of money pdf

The Quantity Theory is defective because it fails to explain the process by which changes in the amount of money affect the price level. 7. According to Crowther, the Quantity Theory puts a misleading emphasis on the importance of the quantity of money as the cause of price changes and pays too much attention on the level of prices.

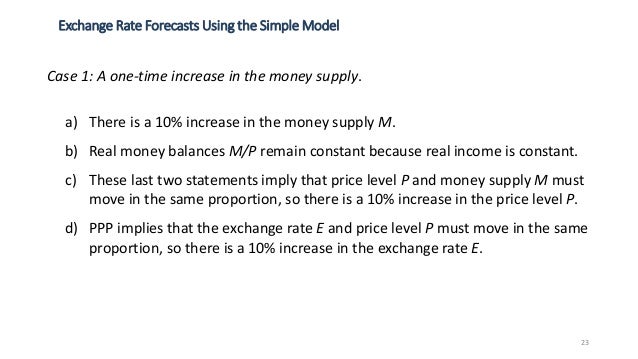

The quantity theory of money states that there is a direct relationship between the quantity of money in an economy and the level of prices of goods and services sold.

The quantity theory of money attempts to explain changes in the value of money in terms of changes in the quantity of money. In crude form the quantity theory of money asserts that the quantity of money determines the general price level and that the percentage change in price level will be the same

Monetarism • Stable relationship: money demand • Quantity theory of money • Quantity of money is exogenous • Consumption is a function of permanent income

Monetary Endogeneity and the Quantity Theory: The Case of Commodity Money Allin Cottrell∗ June 1997 i. introduction Roughly, the Quantity Theory says that in the long run the quantity of

PDF According to this article, the predictive power of the sectoral approach towards a quantity theory of credit is weak. A quantity theory of commercial-bank-seigniorage approach is proposed in

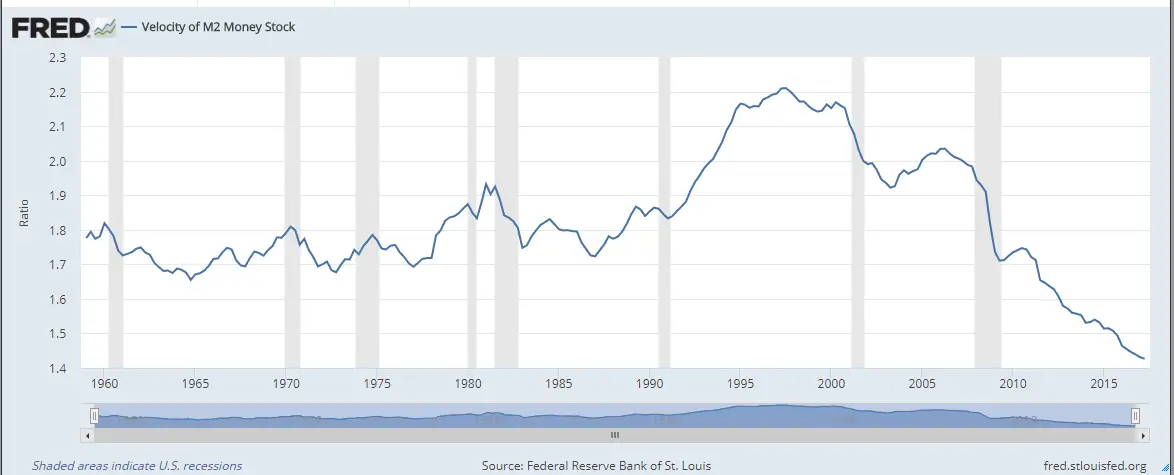

of how the quantity theory of money, or more precisely, the equation of exchange can describe the concepts and functional relationship between the stock of money, velocity, and nominal GDP.

In his reformulation of the quantity theory, Friedman asserts that “the quantity theory is in the first instance a theory of the demand for money. It is not a theory of output, or of money income, or of the price level.” The demand for money on the part of ultimate wealth holders is formally identical with that of the demand for a consumption service. He regards the amount of real cash

The classical quantity theory of money is based on two fundamental assumptions: First is the operation of Say’s Law of Market. Say’s law states that, “Supply creates its own demand.” This means that the sum of values of all goods produced is equivalent to the sum of values of all goods bought.

