Section 11 of income tax act pdf

for default in deduction and payment of tax under the Income-tax Act reduce or waive interest for default in deducting and 27 March 2017 Background As per Section 201(1A) of the Income-tax Act, 1961 (the Act) if any person, including principal officer or company, does not deduct, the whole or any part of the tax, or after deducting fails to pay the tax as required by or under the Act, then

(section 2 of Act 13 of 1985) Income Tax Amendment Act 11 of 1986 (OG 5234) deemed to have come into force on 1 March 1986 (section 2 of Act 11 of 1986) Income Tax Amendment Act 8 of 1987 (OG 5400) “the amendments effected to the principal Act by this Act shall come into operation, or shall be deemed to have come into operation, save in so far as the context indicates otherwise, at the

PERSONAL INCOME TAX ACT ARRANGEMENT OF SECTIONS PART I Imposition of tax and income chargeable SECTION 1. Imposition of tax. 2. Persons on whom tax is to be imposed.

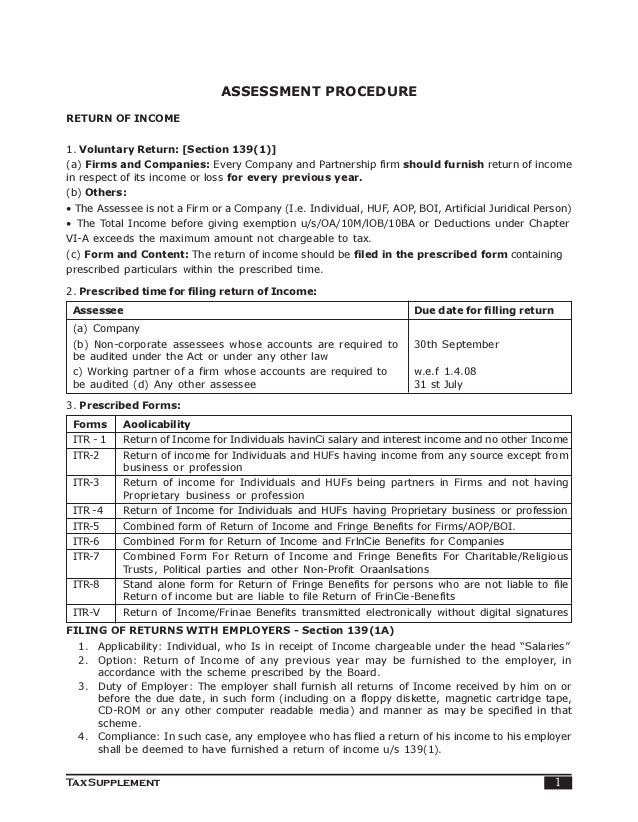

As per the Finance Act, 2018, income-tax is required to be deducted under Section 192 of the Act from income chargeable under the head “Salaries” for the financial year 2018-19 (i.e. Assessment Year 2019-20) at the following rates:

From the Act Section 11(1) (1) Subject to the provisions of sections 60 to 63, the following income shall not be included in the total income of the previous year of the person in receipt of the income—

ACT : INCOME TAX ACT NO. 58 OF 1962 (the Act) SECTION : SECTIONS 11(a), 11(e), 20(1), 23A AND 25D . SUBJECT : TAX IMPLICATIONS OF RENTAL INCOME FROM TANK CONTAINERS . Preamble . In this Note unless the context indicates otherwise – • “section” means a section of the Act; • “tank container” means a large metal container, usually of standard size, used for transporting …

The rate of tax referred to in section 2(1) of this Act to be levied in respect of each rand of taxable income of any public benefit organisation that has been approved by the Commissioner in terms of section 30(3) of the Income Tax Act, 1962 (Act No. 58 of 1962) or any recreational club that has been approved by the Commissioner in terms of section 30A(2) of that Act is, in the case of an

Section 2(15) defines Charitable Purpose and sections 11, 12, 12A, 12AA and 13 of the Income –tax Act, are the main sections that deal with scheme of taxation- exemption in respect of income of charitable or religious trusts/institution.

4 Laws of Malaysia ACT 53 Section 11. (Deleted) 12. Derivation of business income in certain cases 13. General provisions as to employment income 13A.

The Laws of Zambia Copyright Ministry of Legal Affairs, Government of the Republic of Zambia ((((

This Act may be cited as the Income Tax (Amendment) Act 2014, and commences on the pt day of July 2014. 2. The Income Tax Act (hereinafter referred to as the “principal Act”) is amended in section 2 …

income, is expenditure of a preliminary nature and not deductible under se 11(ction a (see Income Tax Case No 697 17 SATC 93 and the cases therein cited, Income Tax

Income Tax Assessment Act 1997 (Division 380)

https://youtube.com/watch?v=9WMQ1w67Tjo

EXPLANATORY MEMORANDUM Income Tax (2018

207.1 – PART XI.1 – Tax in Respect of Deferred Income Plans and Other Tax Exempt Persons 207.3 – PART XI.2 – Tax in Respect of Dispositions of Certain Properties 207.5 – PART XI.3 – Tax in Respect of Retirement Compensation Arrangements

INDIA THE INCOME TAX ACT 1961 Section 11 Income from property held for charitable or religious purposes. (1) Subject to the provisions of section 60, section 61,section 62 and section 63, the

The Income-tax Act, 1961 is the charging Statute of Income Tax in India. It provides for levy, administration, collection and recovery of Income Tax.

This edition of the Income Tax Act, Cap. 332 incorporates all amendments up to 30 th November, 2006 and is printed under the authority of Section 4 of the Laws Revision Act, Cap.4).

act : income tax act no. 58 of 1962 SECTION : SECTION 1(1), DEFINITION OF THE TERM “GROSS INCOME” FOURTH SCHEDULE TO THE ACT, PARAGRAPH 1 DEFINITIONS:

CHAPTER 52:01 INCOME TAX ARRANGEMENT OF SECTIONS SECTION PART I Preliminary 1. Short title 2. Interpretation PART II Administration 3. Appointment of officers 4. Delegation by Commissioner General 5. Secrecy 6. Forms of notices and returns 7. Service of notice or documents PART III Imposition of Income Tax DIVISION I CHARGE TO TAX 8. Charge to tax, general 9. Scope of charge to tax …

—(1) This Act may be cited as the Income Tax Act 2015. (2) Subject to subsection (3), this Act shall come into force on 1st January, 2016 and shall apply to tax years commencing on or after the commencement date.

Income-Tax Act, 1961 as amended by Finance Act . Section Wise Chapter Income from property held for charitable or religious purposes. Section – 12 . Income of trusts or institutions from contributions . Section – 12A . Conditions for applicability of sections 11 and 12. Section – 12AA . Procedure for registration. Section – 13 . Section 11 not to apply in certain cases. Section – 13A

Section HB 11: inserted, on 1 April 2011 (applying for income years beginning on or after 1 April 2011, and for the purposes of the Commissioner receiving LTC elections, on and after 21 December 2010), by section 78(1) of the Taxation (GST and Remedial Matters) Act 2010 (2010 No 130).

Income Tax Act Chapter II: The Taxes Part I: Normal Tax 10. Exemptions 1. There shall be exempt from the tax– a. the revenues of the Government, any provincial administration or of any other state;

[Section-11(5)] : Forms or Modes of Money Accumulated or Set Apart of Trust Income Invested or Deposited: W.e.f. 01.04.1983, the same pattern of investment will apply in relation to accumulation of income in excess of 15%.

schedule to the income tax act 58 of 1962 DETERMINATION OF THE DAILY ALLOWANCE IN RESPECT OF MEALS AND INCIDENTAL COSTS FOR PURPOSES OF SECTION 8(1) OF THE INCOME TAX ACT 58 OF 1962

No. 11 Income Tax 2004 THE INCOME TAX ACT, 2004 ARRANGEMENT OF SECTIONS Section Title PART I PRELIMINARY 1. Short Title and Commencement. 2. Application.

Section 11 of the Maternity Protection Act, (Ch. 45:57) provides for an employer to claim the full amount paid to an employee for maternity leave as a tax deduction. Note on Hotel Development Act, 2000 All references in the Income Tax Act to the Hotel Development Act, (formerly Ch. 85:02) have been changed to the Tourism Development Act, (Ch. 87:22) which repealed and replaced the Hotel

Act No. 38 of 1997 as amended, taking into account amendments up to Tax Laws Amendment (Clean Building Managed Investment Trust) Act 2012 An Act about income tax and related matters Administered by: Treasury General Comments: This compilation is affected by retrospective amendments. Please see the

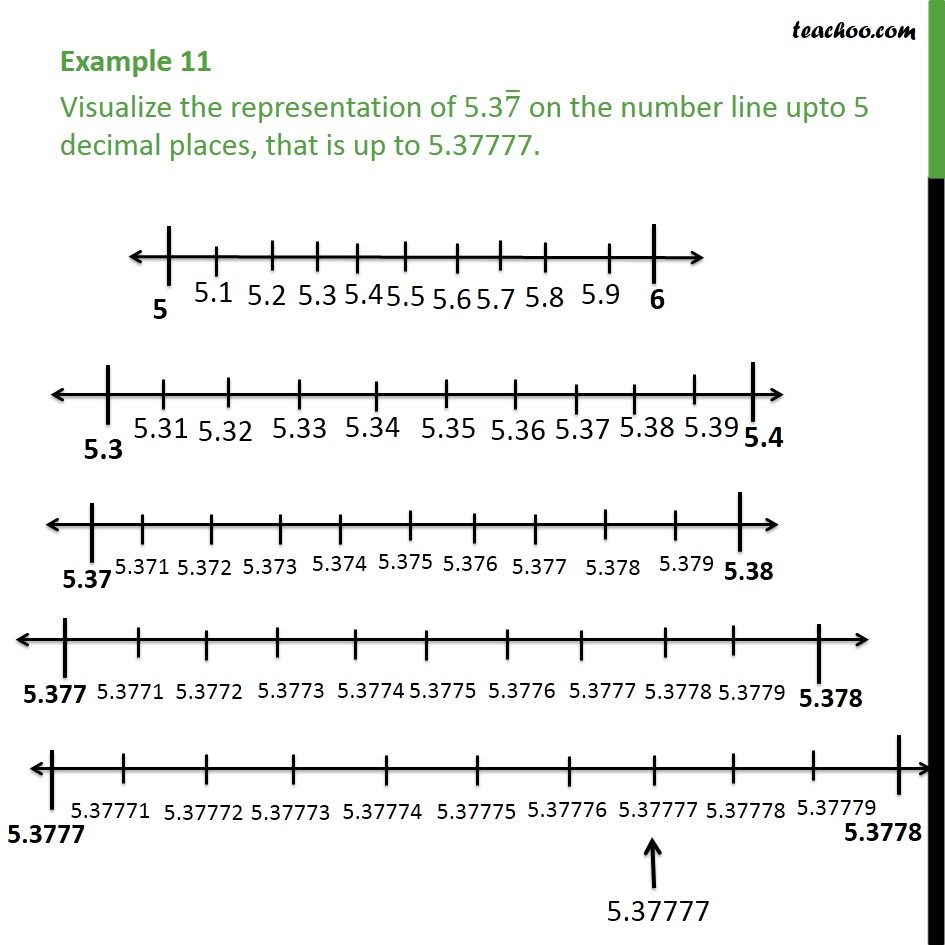

Section 54 to 54 H Chart Last updated at May 29, 2018 by Teachoo This is the Summary of Different Sections of Income Tax Act for Easier Understanding and Rememberance

Section 11(a) of the Income Tax Act provides a deduction for the following: ‘… expenditure and losses actually incurred in the production of the income, provided such expenditure and losses are not of a capital nature…’Section 11(a) must be read with section 23.

Income Tax Exemption An Income Tax exemption means ex-emption from paying income tax. This means that an exempt organisation does not have to pay income tax on its income. NGOs and charitable or religious or-ganisations are exempt from income tax. To get this exemption, they must fulfil certain conditions. These condi-tions vary depending on the category of exemption sought. Who can …

Income Tax 11 PART VIIA FUND FOR TAX REFUND Section 111 B. Establishment of Fund for Tax Refund 111 C. Non applicability of section 14A of the Financial Procedure Act 1957 111 D. Compensation for over-payment of tax PART VIII OFFENCES AND PENALTIES 112. Failure to furnish return or give notice of chargeability 112A. Failure to furnish country-by-country report 113. Incorrect …

https://youtube.com/watch?v=lTSCS0c_sSc

Income Tax Act 1962 About Into SA

INCOME TAX ACT ARRANGEMENT OF SECTIONS SECTION 1. Short title. 2. Interpretation. ADMINISTRATION 3. Appointment of administrative authority. 4. Official secrecy IMPOSITION OF INCOME TAX 5. Charge of income tax. 6. Gains or profits from employment deemed to be derived from Guyana. 7. Provisions relating to income from employment, etc. 8. Relief for aged and incapacitated …

DRAFT TAX ADMINISTRATION BILL SCHEDULE OF AMENDMENTS No. and Year Short Title Exent of amendment or Repeal Act No. 58 of 1962 Income Tax Act, 1962 Amendment of section 1 of Act 58 of 1962 1. Section 1 of the Income Tax Act, 1962 , is hereby amended─ (a) by the substitution for the words before the definition of ―agent‖ of the following words: ―1. Interpretation.─In this Act, unless

INDIA INCOME TAX ACT 1961 Section 10 Incomes not included in total income. (23C) any income received by any person on behalf of- (i) the Prime Minister’s National Relief Fund; or

186 OBITER 2012 THE MEANING OF “EXPENDITURE” FOR PURPOSES OF SECTION 11(A) AND (GA) OF THE INCOME TAX ACT 58 OF 1962 CSARS v Labat Africa Ltd [2011] ZASCA 157 1 Introduction It is trite that a taxpayer may deduct, from his/her gross income, any expenditure or losses that were actually incurred

income in terms of section 11(k) or (n) as has not previously been – (a) allowed to the person as a deduction in the 7 th schedule; or (b) exempted from normal tax in this section,

Income Tax Assessment Act 1997 . No. 38, 1997 as amended . Compilation start date: 25 June 2014 . Includes amendments up to: Act No. 49, 2014 . This compilation has been split into 11 volumes

COMPANIES INCOME TAX ACT ARRANGEMENT OF SECTIONS PART I [Repealed] PART 11 Imposition of tax and profits chargeable SECTION

Any tax imposed under the Income Tax Act; or Interest or penalty imposed by an Act administered by CSARS A taxpayer may not claim a deduction for aany provision unless the Act provides for it.

base company income and gross insurance income for the tax year is less than the lesser of 5% of gross income or ,000,000, then none of the CFC’s gross income for the tax year is treated as foreign base company income or insurance income.