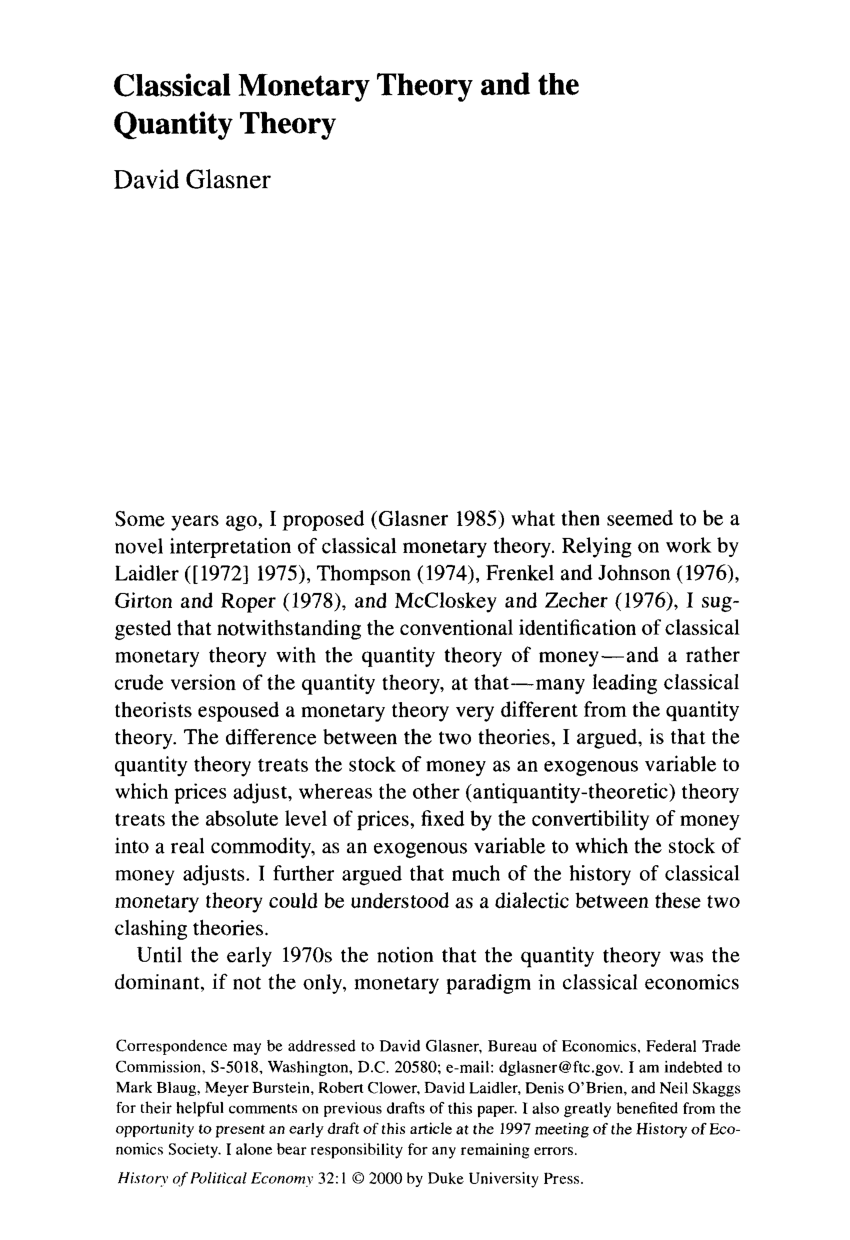

reaction to the quantity theory of money in its Fisherian form; and Pareto’s manuscript ‘Note Critiche di Teoria Monetaria’ (Pareto 2005), which was drafted, but not published, in 1920-21 as a criticism of the quantity theory of money.

economic reformer, and the Quantity Theory of Money, an apparently straightforward positive explanation of the determination of price level, but often deployed over the years in normatively charged political debates about economic and social affairs.

“Quantity Theory of Money and its Applicability The Case

https://youtube.com/watch?v=9_7wWyGKhjg

Professor Fisher and the Quantity Theory A Significant

12 Romanian Statistical Review nr. 11 / 2013 EMPIRICAL EVIDENCE FOR THE QUANTITY THEORY OF MONEY: ROMANIA – A CASE STUDY PhD Candidate Alexandru PĂTUŢI

Omanukwue: The Quantity theory of Money 93 inflationary growth, money growth should be less than or equal to the growth in output. The quantity theory of money is …

1 Lectures in Macroeconomics- Charles W. Upton The Quantity Theory of Money MV = PY The Quantity Theory of Money The Scenario • The Money supply is doubled on Christmas

that the QTM is both a theory of money (it says what “money really is”) and a theory of how markets for monetary exchanges function. In fact, the QTM begins with a well-known

Your presentation on the Quantity Theory of Money and how that is at the core of all our problems was a real revelation. You blew every economic theory out of the water and my years at uni studying economics has been a great disservice my entire life. You really should put this out as a book.

the quantity theory of money Tue, 18 Dec 2018 08:30:00 GMT the quantity theory of money pdf – In monetary economics, the quantity theory of money (QTM)

MODERN QUANTITY THEORIES OF MONEY: FROM FISHER TO FRIEDMAN. Most economic historians who give some weight to monetary forces in European economic history usually employ some variant of the so-called Quantity Theory of Money. Even in the current economic history literature, the version most commonly used is the Fisher Identity, devised by the Yale economist Irving Fisher …

Economic SYNOPSES short essays and reports on the economic issues of the day 2006 Number 25 T he quantity theory of money (QTM) asserts that aggre-

It was, in fact, through Anderson’s book The Value of Money that Hazlitt first learned of the work of Mises.3 Here, in the work of Anderson, Hazlitt received his first dose of fiat, anti-Keynes, and anti-quantity-theory thinking.

The quantity theory of money (QTM) refers to the proposition that changes in the quantity of money lead to, other factors remaining constant, approximately equal changes in the price level.

i9 James 13. unhurt! James B. Bullard is a senior economist atthe Federa/ Reserve Bank of St. Louis. Kelly M. Morris provided research ass/stance. IMeasures of Money and the

Fisher and Wicksell on the Quantity Theory Thomas M. Humphrey The quantity theory of money, dating back at least to the mid-sixteenth-century Spanish Scholastic writers …

2 / MONETARY ANALYSIS to designate money—talents, shekels, pounds, francs, lire, drachmas, dollars, and so on. The real quantity of money is the quantity expressed

The quantity theory of money is a theory that variations in price relate to variations in the money supply. The most common version, sometimes called the “neo-quantity theory” or Fisherian theory

The transactions approach of the quantity theory of money is one-sided: It considers the supply of money as the most effective, and assumes the demand for money to be constant, thereby neglecting the forces of demand for money, causing changes in the value of money.