4.3 An individual’s lump sum tax payable for a taxation year is 50% of the total of the amounts added by sections 120.3 and 120.31 of the federal Act and section 40 of the Income Tax Application Rules (Canada) to the individual’s tax payable for the year under the federal Act.

COMPANIES INCOME TAX AMENDMENT ACT 2007 PLAC

Summary of The Income Tax Act Section 9 of the Income Tax Act, 1961(hereinafter referred to as ‘Act’) is a sort of a legislation which may be extra-territorial, and time and again, its validity has been challenged which proved of no avail.

The following section is hereby inserted in the Income Tax Act, 1962, after section 11: “Deductions in respect of expenditure and losses incurred prior to commencement of trade 11A. (1) For purposes of determining the taxable income derived during any year of assessment by a person from carrying on any trade, there shall be allowed as a deduction from the income so derived, any expenditure

Section 11 in The Income- Tax Act, 1995. 11. 1 Income from property held for charitable or religious purposes 2. Subject to the provisions of sections 60 to 63, the following income shall not be included in the total income of the previous year of the person in receipt of the income-3 income derived from property held under trust wholly for charitable or religious purposes, to the extent to

Notice in terms of Section 10(1)(Y) of the Income Tax Act, 1962 Fixing of rate per kilometre in respect of motor vehicles Determination of the Daily Amount in respect of Meals and Incidental Costs

2007 No. 11 Companies Income Tax (Amendment) Act (2) The profits on which tax may be imposed in an insurance company which is a life insurance company, whether proprietary or mutual, other than a …

equity shares for the purposes of Section 56 and Section 50CA of the Act. It is proposed to amend the rules to prescribe the method of valuation of unquoted equity shares for the purpose of Section 56(2)(x) and Section 50CA of the Act by taking into account the FMV of jewellery, artistic work, shares and securities and stamp duty value in case of immovable property and book value for the rest

INCOME TAX [CAP. 123. 1 CHAPTER 123 INCOME TAX ACT To impose a Tax upon Incomes. Amended by: XVII. 1994.35. 1st January, 1949 ACT LIV of 1948, as amended by Acts: VI of 1953, XX of 1955, V of 1958; Emergency

Income Tax Act 24 of 1981 Legal Assistance Centre-Namibia

ACT INCOME TAX ACT NO. 58 OF 1962 SECTION – SAPA

Home Indian Law Acts Income-Tax Act, 1961 Section 12A of Income-Tax Act, 1961 Section 12A of Income-Tax Act, 1961 deals with the topic of Conditions for applicability of sections 11 and 12 and Registration of Charitable/religious trust .

Section 11 and 12 of Income Tax Act 1961 Both section are covered under Income which do not form part of Total Income Section 11 Section 11 – Tax Exemption After consider provisions of section 60 to 63, the income of a religious/charitable trust/institutions, to the extent specified in the act, is exempt from tax after fulfill certain conditions. This income does not even form part of the

1 LEGISLATIVE PROPOSALS RELATING TO THE INCOME TAX ACT AND RELATED REGULATIONS INCOME TAX ACT 1. (1) Section 34.2 of the Income Tax Act is …

section 23(g) of the Income Tax Act 58 of 1962 (the Act). While section 11(a) While section 11(a) provides positively for what may be deducted, section 23(g) provides negatively for

Section 11(5) in The Income- Tax Act, 1995 (5) 1 The forms and modes of investing or depositing the money referred to in clause (b) of sub- section (2) shall be the following, namely:-investment in savings certificates as defined in clause (c) of section 2 of the Government Savings Certificates Act, 1959 3 (46 of 1959 ), and any other securities or certificates issued by the Central Government

RELATED REGULATIONS LEGISLATIVE PROPOSALS RELATING TO THE

CARMEN VENTER WORKSHOPS FOR CFP® EXAMINATIONS 2014

2. Any sum received by a Co-parcener from Hindu Undivided Family (H.U.F.) [Section 10(2)] As per section 10(2), amount received out of family income, or in case of impartible estate, amount received out of income of family estate by any member of such HUF is exempt from tax.

Section 12A of Income Tax Act “Conditions for applicability of sections 11 and 12” 12A. (1) The provisions of section 11 and section 12 shall not apply in relation to the income of any trust or institution unless the following conditions are fulfilled, namely:-

Section – 2, Income-tax Act, 1961 – 2015 Definitions. 2. In this Act, unless the context otherwise requires,— 3[(1) “advance tax” means the advance tax payable in accordance with the …

is income tax collected by withholding as a final tax under this Act unless Subsection (5) applies to the non-resident. (3) A person to whom Subsection (1) does not apply but who requires a …

Analysis of Section 269ST of Income Tax Act – Restrictions imposed by it on Cash Dealings The restriction of the section 269ST is only on money receipt not on receipt of anything in kind : Under this section the restriction is only on receipt, it does not restrict receipt of anything in kind.

GOVERNMENT OF INDIA MINISTRY OF FINANCE (DEPARTMENT

Summary of The Income Tax Act Law Teacher

Exemption under Section 11 of the Income-tax Act is not

Important Provisions Related to Charitable or Religious

INCOME TAX (AMENDMENT) ACT 2014 (NO.7 OF 2014)

https://youtube.com/watch?v=y3exFOl9z74

Manitoba Laws

Short notes on DEDUCTIONS FROM TAXABLE INCOME – A BRIEF

DRAFT TAX ADMINISTRATION BILL SCHEDULE OF AMENDMENTS

Income-Tax Act, 1961 as amended by Finance Act . Section Wise Chapter Income from property held for charitable or religious purposes. Section – 12 . Income of trusts or institutions from contributions . Section – 12A . Conditions for applicability of sections 11 and 12. Section – 12AA . Procedure for registration. Section – 13 . Section 11 not to apply in certain cases. Section – 13A

for default in deduction and payment of tax under the Income-tax Act reduce or waive interest for default in deducting and 27 March 2017 Background As per Section 201(1A) of the Income-tax Act, 1961 (the Act) if any person, including principal officer or company, does not deduct, the whole or any part of the tax, or after deducting fails to pay the tax as required by or under the Act, then

COMPANIES INCOME TAX ACT ARRANGEMENT OF SECTIONS PART I [Repealed] PART 11 Imposition of tax and profits chargeable SECTION

The following section is hereby inserted in the Income Tax Act, 1962, after section 11: “Deductions in respect of expenditure and losses incurred prior to commencement of trade 11A. (1) For purposes of determining the taxable income derived during any year of assessment by a person from carrying on any trade, there shall be allowed as a deduction from the income so derived, any expenditure

Income Tax Assessment Act 1997 . No. 38, 1997 as amended . Compilation start date: 25 June 2014 . Includes amendments up to: Act No. 49, 2014 . This compilation has been split into 11 volumes

Home Indian Law Acts Income-Tax Act, 1961 Section 12A of Income-Tax Act, 1961 Section 12A of Income-Tax Act, 1961 deals with the topic of Conditions for applicability of sections 11 and 12 and Registration of Charitable/religious trust .

From the Act Section 11(1) (1) Subject to the provisions of sections 60 to 63, the following income shall not be included in the total income of the previous year of the person in receipt of the income—

The Laws of Zambia Copyright Ministry of Legal Affairs, Government of the Republic of Zambia ((((

Notice in terms of Section 10(1)(Y) of the Income Tax Act, 1962 Fixing of rate per kilometre in respect of motor vehicles Determination of the Daily Amount in respect of Meals and Incidental Costs

RELATED REGULATIONS LEGISLATIVE PROPOSALS RELATING TO THE

ACT INCOME TAX ACT NO. 58 OF 1962 SECTION SECTIONS 11

INDIA THE INCOME TAX ACT 1961 Section 11 Income from property held for charitable or religious purposes. (1) Subject to the provisions of section 60, section 61,section 62 and section 63, the

The Income-tax Act, 1961 is the charging Statute of Income Tax in India. It provides for levy, administration, collection and recovery of Income Tax.

Any tax imposed under the Income Tax Act; or Interest or penalty imposed by an Act administered by CSARS A taxpayer may not claim a deduction for aany provision unless the Act provides for it.

Section 12A of Income Tax Act “Conditions for applicability of sections 11 and 12” 12A. (1) The provisions of section 11 and section 12 shall not apply in relation to the income of any trust or institution unless the following conditions are fulfilled, namely:-

INDIA INCOME TAX ACT 1961 Section 10 Incomes not included in total income. (23C) any income received by any person on behalf of- (i) the Prime Minister’s National Relief Fund; or

base company income and gross insurance income for the tax year is less than the lesser of 5% of gross income or ,000,000, then none of the CFC’s gross income for the tax year is treated as foreign base company income or insurance income.

Section 11(a) of the Income Tax Act provides a deduction for the following: ‘… expenditure and losses actually incurred in the production of the income, provided such expenditure and losses are not of a capital nature…’Section 11(a) must be read with section 23.

207.1 – PART XI.1 – Tax in Respect of Deferred Income Plans and Other Tax Exempt Persons 207.3 – PART XI.2 – Tax in Respect of Dispositions of Certain Properties 207.5 – PART XI.3 – Tax in Respect of Retirement Compensation Arrangements

Section 11 and 12 of Income Tax Act 1961 Both section are covered under Income which do not form part of Total Income Section 11 Section 11 – Tax Exemption After consider provisions of section 60 to 63, the income of a religious/charitable trust/institutions, to the extent specified in the act, is exempt from tax after fulfill certain conditions. This income does not even form part of the

PERSONAL INCOME TAX ACT ARRANGEMENT OF SECTIONS PART I Imposition of tax and income chargeable SECTION 1. Imposition of tax. 2. Persons on whom tax is to be imposed.

Act No. 38 of 1997 as amended, taking into account amendments up to Tax Laws Amendment (Clean Building Managed Investment Trust) Act 2012 An Act about income tax and related matters Administered by: Treasury General Comments: This compilation is affected by retrospective amendments. Please see the

DRAFT TAX ADMINISTRATION BILL SCHEDULE OF AMENDMENTS No. and Year Short Title Exent of amendment or Repeal Act No. 58 of 1962 Income Tax Act, 1962 Amendment of section 1 of Act 58 of 1962 1. Section 1 of the Income Tax Act, 1962 , is hereby amended─ (a) by the substitution for the words before the definition of ―agent‖ of the following words: ―1. Interpretation.─In this Act, unless

COMPANIES INCOME TAX ACT ARRANGEMENT OF SECTIONS PART I [Repealed] PART 11 Imposition of tax and profits chargeable SECTION

12A of Income Tax ActConditions for applicability of

Analysis of Section 269ST of Income Tax Act- Restrictions

The Income-tax Act, 1961 is the charging Statute of Income Tax in India. It provides for levy, administration, collection and recovery of Income Tax.

Home Indian Law Acts Income-Tax Act, 1961 Section 12A of Income-Tax Act, 1961 Section 12A of Income-Tax Act, 1961 deals with the topic of Conditions for applicability of sections 11 and 12 and Registration of Charitable/religious trust .

Act No. 38 of 1997 as amended, taking into account amendments up to Tax Laws Amendment (Clean Building Managed Investment Trust) Act 2012 An Act about income tax and related matters Administered by: Treasury General Comments: This compilation is affected by retrospective amendments. Please see the

INDIA THE INCOME TAX ACT 1961 Section 11 Income from property held for charitable or religious purposes. (1) Subject to the provisions of section 60, section 61,section 62 and section 63, the

Section 12A of Income Tax Act “Conditions for applicability of sections 11 and 12” 12A. (1) The provisions of section 11 and section 12 shall not apply in relation to the income of any trust or institution unless the following conditions are fulfilled, namely:-

INDIA INCOME TAX ACT 1961 Section 10 Incomes not included in total income. (23C) any income received by any person on behalf of- (i) the Prime Minister’s National Relief Fund; or

section 23(g) of the Income Tax Act 58 of 1962 (the Act). While section 11(a) While section 11(a) provides positively for what may be deducted, section 23(g) provides negatively for

Summary of The Income Tax Act Section 9 of the Income Tax Act, 1961(hereinafter referred to as ‘Act’) is a sort of a legislation which may be extra-territorial, and time and again, its validity has been challenged which proved of no avail.

This Act may be cited as the Income Tax (Amendment) Act 2014, and commences on the pt day of July 2014. 2. The Income Tax Act (hereinafter referred to as the “principal Act”) is amended in section 2 …

Section 54 to 54 H Chart Last updated at May 29, 2018 by Teachoo This is the Summary of Different Sections of Income Tax Act for Easier Understanding and Rememberance

CHAPTER 123 INCOME TAX ACT Justice Services

Draft Legislation on Start-up Expenses National Treasury

equity shares for the purposes of Section 56 and Section 50CA of the Act. It is proposed to amend the rules to prescribe the method of valuation of unquoted equity shares for the purpose of Section 56(2)(x) and Section 50CA of the Act by taking into account the FMV of jewellery, artistic work, shares and securities and stamp duty value in case of immovable property and book value for the rest

This Act may be cited as the Income Tax (Amendment) Act 2014, and commences on the pt day of July 2014. 2. The Income Tax Act (hereinafter referred to as the “principal Act”) is amended in section 2 …

Summary of The Income Tax Act Section 9 of the Income Tax Act, 1961(hereinafter referred to as ‘Act’) is a sort of a legislation which may be extra-territorial, and time and again, its validity has been challenged which proved of no avail.