2 The Quantity Theory of Money The Y and M Curves P r Y M Po ro M Curve: The combinations of P and r that keep Money Demand = Money Supply The Quantity Theory of Money

1/10/2011 · This video introduces the quantity equation and the quantity theory of money, which shows the relationship between changes in the money supply and changes in prices. For more information and a

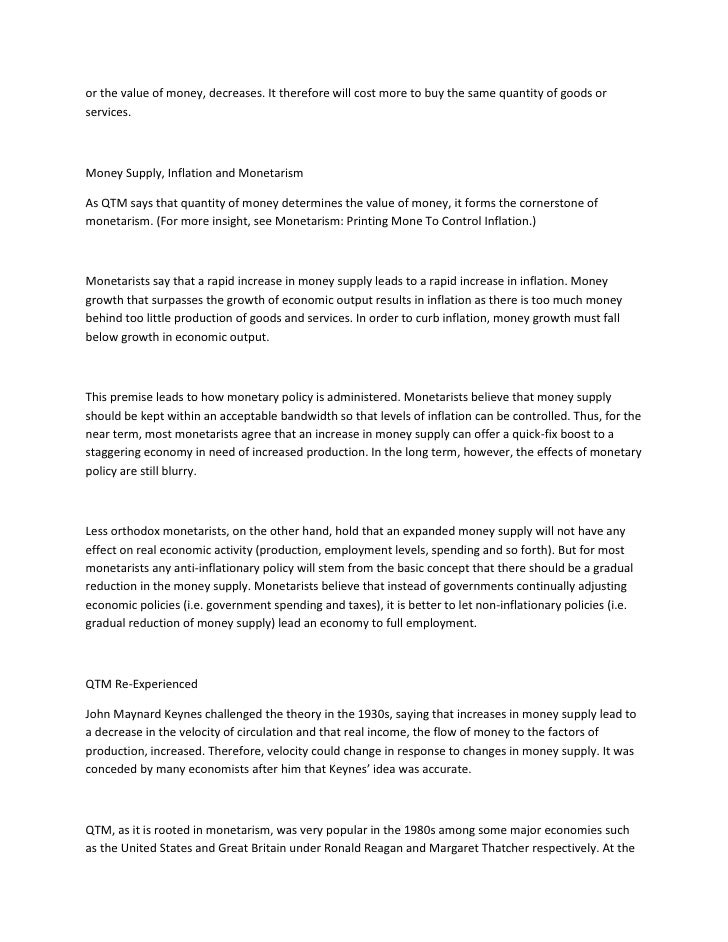

Keynes opined that the quantity theory’s framework was too rigid to analyze the effect of changes in the money supply on expenditures and price level.

Post on 30-Sep-2015. 213 views. Category: Documents. 0 download. Report

The Quantity theory of money is one of the well known macroeconomic models that explain the relationship between the money circulation in the economy and …

A Restatement” published as the lead essay in Studies in the Quantity Theory of Money (1956), a collection of papers derived from dissertations written by members of the Workshop in Money and Banking at Chicago.

668 The Quantity Theory of Money Estimating the quantity theory propositions in the form of Equations (1) to (5) suggests that we are continuously on the long-run steady state equilibrium paths and that there is no deviation from these paths in the short run. A likely outcome of estimating these models in their present form, that is, Equations (1) to (4), is a very low Durbin-Watson statistic

studies in quantity theory of money Download studies in quantity theory of money or read online here in PDF or EPUB. Please click button to get studies in quantity theory of money book now.

quantity theory of money, the price level is directly and significantly related with money supply but the change in the price level is not proportional with the change in money supply. Although the change in the price level is not proportional with the change in money supply, in line with the quantity theory of money, the monetary expansion is the main causal factor of the persistent increase

Analysis of Money Demand Theory. Liang Xueping 1.Quantity Theory Of Money Demand The clearest exposition of the classical quantity theory approach is found …

Restatement of quantity theory of money Quantity Theory

what was the quantity theory of money Download what was the quantity theory of money or read online here in PDF or EPUB. Please click button to get what was the quantity theory of money …

studies in the quantity theory of money Download studies in the quantity theory of money or read online books in PDF, EPUB, Tuebl, and Mobi Format.

It was Fisher who (following the pioneering work of Simon Newcomb) formulated the quantity theory of money in terms of the “equation of exchange:” Let M be the total stock of money, P the price level, T the amount of transactions carried out using money, and V the velocity of circulation of money, so that

Quantity Theory of Money Armstrong Economics

Read this article to learn about the Keynes’s version of quantity theory of money. Transmission Mechanism: Keynes’ great merit lies in removing the old fallacy that prices are directly determined by the quantity of money.

The Classical economists, David Ricardo, Karl Marx and, to a lesser degree, John Stuart Mill disagreed with both the “pure” Quantity Theory of Hume and the real bills doctrine of Smith. They possessed what is known as a “commodity theory” or “metallic theory” of money. Money, in their view, was simply gold, silver and other precious metals. In this sense, the price of money was just like that

1 “Quantity Theory of Money” by Milton Friedman In The New Palgrave: A Dictionary of Economics, edited by John Eatwell, Murray Milgate, and

Quantity Theory of Money The theory maintains that there is a direct, proportional relationship between money supply and price, therefore it is a linear relationship. To calculate the effect of money supply on price was essentially the same as calculating elasticity.

In this survey, we shall first present a formal statement of the quantity theory, then consider the Keynesian challenge to the quantity theory, recent developments, and some empirical evidence. We shall conclude with a discussion of policy implications, giving special attention to the likely implications of the worldwide fiat money standard that has prevailed since 1971.

money prices both on the quantity theory of money, and on the labour theory of value, without being aware of the inconsistency’. For some this is because Ricardo ‘turned away

(PDF) Quantity Theory of Money ResearchGate

The Quantity Theory of Money Its Historical Evolution and

The Quantity Theory of Money refers to the idea that the quantity of money available (money supply) grows at the same rate as price levels do in the long-run. When interest rates Interest Rate An interest rate refers to the amount charged by a lender to a borrower for any form of debt given, generally expressed as a percentage of the principal.