Section 11(5) in The Income- Tax Act, 1995 (5) 1 The forms and modes of investing or depositing the money referred to in clause (b) of sub- section (2) shall be the following, namely:-investment in savings certificates as defined in clause (c) of section 2 of the Government Savings Certificates Act, 1959 3 (46 of 1959 ), and any other securities or certificates issued by the Central Government

The following section is hereby inserted in the Income Tax Act, 1962, after section 11: “Deductions in respect of expenditure and losses incurred prior to commencement of trade 11A. (1) For purposes of determining the taxable income derived during any year of assessment by a person from carrying on any trade, there shall be allowed as a deduction from the income so derived, any expenditure

CHAPTER 52:01 INCOME TAX ARRANGEMENT OF SECTIONS SECTION PART I Preliminary 1. Short title 2. Interpretation PART II Administration 3. Appointment of officers 4. Delegation by Commissioner General 5. Secrecy 6. Forms of notices and returns 7. Service of notice or documents PART III Imposition of Income Tax DIVISION I CHARGE TO TAX 8. Charge to tax, general 9. Scope of charge to tax …

Section 54 to 54 H Chart Last updated at May 29, 2018 by Teachoo This is the Summary of Different Sections of Income Tax Act for Easier Understanding and Rememberance

income, is expenditure of a preliminary nature and not deductible under se 11(ction a (see Income Tax Case No 697 17 SATC 93 and the cases therein cited, Income Tax

The Income-tax Act, 1961 is the charging Statute of Income Tax in India. It provides for levy, administration, collection and recovery of Income Tax.

PERSONAL INCOME TAX ACT LawPàdí

Income Tax Act 24 of 1981 Legal Assistance Centre-Namibia

Section – 2, Income-tax Act, 1961 – 2015 Definitions. 2. In this Act, unless the context otherwise requires,— 3[(1) “advance tax” means the advance tax payable in accordance with the …

INDIA INCOME TAX ACT 1961 Section 10 Incomes not included in total income. (23C) any income received by any person on behalf of- (i) the Prime Minister’s National Relief Fund; or

income, is expenditure of a preliminary nature and not deductible under se 11(ction a (see Income Tax Case No 697 17 SATC 93 and the cases therein cited, Income Tax

income in terms of section 11(k) or (n) as has not previously been – (a) allowed to the person as a deduction in the 7 th schedule; or (b) exempted from normal tax in this section,

No. 11 Income Tax 2004 THE INCOME TAX ACT, 2004 ARRANGEMENT OF SECTIONS Section Title PART I PRELIMINARY 1. Short Title and Commencement. 2. Application.

As per the Finance Act, 2018, income-tax is required to be deducted under Section 192 of the Act from income chargeable under the head “Salaries” for the financial year 2018-19 (i.e. Assessment Year 2019-20) at the following rates:

From the Act Section 11(1) (1) Subject to the provisions of sections 60 to 63, the following income shall not be included in the total income of the previous year of the person in receipt of the income—

Section 54 to 54 H Chart Last updated at May 29, 2018 by Teachoo This is the Summary of Different Sections of Income Tax Act for Easier Understanding and Rememberance

Notice in terms of Section 10(1)(Y) of the Income Tax Act, 1962 Fixing of rate per kilometre in respect of motor vehicles Determination of the Daily Amount in respect of Meals and Incidental Costs

for default in deduction and payment of tax under the Income-tax Act reduce or waive interest for default in deducting and 27 March 2017 Background As per Section 201(1A) of the Income-tax Act, 1961 (the Act) if any person, including principal officer or company, does not deduct, the whole or any part of the tax, or after deducting fails to pay the tax as required by or under the Act, then

CHAPTER 5201 INCOME TAX BURS

Income Tax Act 2007 New Zealand Legislation

income, is expenditure of a preliminary nature and not deductible under se 11(ction a (see Income Tax Case No 697 17 SATC 93 and the cases therein cited, Income Tax

The Laws of Zambia Copyright Ministry of Legal Affairs, Government of the Republic of Zambia ((((

INDIA THE INCOME TAX ACT 1961 Section 11 Income from property held for charitable or religious purposes. (1) Subject to the provisions of section 60, section 61,section 62 and section 63, the

equity shares for the purposes of Section 56 and Section 50CA of the Act. It is proposed to amend the rules to prescribe the method of valuation of unquoted equity shares for the purpose of Section 56(2)(x) and Section 50CA of the Act by taking into account the FMV of jewellery, artistic work, shares and securities and stamp duty value in case of immovable property and book value for the rest

Section 11 and 12 of Income Tax Act 1961 Both section are covered under Income which do not form part of Total Income Section 11 Section 11 – Tax Exemption After consider provisions of section 60 to 63, the income of a religious/charitable trust/institutions, to the extent specified in the act, is exempt from tax after fulfill certain conditions. This income does not even form part of the

Analysis of Section 269ST of Income Tax Act – Restrictions imposed by it on Cash Dealings The restriction of the section 269ST is only on money receipt not on receipt of anything in kind : Under this section the restriction is only on receipt, it does not restrict receipt of anything in kind.

As per the Finance Act, 2018, income-tax is required to be deducted under Section 192 of the Act from income chargeable under the head “Salaries” for the financial year 2018-19 (i.e. Assessment Year 2019-20) at the following rates:

PERSONAL INCOME TAX ACT ARRANGEMENT OF SECTIONS PART I Imposition of tax and income chargeable SECTION 1. Imposition of tax. 2. Persons on whom tax is to be imposed.

2007 No. 11 Companies Income Tax (Amendment) Act (2) The profits on which tax may be imposed in an insurance company which is a life insurance company, whether proprietary or mutual, other than a …

DRAFT TAX ADMINISTRATION BILL SCHEDULE OF AMENDMENTS No. and Year Short Title Exent of amendment or Repeal Act No. 58 of 1962 Income Tax Act, 1962 Amendment of section 1 of Act 58 of 1962 1. Section 1 of the Income Tax Act, 1962 , is hereby amended─ (a) by the substitution for the words before the definition of ―agent‖ of the following words: ―1. Interpretation.─In this Act, unless

section 23(g) of the Income Tax Act 58 of 1962 (the Act). While section 11(a) While section 11(a) provides positively for what may be deducted, section 23(g) provides negatively for

Section 11(5) in The Income- Tax Act, 1995 (5) 1 The forms and modes of investing or depositing the money referred to in clause (b) of sub- section (2) shall be the following, namely:-investment in savings certificates as defined in clause (c) of section 2 of the Government Savings Certificates Act, 1959 3 (46 of 1959 ), and any other securities or certificates issued by the Central Government

Notice in terms of Section 10(1)(Y) of the Income Tax Act, 1962 Fixing of rate per kilometre in respect of motor vehicles Determination of the Daily Amount in respect of Meals and Incidental Costs

CHAPTER 8101 INCOME TAX ACT ARRANGEMENT OF SECTIONS

Manitoba Laws

INCOME TAX ACT ARRANGEMENT OF SECTIONS SECTION 1. Short title. 2. Interpretation. ADMINISTRATION 3. Appointment of administrative authority. 4. Official secrecy IMPOSITION OF INCOME TAX 5. Charge of income tax. 6. Gains or profits from employment deemed to be derived from Guyana. 7. Provisions relating to income from employment, etc. 8. Relief for aged and incapacitated …

Income Tax 11 PART VIIA FUND FOR TAX REFUND Section 111 B. Establishment of Fund for Tax Refund 111 C. Non applicability of section 14A of the Financial Procedure Act 1957 111 D. Compensation for over-payment of tax PART VIII OFFENCES AND PENALTIES 112. Failure to furnish return or give notice of chargeability 112A. Failure to furnish country-by-country report 113. Incorrect …

Home Indian Law Acts Income-Tax Act, 1961 Section 12A of Income-Tax Act, 1961 Section 12A of Income-Tax Act, 1961 deals with the topic of Conditions for applicability of sections 11 and 12 and Registration of Charitable/religious trust .

Section – 2, Income-tax Act, 1961 – 2015 Definitions. 2. In this Act, unless the context otherwise requires,— 3[(1) “advance tax” means the advance tax payable in accordance with the …

207.1 – PART XI.1 – Tax in Respect of Deferred Income Plans and Other Tax Exempt Persons 207.3 – PART XI.2 – Tax in Respect of Dispositions of Certain Properties 207.5 – PART XI.3 – Tax in Respect of Retirement Compensation Arrangements

Section 11(a) of the Income Tax Act provides a deduction for the following: ‘… expenditure and losses actually incurred in the production of the income, provided such expenditure and losses are not of a capital nature…’Section 11(a) must be read with section 23.

The rate of tax referred to in section 2(1) of this Act to be levied in respect of each rand of taxable income of any public benefit organisation that has been approved by the Commissioner in terms of section 30(3) of the Income Tax Act, 1962 (Act No. 58 of 1962) or any recreational club that has been approved by the Commissioner in terms of section 30A(2) of that Act is, in the case of an

The Laws of Zambia Copyright Ministry of Legal Affairs, Government of the Republic of Zambia ((((

Act No. 38 of 1997 as amended, taking into account amendments up to Tax Laws Amendment (Clean Building Managed Investment Trust) Act 2012 An Act about income tax and related matters Administered by: Treasury General Comments: This compilation is affected by retrospective amendments. Please see the

INDIA THE INCOME TAX ACT 1961 Section 11 Income from property held for charitable or religious purposes. (1) Subject to the provisions of section 60, section 61,section 62 and section 63, the

No. 11 Income Tax 2004 THE INCOME TAX ACT, 2004 ARRANGEMENT OF SECTIONS Section Title PART I PRELIMINARY 1. Short Title and Commencement. 2. Application.

schedule to the income tax act 58 of 1962 DETERMINATION OF THE DAILY ALLOWANCE IN RESPECT OF MEALS AND INCIDENTAL COSTS FOR PURPOSES OF SECTION 8(1) OF THE INCOME TAX ACT 58 OF 1962

Income Tax Act Chapter II: The Taxes Part I: Normal Tax 10. Exemptions 1. There shall be exempt from the tax– a. the revenues of the Government, any provincial administration or of any other state;

Section 12A of Income Tax Act “Conditions for applicability of sections 11 and 12” 12A. (1) The provisions of section 11 and section 12 shall not apply in relation to the income of any trust or institution unless the following conditions are fulfilled, namely:-

Draft Legislation on Start-up Expenses National Treasury

Trade TaxStudents

is income tax collected by withholding as a final tax under this Act unless Subsection (5) applies to the non-resident. (3) A person to whom Subsection (1) does not apply but who requires a …

From the Act Section 11(1) (1) Subject to the provisions of sections 60 to 63, the following income shall not be included in the total income of the previous year of the person in receipt of the income—

The Laws of Zambia Copyright Ministry of Legal Affairs, Government of the Republic of Zambia ((((

Section 11 of the Maternity Protection Act, (Ch. 45:57) provides for an employer to claim the full amount paid to an employee for maternity leave as a tax deduction. Note on Hotel Development Act, 2000 All references in the Income Tax Act to the Hotel Development Act, (formerly Ch. 85:02) have been changed to the Tourism Development Act, (Ch. 87:22) which repealed and replaced the Hotel

PERSONAL INCOME TAX ACT ARRANGEMENT OF SECTIONS PART I Imposition of tax and income chargeable SECTION 1. Imposition of tax. 2. Persons on whom tax is to be imposed.

4.3 An individual’s lump sum tax payable for a taxation year is 50% of the total of the amounts added by sections 120.3 and 120.31 of the federal Act and section 40 of the Income Tax Application Rules (Canada) to the individual’s tax payable for the year under the federal Act.

INDIA THE INCOME TAX ACT 1961 Section 11 Income from property held for charitable or religious purposes. (1) Subject to the provisions of section 60, section 61,section 62 and section 63, the

act : income tax act no. 58 of 1962 SECTION : SECTION 1(1), DEFINITION OF THE TERM “GROSS INCOME” FOURTH SCHEDULE TO THE ACT, PARAGRAPH 1 DEFINITIONS:

As per the Finance Act, 2018, income-tax is required to be deducted under Section 192 of the Act from income chargeable under the head “Salaries” for the financial year 2018-19 (i.e. Assessment Year 2019-20) at the following rates:

income in terms of section 11(k) or (n) as has not previously been – (a) allowed to the person as a deduction in the 7 th schedule; or (b) exempted from normal tax in this section,

CARMEN VENTER WORKSHOPS FOR CFP® EXAMINATIONS 2014

ACT INCOME TAX ACT NO. 58 OF 1962 SECTION SECTIONS 11

equity shares for the purposes of Section 56 and Section 50CA of the Act. It is proposed to amend the rules to prescribe the method of valuation of unquoted equity shares for the purpose of Section 56(2)(x) and Section 50CA of the Act by taking into account the FMV of jewellery, artistic work, shares and securities and stamp duty value in case of immovable property and book value for the rest

The Laws of Zambia Copyright Ministry of Legal Affairs, Government of the Republic of Zambia ((((

Section 11 in The Income- Tax Act, 1995. 11. 1 Income from property held for charitable or religious purposes 2. Subject to the provisions of sections 60 to 63, the following income shall not be included in the total income of the previous year of the person in receipt of the income-3 income derived from property held under trust wholly for charitable or religious purposes, to the extent to

base company income and gross insurance income for the tax year is less than the lesser of 5% of gross income or ,000,000, then none of the CFC’s gross income for the tax year is treated as foreign base company income or insurance income.

act : income tax act no. 58 of 1962 SECTION : SECTION 1(1), DEFINITION OF THE TERM “GROSS INCOME” FOURTH SCHEDULE TO THE ACT, PARAGRAPH 1 DEFINITIONS:

—(1) This Act may be cited as the Income Tax Act 2015. (2) Subject to subsection (3), this Act shall come into force on 1st January, 2016 and shall apply to tax years commencing on or after the commencement date.