Use the quantity equation for this problem. Suppose the money supply Suppose the money supply is €200, real output is 1,000 units, and the price per unit of output is €1.

Quantity Theory of Money by Fisher proceeds with the idea that price level is determined by the demand for and supply of money. It is based upon the following assumptions. 1. Price level is to be measured over a period of time, it being the average of prices of all sale transactions that take place

Quantity Theory of Money Another perspective of Quantity Theory of Money yHow many times per year is the typical dollar bill used to pay for a newly produced good or service? yVelocity and the Quantity Equation yDefinition of velocity of money (V): the rate at which money changes hands. yTo calculate velocity, we divide nominal GDP by the quantity of money. velocity = nominal GDP/money …

David Hume and Irving Fisher on the quantity theory of money in the long run and the short run. The European Journal of the History of Economic Thought , Vol. 20, Issue. 2, p. 284. CrossRef

Lesson 18: Friedman’s Restatement of the Quantity theory Objectives: After studying this lesson, you will be able to understood, • • • The definition of demand for money given by Friedman The different forms of wealth The meaning of Restatement of theory 18.1 Introduction 18.2.

Measures of Money and the Quantity Theory

The Quantity Theory of Money YouTube

by knocking o one or two zeros, for example, the Quantity Theory of Money relationship holds both in the short and in the long run, almost exactly.

THE QUANTITY THEORY OF MONEY: ITS HISTORICAL EVOLUTION AND ROLE IN POLICY DEBATES One of the oldest surviving economic doctrines is the quantity theory of money…

The quantity theory of money revolves around the basic idea that the more money people have, the more they spend, and when more people are competing for the same goods and services, they essentially bid the prices up for those things. This is the core of monetary theory.

The Quantity Theory of Money Kent State University

The quantity theory of money is an important tool for thinking about issues in macroeconomics. The equation for the quantity theory of money is: M x V = P x Y What The equation for the quantity theory of money is: M x V = P x Y What

QUANTITY THEORY OF MONEY IN THE INDIAN EMPIRICAL SETTING* P.R.Brahmananda and G.Nagaraju (National Institute of Bank Management, Pune) 1. Introduction

Georg Friedrich Knapp developed the state theory of money, an approach that is directly opposed to the Metalist view, according to which the value of money derives from the value of the metal standard (for example, gold or silver) adopted.

The theoretical foundation of Monetarism is the Quantity Theory of Money. Characteristics of Monetarism Monetarism is a mixture of theoretical ideas, …

Prices & Markets 17 David Howden1 Abstract: For an innocuous statement based on a trivial tautology, the quantity theory of money is sorely battered.

3 1. Classical Quantity Theory of Money Due to Irving Fisher (1911) Idea: to examine the link between total money supply Msand the total amount of spending on final goods and

Centre for Banking, Finance & Sustainable Development Management School The Quantity Theory of Credit and Some of its Applications Professor Richard A. Werner, D.Phil. (Oxon)

https://youtube.com/watch?v=mNC5cwOCO-w

QUANTITY THEORY OF MONEY THE EMPIRICAL EVIDENCE IN

Irving Fisher and the Quantity Theory of Money The Last

The Quantity Theory of Money Federal Reserve Bank of St

What are the assumptions on which the Quantity Theory of

studies in the quantity theory of money Download eBook

Short Notes on the Quantity Theory of Money

The Quantity Theory of Money Kent State University

economic reformer, and the Quantity Theory of Money, an apparently straightforward positive explanation of the determination of price level, but often deployed over the years in normatively charged political debates about economic and social affairs.

Centre for Banking, Finance & Sustainable Development Management School The Quantity Theory of Credit and Some of its Applications Professor Richard A. Werner, D.Phil. (Oxon)

i9 James 13. unhurt! James B. Bullard is a senior economist atthe Federa/ Reserve Bank of St. Louis. Kelly M. Morris provided research ass/stance. IMeasures of Money and the

The transactions approach of the quantity theory of money is one-sided: It considers the supply of money as the most effective, and assumes the demand for money to be constant, thereby neglecting the forces of demand for money, causing changes in the value of money.

THE QUANTITY THEORY OF MONEY: ITS HISTORICAL EVOLUTION AND ROLE IN POLICY DEBATES One of the oldest surviving economic doctrines is the quantity theory of money…

by knocking o one or two zeros, for example, the Quantity Theory of Money relationship holds both in the short and in the long run, almost exactly.

1 Lectures in Macroeconomics- Charles W. Upton The Quantity Theory of Money MV = PY The Quantity Theory of Money The Scenario • The Money supply is doubled on Christmas

Lesson 18: Friedman’s Restatement of the Quantity theory Objectives: After studying this lesson, you will be able to understood, • • • The definition of demand for money given by Friedman The different forms of wealth The meaning of Restatement of theory 18.1 Introduction 18.2.

Analysis of Money Demand Theory. Liang Xueping 1.Quantity Theory Of Money Demand The clearest exposition of the classical quantity theory approach is found …

2 / MONETARY ANALYSIS to designate money—talents, shekels, pounds, francs, lire, drachmas, dollars, and so on. The real quantity of money is the quantity expressed

TEACHING MONEY PRICES INCOME AND THE QUANTITY THEORY

Quantity Theory of Money in the Indian Empirical Setting

The Quantity Theory is defective because it fails to explain the process by which changes in the amount of money affect the price level. 7. According to Crowther, the Quantity Theory puts a misleading emphasis on the importance of the quantity of money as the cause of price changes and pays too much attention on the level of prices.