Section 11 and 12 of Income Tax Act 1961 Both section are covered under Income which do not form part of Total Income Section 11 Section 11 – Tax Exemption After consider provisions of section 60 to 63, the income of a religious/charitable trust/institutions, to the extent specified in the act, is exempt from tax after fulfill certain conditions. This income does not even form part of the

This Act may be cited as the Income Tax (Amendment) Act 2014, and commences on the pt day of July 2014. 2. The Income Tax Act (hereinafter referred to as the “principal Act”) is amended in section 2 …

Section – 2, Income-tax Act, 1961 – 2015 Definitions. 2. In this Act, unless the context otherwise requires,— 3[(1) “advance tax” means the advance tax payable in accordance with the …

income, is expenditure of a preliminary nature and not deductible under se 11(ction a (see Income Tax Case No 697 17 SATC 93 and the cases therein cited, Income Tax

Income Tax Act 24 of 1981 Legal Assistance Centre-Namibia

Income Tax Assessment Act 1997 Screen Australia

income, is expenditure of a preliminary nature and not deductible under se 11(ction a (see Income Tax Case No 697 17 SATC 93 and the cases therein cited, Income Tax

Section 2(15) defines Charitable Purpose and sections 11, 12, 12A, 12AA and 13 of the Income –tax Act, are the main sections that deal with scheme of taxation- exemption in respect of income of charitable or religious trusts/institution.

The Laws of Zambia Copyright Ministry of Legal Affairs, Government of the Republic of Zambia ((((

Analysis of Section 269ST of Income Tax Act – Restrictions imposed by it on Cash Dealings The restriction of the section 269ST is only on money receipt not on receipt of anything in kind : Under this section the restriction is only on receipt, it does not restrict receipt of anything in kind.

Section 12A of Income Tax Act “Conditions for applicability of sections 11 and 12” 12A. (1) The provisions of section 11 and section 12 shall not apply in relation to the income of any trust or institution unless the following conditions are fulfilled, namely:-

Income Tax 11 PART VIIA FUND FOR TAX REFUND Section 111 B. Establishment of Fund for Tax Refund 111 C. Non applicability of section 14A of the Financial Procedure Act 1957 111 D. Compensation for over-payment of tax PART VIII OFFENCES AND PENALTIES 112. Failure to furnish return or give notice of chargeability 112A. Failure to furnish country-by-country report 113. Incorrect …

No. 11 Income Tax 2004 THE INCOME TAX ACT, 2004 ARRANGEMENT OF SECTIONS Section Title PART I PRELIMINARY 1. Short Title and Commencement. 2. Application.

Section 11 in The Income- Tax Act, 1995. 11. 1 Income from property held for charitable or religious purposes 2. Subject to the provisions of sections 60 to 63, the following income shall not be included in the total income of the previous year of the person in receipt of the income-3 income derived from property held under trust wholly for charitable or religious purposes, to the extent to

4.3 An individual’s lump sum tax payable for a taxation year is 50% of the total of the amounts added by sections 120.3 and 120.31 of the federal Act and section 40 of the Income Tax Application Rules (Canada) to the individual’s tax payable for the year under the federal Act.

Income-Tax Act, 1961 as amended by Finance Act . Section Wise Chapter Income from property held for charitable or religious purposes. Section – 12 . Income of trusts or institutions from contributions . Section – 12A . Conditions for applicability of sections 11 and 12. Section – 12AA . Procedure for registration. Section – 13 . Section 11 not to apply in certain cases. Section – 13A

DRAFT TAX ADMINISTRATION BILL SCHEDULE OF AMENDMENTS

CHAPTER 5201 INCOME TAX BURS

As per the Finance Act, 2018, income-tax is required to be deducted under Section 192 of the Act from income chargeable under the head “Salaries” for the financial year 2018-19 (i.e. Assessment Year 2019-20) at the following rates:

The rate of tax referred to in section 2(1) of this Act to be levied in respect of each rand of taxable income of any public benefit organisation that has been approved by the Commissioner in terms of section 30(3) of the Income Tax Act, 1962 (Act No. 58 of 1962) or any recreational club that has been approved by the Commissioner in terms of section 30A(2) of that Act is, in the case of an

No. 11 Income Tax 2004 THE INCOME TAX ACT, 2004 ARRANGEMENT OF SECTIONS Section Title PART I PRELIMINARY 1. Short Title and Commencement. 2. Application.

Income-Tax Act, 1961 as amended by Finance Act . Section Wise Chapter Income from property held for charitable or religious purposes. Section – 12 . Income of trusts or institutions from contributions . Section – 12A . Conditions for applicability of sections 11 and 12. Section – 12AA . Procedure for registration. Section – 13 . Section 11 not to apply in certain cases. Section – 13A

Section 2(15) defines Charitable Purpose and sections 11, 12, 12A, 12AA and 13 of the Income –tax Act, are the main sections that deal with scheme of taxation- exemption in respect of income of charitable or religious trusts/institution.

Act No. 38 of 1997 as amended, taking into account amendments up to Tax Laws Amendment (Clean Building Managed Investment Trust) Act 2012 An Act about income tax and related matters Administered by: Treasury General Comments: This compilation is affected by retrospective amendments. Please see the

Section – 2, Income-tax Act, 1961 – 2015 Definitions. 2. In this Act, unless the context otherwise requires,— 3[(1) “advance tax” means the advance tax payable in accordance with the …

act : income tax act no. 58 of 1962 SECTION : SECTION 1(1), DEFINITION OF THE TERM “GROSS INCOME” FOURTH SCHEDULE TO THE ACT, PARAGRAPH 1 DEFINITIONS:

income in terms of section 11(k) or (n) as has not previously been – (a) allowed to the person as a deduction in the 7 th schedule; or (b) exempted from normal tax in this section,

4 Laws of Malaysia ACT 53 Section 11. (Deleted) 12. Derivation of business income in certain cases 13. General provisions as to employment income 13A.

2. Any sum received by a Co-parcener from Hindu Undivided Family (H.U.F.) [Section 10(2)] As per section 10(2), amount received out of family income, or in case of impartible estate, amount received out of income of family estate by any member of such HUF is exempt from tax.

No. 11 Income Tax 2004 THE INCOME TAX ACT 2004

RELATED REGULATIONS LEGISLATIVE PROPOSALS RELATING TO THE

base company income and gross insurance income for the tax year is less than the lesser of 5% of gross income or ,000,000, then none of the CFC’s gross income for the tax year is treated as foreign base company income or insurance income.

Section 11 in The Income- Tax Act, 1995. 11. 1 Income from property held for charitable or religious purposes 2. Subject to the provisions of sections 60 to 63, the following income shall not be included in the total income of the previous year of the person in receipt of the income-3 income derived from property held under trust wholly for charitable or religious purposes, to the extent to

The Laws of Zambia Copyright Ministry of Legal Affairs, Government of the Republic of Zambia ((((

2007 No. 11 Companies Income Tax (Amendment) Act (2) The profits on which tax may be imposed in an insurance company which is a life insurance company, whether proprietary or mutual, other than a …

Section 2(15) defines Charitable Purpose and sections 11, 12, 12A, 12AA and 13 of the Income –tax Act, are the main sections that deal with scheme of taxation- exemption in respect of income of charitable or religious trusts/institution.

income in terms of section 11(k) or (n) as has not previously been – (a) allowed to the person as a deduction in the 7 th schedule; or (b) exempted from normal tax in this section,

NZ Legislation Income Tax Act 2007

INCOME TAX (AMENDMENT) ACT 2014 (NO.7 OF 2014)

[Section-11(5)] : Forms or Modes of Money Accumulated or Set Apart of Trust Income Invested or Deposited: W.e.f. 01.04.1983, the same pattern of investment will apply in relation to accumulation of income in excess of 15%.