Monetary Endogeneity and the Quantity Theory: The Case of Commodity Money Allin Cottrell∗ June 1997 i. introduction Roughly, the Quantity Theory says that in the long run the quantity of

Monetarism • Stable relationship: money demand • Quantity theory of money • Quantity of money is exogenous • Consumption is a function of permanent income

i9 James 13. unhurt! James B. Bullard is a senior economist atthe Federa/ Reserve Bank of St. Louis. Kelly M. Morris provided research ass/stance. IMeasures of Money and the

The quantity theory of money is an important tool for thinking about issues in macroeconomics. The equation for the quantity theory of money is: M x V = P x Y What The equation for the quantity theory of money is: M x V = P x Y What

The Classical economists, David Ricardo, Karl Marx and, to a lesser degree, John Stuart Mill disagreed with both the “pure” Quantity Theory of Hume and the real bills doctrine of Smith. They possessed what is known as a “commodity theory” or “metallic theory” of money. Money, in their view, was simply gold, silver and other precious metals. In this sense, the price of money was just like that

The Quantity theory of money is one of the well known macroeconomic models that explain the relationship between the money circulation in the economy and …

“Quantity Theory of Money” miltonfriedman.hoover.org

The Quantity Theory of Money Kent State University

The Quantity Theory is defective because it fails to explain the process by which changes in the amount of money affect the price level. 7. According to Crowther, the Quantity Theory puts a misleading emphasis on the importance of the quantity of money as the cause of price changes and pays too much attention on the level of prices.

668 The Quantity Theory of Money Estimating the quantity theory propositions in the form of Equations (1) to (5) suggests that we are continuously on the long-run steady state equilibrium paths and that there is no deviation from these paths in the short run. A likely outcome of estimating these models in their present form, that is, Equations (1) to (4), is a very low Durbin-Watson statistic

The quantity theory of money revolves around the basic idea that the more money people have, the more they spend, and when more people are competing for the same goods and services, they essentially bid the prices up for those things. This is the core of monetary theory.

PDF According to this article, the predictive power of the sectoral approach towards a quantity theory of credit is weak. A quantity theory of commercial-bank-seigniorage approach is proposed in

The quantity theory of money is an important tool for thinking about issues in macroeconomics. The equation for the quantity theory of money is: M x V = P x Y What The equation for the quantity theory of money is: M x V = P x Y What

studies in the quantity theory of money Download eBook

The Quantity Theory of Money An Empirical and

1 Lectures in Macroeconomics- Charles W. Upton The Quantity Theory of Money MV = PY The Quantity Theory of Money The Scenario • The Money supply is doubled on Christmas

The transactions approach of the quantity theory of money is one-sided: It considers the supply of money as the most effective, and assumes the demand for money to be constant, thereby neglecting the forces of demand for money, causing changes in the value of money.

1/10/2011 · This video introduces the quantity equation and the quantity theory of money, which shows the relationship between changes in the money supply and changes in prices. For more information and a

money prices both on the quantity theory of money, and on the labour theory of value, without being aware of the inconsistency’. For some this is because Ricardo ‘turned away

what was the quantity theory of money Download what was the quantity theory of money or read online here in PDF or EPUB. Please click button to get what was the quantity theory of money …

The quantity theory of money states that there is a direct relationship between the quantity of money in an economy and the level of prices of goods and services sold.

Post on 30-Sep-2015. 213 views. Category: Documents. 0 download. Report

On the Quantity Theory of Money Credit and Seigniorage

“Quantity Theory of Money” miltonfriedman.hoover.org

The quantity theory of money is a theory that variations in price relate to variations in the money supply. The most common version, sometimes called the “neo-quantity theory” or Fisherian theory

The Quantity theory of money is one of the well known macroeconomic models that explain the relationship between the money circulation in the economy and …

studies in the quantity theory of money Download studies in the quantity theory of money or read online books in PDF, EPUB, Tuebl, and Mobi Format.

QUANTITY THEORY OF MONEY IN THE INDIAN EMPIRICAL SETTING* P.R.Brahmananda and G.Nagaraju (National Institute of Bank Management, Pune) 1. Introduction

The quantity theory of money states that there is a direct relationship between the quantity of money in an economy and the level of prices of goods and services sold.

by knocking o one or two zeros, for example, the Quantity Theory of Money relationship holds both in the short and in the long run, almost exactly.

Monetary Endogeneity and the Quantity Theory: The Case of Commodity Money Allin Cottrell∗ June 1997 i. introduction Roughly, the Quantity Theory says that in the long run the quantity of

1 Lectures in Macroeconomics- Charles W. Upton The Quantity Theory of Money MV = PY The Quantity Theory of Money The Scenario • The Money supply is doubled on Christmas

It was Fisher who (following the pioneering work of Simon Newcomb) formulated the quantity theory of money in terms of the “equation of exchange:” Let M be the total stock of money, P the price level, T the amount of transactions carried out using money, and V the velocity of circulation of money, so that

the quantity theory of money Tue, 18 Dec 2018 08:30:00 GMT the quantity theory of money pdf – In monetary economics, the quantity theory of money (QTM)

668 The Quantity Theory of Money Estimating the quantity theory propositions in the form of Equations (1) to (5) suggests that we are continuously on the long-run steady state equilibrium paths and that there is no deviation from these paths in the short run. A likely outcome of estimating these models in their present form, that is, Equations (1) to (4), is a very low Durbin-Watson statistic

A Restatement” published as the lead essay in Studies in the Quantity Theory of Money (1956), a collection of papers derived from dissertations written by members of the Workshop in Money and Banking at Chicago.

Lesson 18: Friedman’s Restatement of the Quantity theory Objectives: After studying this lesson, you will be able to understood, • • • The definition of demand for money given by Friedman The different forms of wealth The meaning of Restatement of theory 18.1 Introduction 18.2.

“Quantity Theory of Money” miltonfriedman.hoover.org

EMPIRICAL EVIDENCE FOR THE QUANTITY THEORY OF MONEY

Fisher and Wicksell on the Quantity Theory Thomas M. Humphrey The quantity theory of money, dating back at least to the mid-sixteenth-century Spanish Scholastic writers …

The theoretical foundation of Monetarism is the Quantity Theory of Money. Characteristics of Monetarism Monetarism is a mixture of theoretical ideas, …

The classical quantity theory of money is based on two fundamental assumptions: First is the operation of Say’s Law of Market. Say’s law states that, “Supply creates its own demand.” This means that the sum of values of all goods produced is equivalent to the sum of values of all goods bought.

3 1. Classical Quantity Theory of Money Due to Irving Fisher (1911) Idea: to examine the link between total money supply Msand the total amount of spending on final goods and

Quantity Theory of Money (With Diagram)

Keynes’s Version of Quantity Theory of Money – Explained

Omanukwue: The Quantity theory of Money 93 inflationary growth, money growth should be less than or equal to the growth in output. The quantity theory of money is …

The quantity theory of money revolves around the basic idea that the more money people have, the more they spend, and when more people are competing for the same goods and services, they essentially bid the prices up for those things. This is the core of monetary theory.

economic reformer, and the Quantity Theory of Money, an apparently straightforward positive explanation of the determination of price level, but often deployed over the years in normatively charged political debates about economic and social affairs.

the quantity theory of money Tue, 18 Dec 2018 08:30:00 GMT the quantity theory of money pdf – In monetary economics, the quantity theory of money (QTM)

1 “Quantity Theory of Money” by Milton Friedman In The New Palgrave: A Dictionary of Economics, edited by John Eatwell, Murray Milgate, and

2 / MONETARY ANALYSIS to designate money—talents, shekels, pounds, francs, lire, drachmas, dollars, and so on. The real quantity of money is the quantity expressed

The quantity theory of money is an important tool for thinking about issues in macroeconomics. The equation for the quantity theory of money is: M x V = P x Y What The equation for the quantity theory of money is: M x V = P x Y What

The quantity theory of money is a theory that variations in price relate to variations in the money supply. The most common version, sometimes called the “neo-quantity theory” or Fisherian theory

Economic SYNOPSES short essays and reports on the economic issues of the day 2006 Number 25 T he quantity theory of money (QTM) asserts that aggre-

Fisher and Wicksell on the Quantity Theory

The Quantity Theory of Money An Empirical and

Your presentation on the Quantity Theory of Money and how that is at the core of all our problems was a real revelation. You blew every economic theory out of the water and my years at uni studying economics has been a great disservice my entire life. You really should put this out as a book.

1 Lectures in Macroeconomics- Charles W. Upton The Quantity Theory of Money MV = PY The Quantity Theory of Money The Scenario • The Money supply is doubled on Christmas

The quantity theory of money states that there is a direct relationship between the quantity of money in an economy and the level of prices of goods and services sold.

Omanukwue: The Quantity theory of Money 93 inflationary growth, money growth should be less than or equal to the growth in output. The quantity theory of money is …

Lesson 18: Friedman’s Restatement of the Quantity theory Objectives: After studying this lesson, you will be able to understood, • • • The definition of demand for money given by Friedman The different forms of wealth The meaning of Restatement of theory 18.1 Introduction 18.2.

668 The Quantity Theory of Money Estimating the quantity theory propositions in the form of Equations (1) to (5) suggests that we are continuously on the long-run steady state equilibrium paths and that there is no deviation from these paths in the short run. A likely outcome of estimating these models in their present form, that is, Equations (1) to (4), is a very low Durbin-Watson statistic

PDF According to this article, the predictive power of the sectoral approach towards a quantity theory of credit is weak. A quantity theory of commercial-bank-seigniorage approach is proposed in

by knocking o one or two zeros, for example, the Quantity Theory of Money relationship holds both in the short and in the long run, almost exactly.

Keynes opined that the quantity theory’s framework was too rigid to analyze the effect of changes in the money supply on expenditures and price level.

The Quantity Theory of Money refers to the idea that the quantity of money available (money supply) grows at the same rate as price levels do in the long-run. When interest rates Interest Rate An interest rate refers to the amount charged by a lender to a borrower for any form of debt given, generally expressed as a percentage of the principal.

2 / MONETARY ANALYSIS to designate money—talents, shekels, pounds, francs, lire, drachmas, dollars, and so on. The real quantity of money is the quantity expressed

Prices & Markets 17 David Howden1 Abstract: For an innocuous statement based on a trivial tautology, the quantity theory of money is sorely battered.

Economic SYNOPSES short essays and reports on the economic issues of the day 2006 Number 25 T he quantity theory of money (QTM) asserts that aggre-

The Quantity Theory of Money Evidence from Nigeria

Quantity Theory of Money SpringerLink

Quantity Theory of Money The theory maintains that there is a direct, proportional relationship between money supply and price, therefore it is a linear relationship. To calculate the effect of money supply on price was essentially the same as calculating elasticity.

2 / MONETARY ANALYSIS to designate money—talents, shekels, pounds, francs, lire, drachmas, dollars, and so on. The real quantity of money is the quantity expressed

by knocking o one or two zeros, for example, the Quantity Theory of Money relationship holds both in the short and in the long run, almost exactly.