Income-Tax Act, 1961 as amended by Finance Act . Section Wise Chapter Income from property held for charitable or religious purposes. Section – 12 . Income of trusts or institutions from contributions . Section – 12A . Conditions for applicability of sections 11 and 12. Section – 12AA . Procedure for registration. Section – 13 . Section 11 not to apply in certain cases. Section – 13A

The Laws of Zambia Copyright Ministry of Legal Affairs, Government of the Republic of Zambia ((((

Income Tax Exemption An Income Tax exemption means ex-emption from paying income tax. This means that an exempt organisation does not have to pay income tax on its income. NGOs and charitable or religious or-ganisations are exempt from income tax. To get this exemption, they must fulfil certain conditions. These condi-tions vary depending on the category of exemption sought. Who can …

Short notes on DEDUCTIONS FROM TAXABLE INCOME – A BRIEF

CHAPTER 8101 INCOME TAX ACT ARRANGEMENT OF SECTIONS

The Laws of Zambia Copyright Ministry of Legal Affairs, Government of the Republic of Zambia ((((

[Section-11(5)] : Forms or Modes of Money Accumulated or Set Apart of Trust Income Invested or Deposited: W.e.f. 01.04.1983, the same pattern of investment will apply in relation to accumulation of income in excess of 15%.

Section 11 and 12 of Income Tax Act 1961 Both section are covered under Income which do not form part of Total Income Section 11 Section 11 – Tax Exemption After consider provisions of section 60 to 63, the income of a religious/charitable trust/institutions, to the extent specified in the act, is exempt from tax after fulfill certain conditions. This income does not even form part of the

No. 11 Income Tax 2004 THE INCOME TAX ACT, 2004 ARRANGEMENT OF SECTIONS Section Title PART I PRELIMINARY 1. Short Title and Commencement. 2. Application.

Summary of The Income Tax Act Section 9 of the Income Tax Act, 1961(hereinafter referred to as ‘Act’) is a sort of a legislation which may be extra-territorial, and time and again, its validity has been challenged which proved of no avail.

Income Tax Exemption An Income Tax exemption means ex-emption from paying income tax. This means that an exempt organisation does not have to pay income tax on its income. NGOs and charitable or religious or-ganisations are exempt from income tax. To get this exemption, they must fulfil certain conditions. These condi-tions vary depending on the category of exemption sought. Who can …

INDIA THE INCOME TAX ACT 1961 Section 11 Income from property held for charitable or religious purposes. (1) Subject to the provisions of section 60, section 61,section 62 and section 63, the

Section 11 in The Income- Tax Act, 1995. 11. 1 Income from property held for charitable or religious purposes 2. Subject to the provisions of sections 60 to 63, the following income shall not be included in the total income of the previous year of the person in receipt of the income-3 income derived from property held under trust wholly for charitable or religious purposes, to the extent to

COMPANIES INCOME TAX ACT ARRANGEMENT OF SECTIONS PART I [Repealed] PART 11 Imposition of tax and profits chargeable SECTION

Home Indian Law Acts Income-Tax Act, 1961 Section 12A of Income-Tax Act, 1961 Section 12A of Income-Tax Act, 1961 deals with the topic of Conditions for applicability of sections 11 and 12 and Registration of Charitable/religious trust .

186 OBITER 2012 THE MEANING OF “EXPENDITURE” FOR PURPOSES OF SECTION 11(A) AND (GA) OF THE INCOME TAX ACT 58 OF 1962 CSARS v Labat Africa Ltd [2011] ZASCA 157 1 Introduction It is trite that a taxpayer may deduct, from his/her gross income, any expenditure or losses that were actually incurred

Income Tax Assessment Act 1997 . No. 38, 1997 as amended . Compilation start date: 25 June 2014 . Includes amendments up to: Act No. 49, 2014 . This compilation has been split into 11 volumes

4 Laws of Malaysia ACT 53 Section 11. (Deleted) 12. Derivation of business income in certain cases 13. General provisions as to employment income 13A.

Section 11(a) of the Income Tax Act provides a deduction for the following: ‘… expenditure and losses actually incurred in the production of the income, provided such expenditure and losses are not of a capital nature…’Section 11(a) must be read with section 23.

Income Tax Act Chapter II: The Taxes Part I: Normal Tax 10. Exemptions 1. There shall be exempt from the tax– a. the revenues of the Government, any provincial administration or of any other state;

List of Exempted Incomes (Tax-Free) Under Section-10

GOVERNMENT OF INDIA MINISTRY OF FINANCE (DEPARTMENT

As per the Finance Act, 2018, income-tax is required to be deducted under Section 192 of the Act from income chargeable under the head “Salaries” for the financial year 2018-19 (i.e. Assessment Year 2019-20) at the following rates:

Analysis of Section 269ST of Income Tax Act – Restrictions imposed by it on Cash Dealings The restriction of the section 269ST is only on money receipt not on receipt of anything in kind : Under this section the restriction is only on receipt, it does not restrict receipt of anything in kind.

4 Laws of Malaysia ACT 53 Section 11. (Deleted) 12. Derivation of business income in certain cases 13. General provisions as to employment income 13A.

4.3 An individual’s lump sum tax payable for a taxation year is 50% of the total of the amounts added by sections 120.3 and 120.31 of the federal Act and section 40 of the Income Tax Application Rules (Canada) to the individual’s tax payable for the year under the federal Act.

base company income and gross insurance income for the tax year is less than the lesser of 5% of gross income or ,000,000, then none of the CFC’s gross income for the tax year is treated as foreign base company income or insurance income.

Home Indian Law Acts Income-Tax Act, 1961 Section 12A of Income-Tax Act, 1961 Section 12A of Income-Tax Act, 1961 deals with the topic of Conditions for applicability of sections 11 and 12 and Registration of Charitable/religious trust .

This Act may be cited as the Income Tax (Amendment) Act 2014, and commences on the pt day of July 2014. 2. The Income Tax Act (hereinafter referred to as the “principal Act”) is amended in section 2 …

Section 11 in The Income- Tax Act, 1995. 11. 1 Income from property held for charitable or religious purposes 2. Subject to the provisions of sections 60 to 63, the following income shall not be included in the total income of the previous year of the person in receipt of the income-3 income derived from property held under trust wholly for charitable or religious purposes, to the extent to

Income Tax Assessment Act 1997 . No. 38, 1997 as amended . Compilation start date: 25 June 2014 . Includes amendments up to: Act No. 49, 2014 . This compilation has been split into 11 volumes

Section 54 to 54 H Chart Last updated at May 29, 2018 by Teachoo This is the Summary of Different Sections of Income Tax Act for Easier Understanding and Rememberance