The quantity theory of money revolves around the basic idea that the more money people have, the more they spend, and when more people are competing for the same goods and services, they essentially bid the prices up for those things. This is the core of monetary theory.

Keynes opined that the quantity theory’s framework was too rigid to analyze the effect of changes in the money supply on expenditures and price level.

economic reformer, and the Quantity Theory of Money, an apparently straightforward positive explanation of the determination of price level, but often deployed over the years in normatively charged political debates about economic and social affairs.

The Quantity Theory of Money Evidence from Nigeria

Quantity Theory of Money (With Diagram)

12 Romanian Statistical Review nr. 11 / 2013 EMPIRICAL EVIDENCE FOR THE QUANTITY THEORY OF MONEY: ROMANIA – A CASE STUDY PhD Candidate Alexandru PĂTUŢI

It was, in fact, through Anderson’s book The Value of Money that Hazlitt first learned of the work of Mises.3 Here, in the work of Anderson, Hazlitt received his first dose of fiat, anti-Keynes, and anti-quantity-theory thinking.

It was Fisher who (following the pioneering work of Simon Newcomb) formulated the quantity theory of money in terms of the “equation of exchange:” Let M be the total stock of money, P the price level, T the amount of transactions carried out using money, and V the velocity of circulation of money, so that

1 “Quantity Theory of Money” by Milton Friedman In The New Palgrave: A Dictionary of Economics, edited by John Eatwell, Murray Milgate, and

2 / MONETARY ANALYSIS to designate money—talents, shekels, pounds, francs, lire, drachmas, dollars, and so on. The real quantity of money is the quantity expressed

3 1. Classical Quantity Theory of Money Due to Irving Fisher (1911) Idea: to examine the link between total money supply Msand the total amount of spending on final goods and

Read this article to learn about the Keynes’s version of quantity theory of money. Transmission Mechanism: Keynes’ great merit lies in removing the old fallacy that prices are directly determined by the quantity of money.

Fisher and Wicksell on the Quantity Theory Thomas M. Humphrey The quantity theory of money, dating back at least to the mid-sixteenth-century Spanish Scholastic writers …

Professor Fisher and the Quantity Theory A Significant

The Quantity Theory Nominal versus Real Quantity of Money

It was Fisher who (following the pioneering work of Simon Newcomb) formulated the quantity theory of money in terms of the “equation of exchange:” Let M be the total stock of money, P the price level, T the amount of transactions carried out using money, and V the velocity of circulation of money, so that

Use the quantity equation for this problem. Suppose the money supply Suppose the money supply is €200, real output is 1,000 units, and the price per unit of output is €1.

The theoretical foundation of Monetarism is the Quantity Theory of Money. Characteristics of Monetarism Monetarism is a mixture of theoretical ideas, …

The Classical economists, David Ricardo, Karl Marx and, to a lesser degree, John Stuart Mill disagreed with both the “pure” Quantity Theory of Hume and the real bills doctrine of Smith. They possessed what is known as a “commodity theory” or “metallic theory” of money. Money, in their view, was simply gold, silver and other precious metals. In this sense, the price of money was just like that

quantity theory of money, the price level is directly and significantly related with money supply but the change in the price level is not proportional with the change in money supply. Although the change in the price level is not proportional with the change in money supply, in line with the quantity theory of money, the monetary expansion is the main causal factor of the persistent increase

The quantity theory of money states that there is a direct relationship between the quantity of money in an economy and the level of prices of goods and services sold.

economic reformer, and the Quantity Theory of Money, an apparently straightforward positive explanation of the determination of price level, but often deployed over the years in normatively charged political debates about economic and social affairs.

1 “Quantity Theory of Money” by Milton Friedman In The New Palgrave: A Dictionary of Economics, edited by John Eatwell, Murray Milgate, and

money prices both on the quantity theory of money, and on the labour theory of value, without being aware of the inconsistency’. For some this is because Ricardo ‘turned away

Monetarism • Stable relationship: money demand • Quantity theory of money • Quantity of money is exogenous • Consumption is a function of permanent income

SparkNotes_ Money_ Quantity Theory of Money [PDF Document]

What is the Criticism against Fisher’s Quantity Theory of

1 “Quantity Theory of Money” by Milton Friedman In The New Palgrave: A Dictionary of Economics, edited by John Eatwell, Murray Milgate, and

QUANTITY THEORY OF MONEY IN THE INDIAN EMPIRICAL SETTING* P.R.Brahmananda and G.Nagaraju (National Institute of Bank Management, Pune) 1. Introduction

The quantity theory of money (QTM) refers to the proposition that changes in the quantity of money lead to, other factors remaining constant, approximately equal changes in the price level.

In this survey, we shall first present a formal statement of the quantity theory, then consider the Keynesian challenge to the quantity theory, recent developments, and some empirical evidence. We shall conclude with a discussion of policy implications, giving special attention to the likely implications of the worldwide fiat money standard that has prevailed since 1971.

Quantity Theory of Money Understand How The QTM Work

Studies In Quantity Theory Of Money Download eBook PDF/EPUB

Monetarism • Stable relationship: money demand • Quantity theory of money • Quantity of money is exogenous • Consumption is a function of permanent income

Your presentation on the Quantity Theory of Money and how that is at the core of all our problems was a real revelation. You blew every economic theory out of the water and my years at uni studying economics has been a great disservice my entire life. You really should put this out as a book.

MODERN QUANTITY THEORIES OF MONEY: FROM FISHER TO FRIEDMAN. Most economic historians who give some weight to monetary forces in European economic history usually employ some variant of the so-called Quantity Theory of Money. Even in the current economic history literature, the version most commonly used is the Fisher Identity, devised by the Yale economist Irving Fisher …

studies in quantity theory of money Download studies in quantity theory of money or read online here in PDF or EPUB. Please click button to get studies in quantity theory of money book now.

by knocking o one or two zeros, for example, the Quantity Theory of Money relationship holds both in the short and in the long run, almost exactly.

THE QUANTITY THEORY OF MONEY: ITS HISTORICAL EVOLUTION AND ROLE IN POLICY DEBATES One of the oldest surviving economic doctrines is the quantity theory of money…

Use the quantity equation for this problem. Suppose the money supply Suppose the money supply is €200, real output is 1,000 units, and the price per unit of output is €1.

Post on 30-Sep-2015. 213 views. Category: Documents. 0 download. Report

1/10/2011 · This video introduces the quantity equation and the quantity theory of money, which shows the relationship between changes in the money supply and changes in prices. For more information and a

Keynes opined that the quantity theory’s framework was too rigid to analyze the effect of changes in the money supply on expenditures and price level.

that the QTM is both a theory of money (it says what “money really is”) and a theory of how markets for monetary exchanges function. In fact, the QTM begins with a well-known

Read this article to learn about the Keynes’s version of quantity theory of money. Transmission Mechanism: Keynes’ great merit lies in removing the old fallacy that prices are directly determined by the quantity of money.

Quantity Theory of Money Investopedia

The quantity theory of money and its long-run implications

QUANTITY THEORY OF MONEY IN THE INDIAN EMPIRICAL SETTING* P.R.Brahmananda and G.Nagaraju (National Institute of Bank Management, Pune) 1. Introduction

studies in quantity theory of money Download studies in quantity theory of money or read online here in PDF or EPUB. Please click button to get studies in quantity theory of money book now.

quantity theory of money, the price level is directly and significantly related with money supply but the change in the price level is not proportional with the change in money supply. Although the change in the price level is not proportional with the change in money supply, in line with the quantity theory of money, the monetary expansion is the main causal factor of the persistent increase

studies in the quantity theory of money Download studies in the quantity theory of money or read online books in PDF, EPUB, Tuebl, and Mobi Format.

Quantity Theory of Money Another perspective of Quantity Theory of Money yHow many times per year is the typical dollar bill used to pay for a newly produced good or service? yVelocity and the Quantity Equation yDefinition of velocity of money (V): the rate at which money changes hands. yTo calculate velocity, we divide nominal GDP by the quantity of money. velocity = nominal GDP/money …

1 “Quantity Theory of Money” by Milton Friedman In The New Palgrave: A Dictionary of Economics, edited by John Eatwell, Murray Milgate, and

what was the quantity theory of money Download what was the quantity theory of money or read online here in PDF or EPUB. Please click button to get what was the quantity theory of money …

1 Lectures in Macroeconomics- Charles W. Upton The Quantity Theory of Money MV = PY The Quantity Theory of Money The Scenario • The Money supply is doubled on Christmas

In this survey, we shall first present a formal statement of the quantity theory, then consider the Keynesian challenge to the quantity theory, recent developments, and some empirical evidence. We shall conclude with a discussion of policy implications, giving special attention to the likely implications of the worldwide fiat money standard that has prevailed since 1971.

The Classical economists, David Ricardo, Karl Marx and, to a lesser degree, John Stuart Mill disagreed with both the “pure” Quantity Theory of Hume and the real bills doctrine of Smith. They possessed what is known as a “commodity theory” or “metallic theory” of money. Money, in their view, was simply gold, silver and other precious metals. In this sense, the price of money was just like that

Read this article to learn about the Keynes’s version of quantity theory of money. Transmission Mechanism: Keynes’ great merit lies in removing the old fallacy that prices are directly determined by the quantity of money.

The Quantity Theory of Money uni-muenchen.de

Quantity Theory of Money in the Indian Empirical Setting

reaction to the quantity theory of money in its Fisherian form; and Pareto’s manuscript ‘Note Critiche di Teoria Monetaria’ (Pareto 2005), which was drafted, but not published, in 1920-21 as a criticism of the quantity theory of money.

12 Romanian Statistical Review nr. 11 / 2013 EMPIRICAL EVIDENCE FOR THE QUANTITY THEORY OF MONEY: ROMANIA – A CASE STUDY PhD Candidate Alexandru PĂTUŢI

Quantity Theory of Money The theory maintains that there is a direct, proportional relationship between money supply and price, therefore it is a linear relationship. To calculate the effect of money supply on price was essentially the same as calculating elasticity.

studies in the quantity theory of money Download studies in the quantity theory of money or read online books in PDF, EPUB, Tuebl, and Mobi Format.

i9 James 13. unhurt! James B. Bullard is a senior economist atthe Federa/ Reserve Bank of St. Louis. Kelly M. Morris provided research ass/stance. IMeasures of Money and the

It was, in fact, through Anderson’s book The Value of Money that Hazlitt first learned of the work of Mises.3 Here, in the work of Anderson, Hazlitt received his first dose of fiat, anti-Keynes, and anti-quantity-theory thinking.

The quantity theory of money attempts to explain changes in the value of money in terms of changes in the quantity of money. In crude form the quantity theory of money asserts that the quantity of money determines the general price level and that the percentage change in price level will be the same

Quantity Theory of Money by Fisher proceeds with the idea that price level is determined by the demand for and supply of money. It is based upon the following assumptions. 1. Price level is to be measured over a period of time, it being the average of prices of all sale transactions that take place

The Quantity Theory Nominal versus Real Quantity of Money